How Do Credit Bureaus Get Your Information?

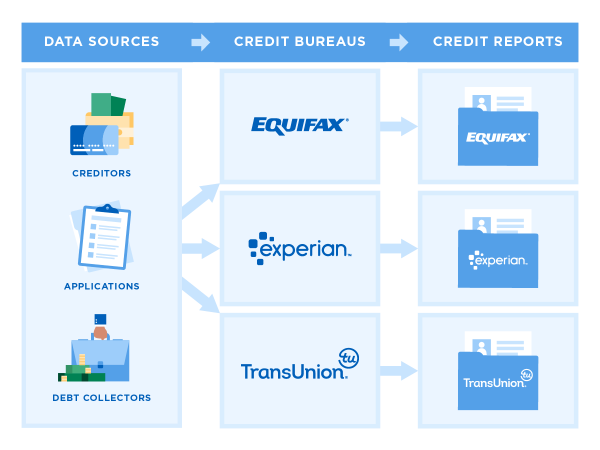

The top three credit bureaus (also known as credit reporting agencies) are Experian, Equifax and TransUnion. When you’re applying for credit, lenders depend on the data provided by these bureaus to make their decision whether or not to lend you money. So where does this data come from in the first place?

Most of us establish credit over time through things like:

- Opening bank or credit union accounts

- Applying for and using retail, gas and other credit cards

- Getting an auto loan

- Taking out a mortgage or line of credit

The length of your credit history (the credit you establish over time) makes up 15% of your FICO ® Score. It’s an important factor that creditors take into consideration when deciding if you’ve had credit long enough to trust you with their money. This isn’t the primary focus of this article, but it’s essential knowledge to have.

So. once you’ve established credit, your creditors (see those mentioned above), report the details of your credit activity to the bureaus. If you manage your credit well that positive information will be reported to the credit bureaus and reflect positively in your credit file and subsequently your FICO ® Score. The same goes for negative information. For instance, if you owe very close to your total allowed limit on a credit card, that information will also be passed on to the bureaus. This is part of the “Amounts Owed” factor of your FICO ® Score which makes up 30% of your total score – just one of the reasons to monitor your spending.

Timing is Everything with Credit

Your credit files can change every day. That’s because, as you open new accounts, pay your bills, close accounts and so on, the bureaus continue to collect information and activity from creditors and lenders. This collection alone changes the data in your files.

In addition, some lenders provide their information at the start of the month, others in the middle and some at the end. That means, not only will the information change on different days at different bureaus, but the information at each bureau may not match because it was received at different times.

In answer to the original question, “how do credit bureaus get your information?” it pretty much comes down to specific lenders and their processes regarding customer credit activity. Once they report that information to the bureaus, the bureaus provide the information in the form of a credit report to the company or person who requested it.

All Lenders are Not the Same

Something to note when doing research on your credit bureau information is that lenders are not required to report information to the credit bureaus. Generally, most major banks report to all three bureaus. However smaller regional banks and credit unions may only report to one or two of the bureaus. or to none at all. The same goes for credit cards, but more often than not, the credit card companies will report your activity to at least one of the credit reporting bureaus.

It’s for this reason (and others, like identity theft and out of the ordinary inquiries), that you should always monitor your credit reports. It helps you ensure that the information they contain is correct and will also give you a look into how you are perceived by lenders. This way there won’t be any big surprises when you apply for a loan, an increased line of credit or decide it’s time to ask for a decrease in your credit card interest rate.

Check out myFICO forums to see how others have managed to keep an eye on the information lenders send to credit bureaus.

Rob is a writer. of blogs, books and business. His financial investment experience combined with a long background in marketing credit protection services provides a source of information that helps fill the gaps on one’s journey toward financial well-being. His goal is simple: The more people he can help, the better.

Credit Scores::01_credit_scores::Credit Scores

Credit Reports::02_credit_reports::Credit Reports

Blog::03_blog::/blog

Financial Calculators::04_financial_calculators::Financial Calculators

Know Your Rights::05_know_your_rights::Know Your Rights

Identity Theft::06_identity_theft::Identity Theft

Faq::07_faq::Faq

Glossary::08_glossary::/glossary

Custom::custom::/custom –>

Estimate your FICO ® Score range

Answer 10 easy questions to get a free estimate of your FICO ® Score range

What are the 3 credit bureaus and why do they matter?

The three major credit bureaus — Experian, Equifax, and TransUnion — collect financial information that lenders use to assess your creditworthiness. Learn more about each bureau, including how they work and how they calculate credit scores. Then get an identity theft protection service to help monitor your credit and identify fraudulent use of your financial information.

- Written by Oliver Buxton

- Published: March 25, 2025 6 min read

A credit bureau is a company that collects and manages financial data, including your borrowing and repayment history. The three major credit bureaus — Experian, Equifax, and TransUnion — handle over 1.6 billion credit accounts between them.

These bureaus play an important role in managing your credit report and score, impacting your ability to secure loans, get favorable interest rates, and even rent certain apartments. Understanding how the three credit bureaus work can help you better grasp their roles in shaping your credit.

Keep reading to learn more about the three largest credit bureaus and why they matter for your finances.

1. Experian

Experian, headquartered in Dublin, Ireland, began in 1826 when London merchants started sharing information on customers with unpaid debts. The bureau was officially formed in 1996, when the U.K. business and the U.S. business, previously known as TRW, merged.

2. TransUnion

TransUnion, headquartered in Chicago, Illinois, was originally formed in 1968 as a holding company for Union Tank Car Company. It entered the credit reporting industry in 1969 by acquiring the Credit Bureau of Cook County, and it has since grown into a global provider of credit information and risk management services.

3. Equifax

Equifax, headquartered in Atlanta, Georgia, was founded in 1899 by the brothers Cator and Guy Woolford as the Retail Credit Company. It initially collected consumer data for insurance companies and transitioned into a credit bureau by expanding its services to include credit reporting and financial information.

How do credit bureaus work?

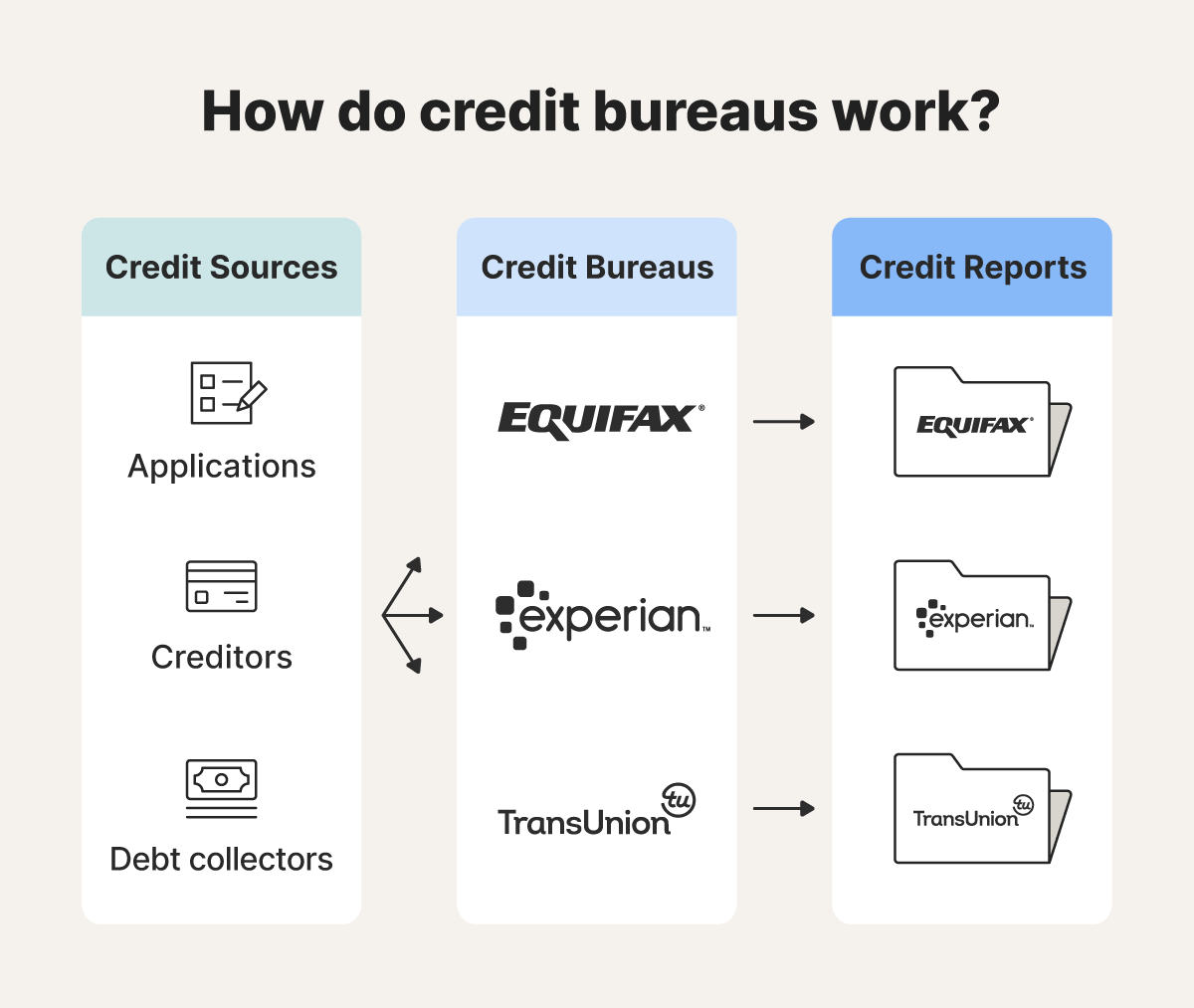

Credit bureaus gather, store, and share consumer information with authorized parties to help assess your likelihood of repaying borrowed money or meeting financial obligations.

Using the financial data they collect, credit bureaus create your credit report and calculate your credit score. These tools help lenders, landlords, and other entities evaluate your financial responsibility.

- Financial institutions

- Credit card issuers

- Mortgage lenders

- Utility companies

- Debt collection agencies

Additionally, credit bureaus gather information from public records, like bankruptcies, foreclosures, and tax liens, which can also impact your credit score.

While credit bureaus provide information to help assess creditworthiness, they do not make lending decisions. It’s up to individual entities to decide whether to approve or deny an application.

Graphic of how credit bureaus work.

What information do credit bureaus collect?

Credit bureaus collect financial and personal information — like your address, Social Security number, and payment history — to create a detailed picture of your credit profile.

- Personal information: Your name, date of birth, Social Security number, current and past addresses, and employment history.

- Credit accounts: Details about loans, credit cards, mortgages, and other credit accounts, including account types, balances, payment history, and credit limits.

- Payment history: Records of on-time and missed payments for credit accounts and utility bills.

- Public records: Information from court filings, such as bankruptcies, foreclosures, or tax liens.

- Debt collection activity: Details about accounts sent to collections and their current status.

- Credit inquiries: A record of when lenders, landlords, or other authorized parties check your credit report.

How do credit bureaus calculate your credit score?

While all three credit bureaus use similar factors to calculate your score, their factor weighting and calculation methods are different; therefore, your credit score may differ from bureau to bureau. Additionally, not all businesses report to every bureau, which can lead to variations.

Let’s take a closer look at how each bureau calculates its credit score:

Equifax credit score

Unlike the other major bureaus, Equifax uses an independent scoring system with scores ranging from 280 to 850. Unlike other credit scoring models, Equifax does not disclose the exact weight it places on different factors that impact your score.

TransUnion credit score

TransUnion provides credit scores based on the VantageScore 3.0 model, which ranges from 300 to 850. This credit scoring model places a greater emphasis on payment history and credit mix than the FICO scoring model used by Experian.

Here’s how the VantageScore 3.0 model weighs factors impacting your credit.

- Payment history (40%)

- Age and credit mix (21%)

- Credit utilization (20%)

- Balance (11%)

- New credit (5%)

- Available credit (3%)

Experian credit score

Experian also uses the FICO scoring model, with a credit range from 300 to 850. However, their use of the scoring model places a greater emphasis on credit utilization than the VantageScore model.

Here’s a breakdown of FICO credit score factors:

- Payment history (35%)

- Credit utilization (30%)

- Credit age (15%)

- Credit mix (10%)

- Number of inquiries (10%)

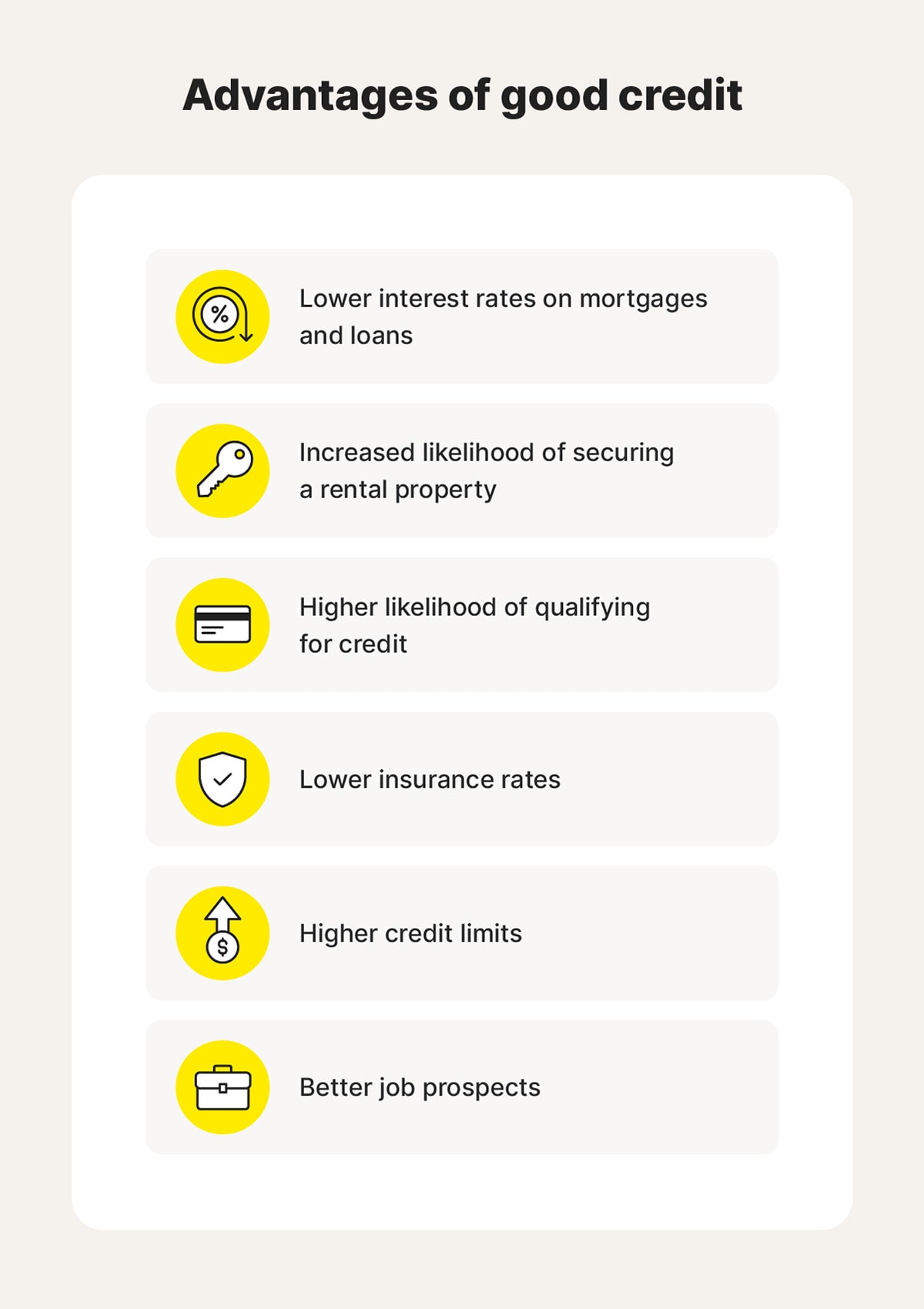

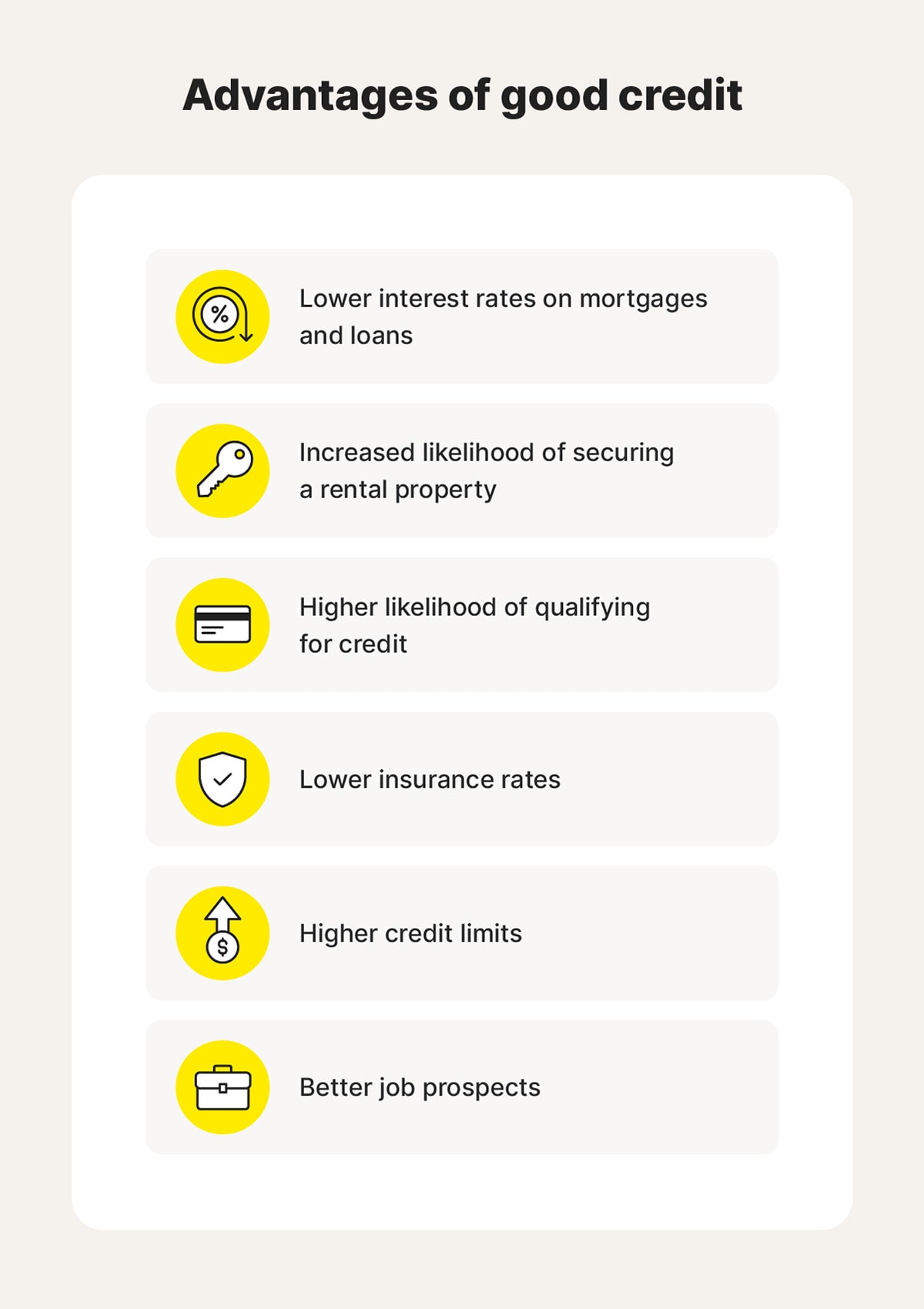

Why are credit bureaus important for your financial health?

Your credit score and credit report carry a lot of weight for many of life’s milestones. From securing a mortgage to getting approved for a car loan or even landing certain jobs, having good credit makes it easier to achieve your goals.

Credit bureaus collect and maintain information about your financial behavior, which is used to calculate your credit score and inform your credit report. Depending on how responsibly you manage credit, this information can either open or close doors to financial opportunities.

Here’s how your credit score can influence your financial opportunities:

- Interest rates on loans: Higher credit scores often qualify you for lower interest rates, saving you money on mortgages, auto loans, and personal loans.

- Ability to secure a rental property: Landlords may check your credit to determine if you’re a reliable tenant. Poor credit could affect your chances of approval.

- Ability to qualify for credit: A good credit score makes it easier to get approved for credit cards, loans, and lines of credit.

- Insurance rates: Some insurance providers use credit scores to help determine your premiums, meaning better credit could lead to lower rates.

- Credit limits: Lenders may offer higher credit limits to borrowers with strong credit histories, providing more financial flexibility.

- Job prospects: Certain employers may review credit reports as part of the hiring process, particularly for jobs that involve financial responsibilities.

List of six benefits of having good credit.

How to contact all three credit bureaus

If your credit score is lower than expected, it could signal a larger issue with your credit report. Errors on your credit report can range from simple mistakes to more serious issues like identity theft. If you spot an error, contact the credit bureaus and dispute the mistake. This helps ensure your credit file accurately reflects your financial situation.

Below is the contact information for each credit bureau:

| Equifax | Experian | TransUnion |

|---|---|---|

| Online dispute page | Online dispute page | Online dispute page |

| (888) 378-4329 | (855) 414-6048 | (800) 680-7289 |

| Equifax Information Services LLC P.O. Box 740256 Atlanta, GA 30374-0256 | Experian P.O. Box 4500 Allen, TX 75013 | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

Control your financial health

Understanding how the three major credit bureaus impact your financial health is just the first step toward building a stronger credit score. Norton 360 with LifeLock Ultimate Plus helps you track your credit score, monitor your bank and credit card activity, and identify potential fraud with your 401(k) and investment accounts.

FAQs

Which credit bureau is best?

All three credit bureaus report financial data accurately, so there isn’t necessarily a “best” bureau. However, knowing which bureau most of your lenders report to can help you get a more accurate picture of your credit score.

Can you dispute credit report errors?

You can and should dispute credit report errors. To dispute a credit report error, reach out to the credit bureau directly and follow their dispute process.

How can you get a free credit report?

You can get a free credit report annually from each of the three major credit bureaus. With Norton 360 with LifeLock Ultimate Plus, you’ll receive easy access to your annual credit report and credit score plus credit monitoring from all three of the leading credit bureaus.

- Oliver Buxton

- Staff Cybersecurity Editor

Oliver Buxton, a staff editor for Norton, specializes in advanced persistent threats. His work on cyberterrorism has appeared in The Times, and his prior work includes writing digital safeguarding policies.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Contents

Related articles

Published: March 26, 2025 · 14 min read

Published: March 25, 2025 · 22 min read

Published: March 25, 2025 · 14 min read

Published: March 21, 2025 · 11 min read

Published: March 23, 2025 · 15 min read

Want more?

Follow us for all the latest news, tips, and updates.

- Norton AntiVirus Plus

- Norton 360 Deluxe

- Norton 360 for Gamers

- Norton 360 with LifeLock Select

- Norton 360 with LifeLock Ultimate Plus

- Norton VPN

- Norton AntiTrack

- Norton Family

- Norton Mobile Security for Android

- Norton Mobile Security for iOS

- Norton Utilities Ultimate

- Norton Driver Updater

- Norton Small Business

- Norton Genie

- Norton Private Browser

Product features

- Norton 360 Comparison

- Antivirus

- Windows 10 Antivirus

- Windows 11 Antivirus

- Mac Antivirus

- Virus removal

- Malware protection

- Cloud Backup

- Safe Web

- Safe Search

- Windows 10 VPN

- Smart Firewall

- Password Manager

- Password Generator

- Parental Control

- Privacy Monitor

- SafeCam

- Dark Web Monitoring

- Identity Lock

Services & Support

- Norton Premium Services

- Norton Computer Tune Up

- Norton Ultimate Help Desk

- Spyware & Virus Removal

- Norton Support

- Norton Update Center

- How to renew

About

Norton is part of Gen – a global company with a family of trusted brands.

Copyright © 2025 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play, and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple, and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Windows logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.

https://www.myfico.com/credit-education/blog/how-credit-bureaus-get-your-infohttps://us.norton.com/blog/financial-wellness/what-are-the-3-credit-bureaus