What are the 3 Credit Reporting Agencies?

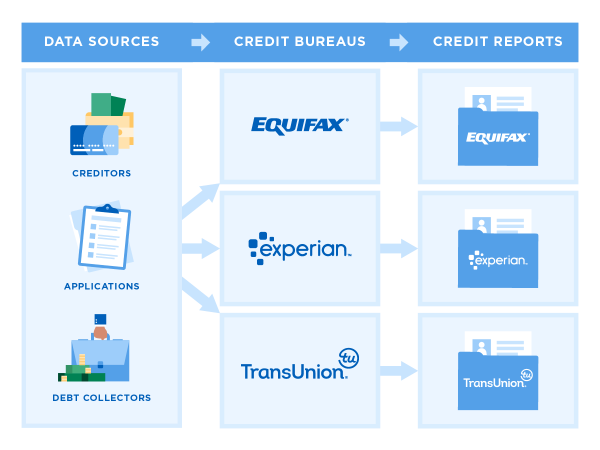

Credit reporting agencies (also known as credit bureaus) are companies that collect and maintain consumer credit information. They gather data from lenders, creditors, and public records to create detailed credit reports. These reports include:

- Personal information (name, address, Social Security number)

- Credit accounts (credit cards, loans, mortgages)

- Payment history (on-time or late payments)

- Credit inquiries (when lenders check your credit)

- Public records (bankruptcies, tax liens, foreclosures)

Lenders, landlords, and even employers use these reports to evaluate your creditworthiness. Based on this data, credit scoring models (like FICO® and VantageScore®) calculate your credit score.

While there are smaller credit reporting agencies, the “Big Three” Equifax, Experian, and TransUnion dominate the industry. Here’s what you need to know about each:

- Equifax

- Founded: 1899

- Headquarters: Atlanta, Georgia

- Key Features:

- Offers credit monitoring and identity theft protection services.

- Provides business credit reports and fraud prevention tools.

- It was affected by a major data breach in 2017, exposing millions of consumers’ data.

- Experian

- Founded: 1996 (formerly TRW Information Systems)

- Headquarters: Dublin, Ireland (U.S. operations in Costa Mesa, California)

- Key Features:

- Tracks alternative payment data (like rent and utility bills) through Experian Boost.

- Offers free credit reports and FICO® scores through their website.

- Provides business credit services globally.

- TransUnion

- Founded: 1968

- Headquarters: Chicago, Illinois

- Key Features:

- Uses trended credit data (up to 30 months of payment history).

- Offers CreditVision, which helps lenders assess risk more accurately.

- Provides credit monitoring and identity protection services.

While all three bureaus collect similar data, they may report slightly different information, leading to variations in your credit scores.

- How Do Credit Bureaus Get Your Information?

Credit bureaus don’t generate your credit data, they compile it from various sources, including:

- Banks and Credit Card Issuers – Report your payment history, balances, and credit limits.

- Loan Providers – Share details about mortgages, auto loans, and personal loans.

- Debt Collectors – Report delinquent accounts sent to collections.

- Public Records – Include bankruptcies, tax liens, and civil judgments.

- Credit Inquiries – When you apply for credit, lenders perform hard or soft inquiries.

Not all creditors report to all three bureaus, which is why your credit reports may differ slightly.

- Why Are There Three Different Credit Reports?

Since lenders aren’t required to report to all three bureaus, discrepancies can occur. For example:

- A credit card issuer may only report to Experian and TransUnion, but not Equifax.

- Late payment might appear in one report but not another.

- Errors or outdated information may affect one bureau’s report.

That’s why it’s essential to check all three reports regularly.

- How to Check and Monitor Your Credit Reports

By law, you’re entitled to a free credit report from each bureau every 12 months through creditreportease.com. Due to the COVID-19 pandemic, you can now check your reports weekly for free until the end of 2023.

Steps to Request Your Free Reports:

- Visit creditrepairease.com.

- Fill out the request form with your details.

- Select which reports you want (Equifax, Experian, TransUnion).

- Verify your identity through security questions.

- Download or view your reports.

Other Ways to Monitor Your Credit:

- Credit Monitoring Services – Companies like Credit Karma, IdentityForce, and myFICO provide alerts for changes in your credit file.

- Bank and Credit Card Alerts – Some financial institutions offer free credit score tracking.

- Disputing Errors on Your Credit Report

Mistakes happen, and errors on your credit report can hurt your score. Common issues include:

- Incorrect personal information

- Accounts that don’t belong to you

- Duplicate accounts

- Outdated negative information

How to Dispute Errors:

- Review Your Reports – Identify inaccuracies.

- Gather Evidence – Collect supporting documents (statements, payment records).

- File a Dispute – Submit a dispute online, by mail, or by phone with the credit bureau.

- Wait for Investigation – Bureaus typically resolve disputes within 30 days.

- Follow Up – If the error isn’t corrected, escalate the issue with the Consumer Financial Protection Bureau (CFPB).

- Tips for Maintaining a Healthy Credit Score

Since credit bureaus track your financial behavior, follow these best practices:

Pay Bills on Time – Payment history is the biggest factor in your credit score.

Keep Credit Utilization Low – Aim to use less than 30% of your available credit.

Avoid Opening Too Many Accounts at Once – Multiple hard inquiries can lower your score.

Check Your Reports Regularly – Catch errors or signs of identity theft early.

Maintain a Mix of Credit Types – Having both revolving (credit cards) and installment (loans) credit can help.Final Thoughts

Equifax, Experian, and TransUnion play a vital role in your financial life by tracking your credit history. Since each bureau may have slightly different information, it’s crucial to monitor all three reports for accuracy.

By understanding how credit reporting works, you can take control of your credit health, dispute errors, and improve your financial standing over time.

Don’t let a low credit score hold you back—call (888) 803-7889 for a personalized action plan!

Suggested Articles

Boost Your FICO® Score Instantly

Contact Us Today for a Free Consultation!

Resources

Recent Post

What Is a Home Equity Loan?

Is Truist a Good Bank for Mortgage Loans? A Comprehensive Review for 2025

Personal Loan Interest Rates and the Role of Credit Scores

What is a credit check ?

What are money orders, and how do they work?

Credit Repair Ease

Understanding the 3 credit bureaus: Equifax, Experian and TransUnion

Credit bureaus play a crucial role in the financial ecosystem by collecting and compiling data related to your credit activities. This data is then used to create credit reports, which are essential tools in calculating credit scores and making lending decisions. Here’s what you need to know about credit bureaus and how they impact your financial life.

What You’ll Learn:

- The three major credit bureaus: Equifax®, Experian®, and TransUnion®.

- The difference between credit bureaus and credit-scoring companies.

- The type of information credit bureaus collect and how they use it.

- How to protect your credit information and access your credit reports.

The Three Major Credit Bureaus

The three nationwide credit bureaus—Equifax®, Experian®, and TransUnion®—are companies that compile and sell credit reports. According to the Consumer Financial Protection Bureau (CFPB), these bureaus gather information from various sources to create credit reports that help calculate your credit scores. Each bureau has its own process for collecting data, which can result in slight differences in your credit reports and scores.

- Equifax® Credit Reports: Learn more about Equifax and their credit reporting services.

- Experian® Credit Reports: Discover Experian’s credit reporting approach.

- TransUnion® Credit Reports: Understand how TransUnion compiles credit reports.

Credit Bureaus vs. Credit Scoring Companies

It’s important to differentiate between credit bureaus and credit-scoring companies. While bureaus compile the data, companies like VantageScore® and FICO® use this data to calculate your credit scores through mathematical formulas called scoring models. This distinction is crucial for understanding how your credit score is determined.

What Information Do Credit Bureaus Collect?

Credit bureaus collect various types of information to create a comprehensive picture of your financial habits. This includes:

- Hard Inquiries: Related to credit applications.

- Account Details: When accounts were opened, loan amounts, credit limits, and balances.

- Payment History: Including late or missed payments.

- Debt Collections: Accounts that have been sent to collections.

- Public Records: Such as bankruptcies, liens, and wage garnishments.

Credit bureaus gather this information from financial institutions, lenders, and public records to build your credit report.

How Do Credit Bureaus Protect Your Information?

Your credit information is protected under the Fair Credit Reporting Act (FCRA), a federal law that ensures the accuracy, privacy, and fairness of information collected by credit bureaus. The FCRA allows credit bureaus to collect data without your explicit permission, but businesses accessing your credit report must have a “permissible purpose” under the law.

To learn more about your rights under the FCRA, visit the Consumer Financial Protection Bureau (CFPB).

It’s recommended to review your reports regularly to ensure accuracy and to catch any potential errors early.

Contacting the Three Major Credit Bureaus

If you need to contact any of the three major credit bureaus, here are the details:

Equifax: Website | Phone: 800-685-1111

Experian: Website | Phone: 888-397-3742

TransUnion: Website | Phone: 888-909-8872Key Takeaways

Credit bureaus like Equifax, Experian, and TransUnion play an integral role in the lending and borrowing process by compiling your credit reports. Understanding how they work, the type of information they collect, and how to protect your credit information is essential for managing your financial health.

For further details on credit reporting and your rights, refer to the NCUA guidelines and the Consumer Financial Protection Bureau for accurate and up-to-date information.

https://www.creditrepairease.com/blog/what-are-the-3-credit-reporting-agencies/https://www.carfcu.org/knowledge-base/understanding-the-3-credit-bureaus-equifax-experian-and-transunion/