How do credit reporting agencies gather information about the consumer

Whenever a consumer applies for a loan, a credit card, or a special retail store financing offer, there is a system of checks and balances working behind the scenes that allows lenders to make timely, informed decisions about their credit worthiness. An important part of the decision-making process involves an assessment of the consumer’s credit history, which is typically accessed by lenders in the form of a credit score. The credit score is a numerical representation of the information contained in a consumer’s credit report. For example, were existing accounts paid on time; for how many other loans or credit cards did the consumer recently apply; how high are the balances on credit cards in comparison to the credit limits on those cards.

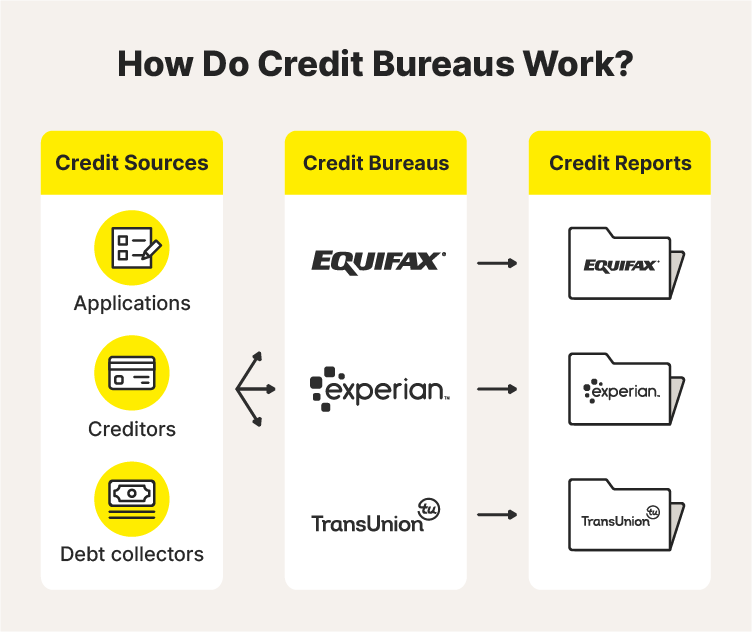

Any consumer who has used a credit card, or taken out a loan to buy a car or a home, is likely to have a credit report on file with each of the three national consumer reporting agencies (CRA): Experian, Equifax and TransUnion. Once every 30 days, information about a consumer’s ongoing credit activity is relayed directly by their creditors to the three national consumer reporting agencies separately. The consumer reporting agencies receive, compile, and maintain the history provided by the creditors and lenders. As the information in a consumer’s credit report is being updated constantly, their credit score changes along with it. It is important to note that a consumer’s reports and scores are likely to vary with each CRA since not every lender reports information to all three major agencies at all times.

The CRAs do not make decisions on whether a consumer qualifies for a loan or credit card. Those decisions are made directly by lenders. When a lender is assessing a consumer’s eligibility for a loan or credit, they access one or more of these reports and the corresponding credit score to assess the consumer’s credit history. Generally, lenders score consumers based on a range of 300 to 850, with scores of 750 and above receiving the most favorable loan rates and terms.

Helpful Tips

- Consumers have three credit reports, which are maintained by the three national consumer reporting agencies: Experian, Equifax and TransUnion.

- The information in these reports comes directly from a consumer’s creditors and indicates how responsibly they have handled their finances over time.

- Lenders review a consumer’s credit reports and scores to help make informed decisions.

What is a credit reporting company?

Credit reporting companies, also known as credit bureaus or consumer reporting agencies, are companies that compile and sell credit reports.

Credit reporting companies collect credit account information about your borrowing and repayment history including:

- The original amount of a loan

- The credit limit on a credit card

- The balance on a credit card or other loan

- The payment status of the account including whether you have repaid your loans on time

- Items sent for collection

- Public records, such as judgments and bankruptcies

Credit reporting companies can gather information from many sources including thousands of lenders across the country; public records, such as bankruptcies, garnishments, liens, and other judgments; and collections agencies, which provide information on delinquent accounts

The Fair Credit Reporting Act (FCRA) is a federal law that provides directions and limits on how credit reporting companies disclose credit report information. FCRA also has provisions regulating users of consumer reports and furnishers of information to credit reporting companies. For example, the FCRA permits credit reporting companies to provide credit reports only to those users who have a permissible purpose listed in the law.

Other reporting companies, including specialty consumer reporting companies, may collect personal information in addition to credit information including, but not limited to, your employment and tenant history as well as publically available data.

Don’t see what you’re looking for?

Browse related questions

- What are specialty consumer reporting agencies and what kind of information do they collect?

- What is a credit report?

- Learn more about credit reports and scores

Page last modified Nov. 12, 2021 @ 09:17 AM EST

About us

We’re the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly.

Legal disclaimer

The content on this page provides general consumer information. It is not legal advice or regulatory guidance. The CFPB updates this information periodically. This information may include links or references to third-party resources or content. We do not endorse the third-party or guarantee the accuracy of this third-party information. There may be other resources that also serve your needs.

https://www.cdiaonline.org/for-consumers/how-credit-reporting-works/https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-reporting-company-en-1251/