Top 3 Credit Bureaus: What They Are and How They Work

Do you know how banks and other lending institutions decide whether someone qualifies for a mortgage? Or how do companies that offer lines of credit, home loans, or auto loans determine if they’re dealing with a high-risk borrower?

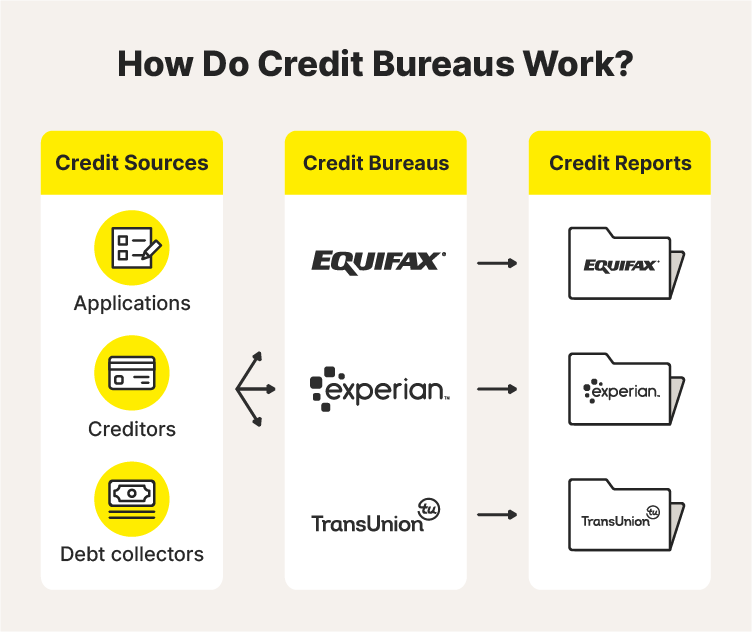

The answer lies in your credit report — a document that provides a comprehensive record of your financial habits and ability to manage debt. These reports are meticulously prepared by credit bureaus, also known as credit reporting agencies (CRAs).

Credit bureaus play a major role in the financial ecosystem. They collect and maintain detailed information about the financial activities of millions of Americans; they serve both consumers and lenders.

For consumers, credit bureaus offer insights into their credit standing, which can help them secure better financial opportunities. For lenders, these agencies provide critical data to assess the risk of extending credit. But what exactly do credit bureaus do, and why are they so important?

What Are Credit Bureaus?

Credit bureaus are companies that gather and maintain credit information for millions of consumers. This data is compiled into credit reports, which lenders and other entities use to assess your creditworthiness.

In the United States, three major credit bureaus dominate the industry: Experian, Equifax, and TransUnion. While smaller credit reporting agencies exist, these three are the most widely used. Each bureau provides a unique credit report for individuals, which means your financial data might differ slightly between them.

Credit Scores from Credit Bureaus

Your credit score is a three-digit number between 300 and 850. This number is derived from the information in your credit reports. This number reflects your creditworthiness. For lenders, a higher credit score means that the borrower carries lower credit risk.

Lenders rely on credit scores to make critical decisions, such as whether to approve your credit application, how much to lend, and the interest rate to offer. A good credit score can unlock better financial opportunities, while a poor score can make borrowing more expensive or inaccessible. This is why so many consumers are keen to improve their credit scores.

Who Regulates Credit Bureaus?

Credit bureaus operate under the Fair Credit Reporting Act (FCRA), a federal law that governs how consumer information is collected, shared, and disclosed. The FCRA also provides consumers with essential protections, including the right to dispute inaccuracies in their credit reports. Yes, it is possible to dispute negative items on your credit report if they are inaccurate, unsubstantiated, incomplete, or biased.

FCRA regulations ensures that credit bureaus handle your financial information responsibly while giving you tools to maintain accurate credit records.

History of the Top 3 Credit Bureaus

The history of the major credit bureaus dates back centuries:

- Experian: The oldest of the three, Experian was founded in 1826 as the Manchester Guardian Company.

- Equifax: Established in 1899, this credit reporting agency has grown into a global credit reporting leader.

- TransUnion: Founded in 1968, it was initially a holding company for a railcar leasing business; it later evolved into a credit reporting company.

Over the years, these bureaus have expanded their operations by acquiring regional agencies. They have solidified their position in the financial industry and this is why they are among the top 3 credit bureaus in the United States today.

How Do Credit Bureaus Gather Information on Consumers?

Credit bureaus collect data from lenders, financial institutions, and other entities that report consumer credit activity. These include details about your loans, credit card usage, payment history, and account balances.

Lenders voluntarily provide this information, which helps credit bureaus create comprehensive credit reports. In turn, this data helps lenders evaluate the risk of extending credit to consumers.

How Do Lenders Use Credit Reports?

When you apply for a loan or credit card, lenders review your credit report and score to assess your creditworthiness. They analyze your payment history, debt levels, and other factors to determine if you qualify for credit, how much to lend, and the interest rate to offer. Lenders can make a hard or soft credit inquiry.

While some lenders rely on one credit report, others—such as mortgage companies—may review reports from all three bureaus to make informed decisions.

What Kind of Information Is Included in My Credit Report?

Your credit report includes both personal and financial details, such as:

- Personal Information: Name, aliases, date of birth, Social Security Number, and addresses.

- Account Information: Details about loans, credit cards, balances, and limits.

- Payment History: A record of on-time, late, or missed payments.

- Credit Inquiries: Records of hard and soft inquiries.

- Public Records: Information such as bankruptcies.

- Collection Accounts: Accounts sent to collections due to non-payment.

What Kind of Information Is Not Included in My Credit Report?

Despite the wealth of information in credit reports, certain details are excluded:

- Civil Lawsuit: Consumers can sue for actual damages, which include the greater of any actual damages sustained or the amount paid to the credit repair company. They can also receive punitive damages, the amount of which will be determined by a judge.

- Attorney’s Fees: Successful litigants can recover costs of action and reasonable attorney fees.

- State Action: State law enforcement can also take action and pursue credit repair organizations that are breaking the law.

- Federal Action: The Federal Trade Commission (FTC) has the authority to take action against credit repair companies that violate the provisions of the Credit Repair Organization Act.

How To Identify A Fraudulent Credit Repair Company

Watch out for red flags, such as:

- Demographics: Race, ethnicity, gender, marital status, and income.

- Medical History: Information about medical conditions or treatments.

- Buying Habits: Specific purchase details or spending patterns.

- Bank Balances: Information about your bank account balances.

- Criminal Record: Criminal history is not included.

- Education Level: Your level of education is not tracked.

Why Can My Score Differ Across Bureaus?

It’s common for credit scores to vary between the top three bureaus due to:

1.Different Data: Not all lenders report to every bureau.

2.Varied Methods: Each bureau has unique processes for collecting and updating information.

3.Timing: Data may be updated at different intervals across bureaus.

4.Scoring Models: FICO scoring models differ, while VantageScore models are consistent across bureaus.

While discrepancies do exist, your scores should generally be similar.

Can Credit Bureaus Make Mistakes?

Yes, credit bureaus can make mistakes, such as reporting errors or failing to update account information. These inaccuracies can negatively impact your credit score and make it difficult to secure credit or favorable terms.

Who Can Take Action to Correct Credit Report Errors?

If you identify an error, you have the right to dispute it. Credit bureaus are legally obligated to investigate and correct mistakes within a reasonable timeframe. Anyone can communicate with the CRAs or creditors to dispute credit report errors.

If you are not prepared to undertake this task, you can rely on an established credit repair company.

Credit repair companies can assist consumers in addressing inaccuracies and negative items on their credit reports. Here’s how they can help:

- Disputing Inaccurate Information: Credit repair companies can help you challenge and dispute errors on your credit report. Their experts can gather the necessary evidence and communicate with the credit bureaus

- Removing Negative Items: Credit repair companies like AMERICA CREDIT CARE can help with the removal of negative items such as charge-offs, repossessions, inquiries, late payments, bankruptcies, foreclosures, and collections. These items can significantly lower your credit score, so getting them removed can improve your credit standing.

- Guidance and Support: Analyzing credit reports and disputing inaccuracies can be challenging. Credit repair companies provide guidance and support throughout the process. They can help you understand your credit report, identify issues, and take the necessary steps to fix them.

- Expertise and Experience: Legitimate credit repair companies have expertise in dispute processes. They are familiar with the different credit bureaus and their procedures, and they can leverage this knowledge to help you get the best results.

- Saving Time and Effort: Repairing your credit can be a time-consuming process, and it may require considerable effort in tracking and gathering information for disputes. Credit repair companies can save you time and effort by taking on these tasks

What Are Credit Bureaus and How Do They Work?

Credit bureaus gather and organize information about consumers to create consumer credit reports. They sell these reports, along with credit scores, to creditors.

Credit bureaus, also known as credit reporting agencies or consumer reporting companies, play an integral part in the financial lives of millions of people. The big three—Experian, TransUnion and Equifax—collect and organize data to create consumer credit reports.

The bureaus don’t make lending decisions or determine your credit scores. However, when you apply for a loan or line of credit, the creditor will often purchase a credit report and a score based on the report from a credit bureau.

The Three Major Consumer Credit Bureaus

The three major consumer credit bureaus are often lumped together, but they’re competitors that try to create the largest and most accurate databases. Here’s a little more background on the bureaus.

Experian

Experian’s history dates back to the early 1800s when a group of tailors in London started sharing information about customers who missed payments. However, the Experian name and the company’s U.S. presence are the result of a series of mergers and acquisitions that happened in the mid-1990s. Today, Experian is a global leader in the credit space, with information on over 1.5 billion consumers and 201 million businesses.

TransUnion

TransUnion was created in 1968 as the parent holding company for a railcar leasing company, but acquired the Credit Bureau of Cook County the next year. TransUnion continued building its credit reporting business and it is now one of the largest credit bureaus in the U.S. and Canada. It also has global credit reporting operations in the UK, India and parts of Africa, Asia Pacific and Latin America.

Equifax

Equifax is one of the oldest U.S.-based credit bureaus. The Retail Credit Co. was founded in 1899 and changed its name to Equifax in 1975. Equifax has also expanded into global markets over the years and offers credit-related services in Asia Pacific, Canada, Europe and Latin America.

Other Consumer Reporting Companies

There are also many specialty consumer reporting companies. Some focus on information that landlords want to know, such as whether you’ve ever been evicted, while other reporting companies track and report consumers’ insurance claims or checking account history.

The Consumer Financial Protection Bureau (CFPB) maintains a list of consumer reporting companies with details on how you can request a free copy of your consumer report from each company.

How Do Credit Bureaus Get Information?

Most of the credit bureaus’ information comes from other companies. In the credit world, these companies are called data furnishers. In everyday terms, they’re the same financial institutions that you regularly interact with, including:

- Banks

- Credit unions

- Credit card issuers

- Mortgage lenders

- Loan servicers

- Collection agencies

Data furnishers send information to the credit bureaus about their customers’ accounts, such as when you opened an account, its current balance and whether you paid the bill on time. Generally, furnishers send an update every month.

Companies will also report information from your applications to the bureaus, which is one reason your credit report might contain your current and past names, addresses, telephone numbers and employers.

Furnishers aren’t required to send information to the credit bureaus—it’s all voluntary. But doing so allows furnishers to report late payments to the bureaus, incentivizing borrowers to pay their bills on time.

What Information Do Credit Bureaus Collect?

Although most of the information in your credit report comes from data furnishers, the credit bureaus collect public records data, such as bankruptcy filings. Tax liens and civil judgments used to be part of consumer credit reports, but the bureaus no longer add these to your credit reports.

What Information Isn’t in Your Credit Report?

Even if the information is available, credit bureaus also don’t include everything on your credit report. For example, Experian won’t include information about a consumer’s:

- Race

- Ethnicity

- Religion

- Marital status

- Medical history

- Sexual orientation

- Political affiliations

- Friends

- Criminal records

Your credit reports also don’t contain information about your income, bank account or investment account balances.

Who Uses Credit Reports?

Many organizations use credit reports to better understand the financial risk associated with an individual. These include:

Creditors

Creditors, such as lenders and credit card issuers, use credit reports and credit data from the credit bureaus in several ways:

- Decide whom to send offers to: Creditors might work with a credit bureau to create a list of consumers who meet certain criteria and then send those consumers a preapproved credit offer—like the credit card offers you get in the mail.

- Make decisions about an application: When someone applies for credit, the creditor will often use a credit report and credit score to decide whether to approve the application and the terms to offer.

- Monitor customers’ creditworthiness: Creditors regularly purchase credit reports and scores to monitor existing accounts. They may close your account, offer you a card upgrade or change your credit limit based on changes in your credit report.

Employers

In some states, employers can use credit checks when hiring or promoting someone. This may be more common within the financial sector, for roles related to financial management or if the position requires security clearance.

Employers never receive a credit score with the credit report. And the credit report they receive is different from the one given to lenders. For example, it doesn’t include your date of birth or account numbers.

Landlords

Landlords also might use a credit report and credit score when reviewing rental applications. Someone with a poor credit history might have trouble qualifying for a rental or have to pay a larger security deposit.

Many Other Organizations Also Use Credit Bureau Data

Almost every company that has to verify its users’ identities—including financial institutions, casinos and online marketplaces—might use data from the credit bureaus.

Although they don’t receive a credit report, the companies might verify that the identifying information someone provides matches what’s in a credit bureau’s database. If there’s a mismatch in the name, address or date of birth, that could be a sign of identity fraud.

The Fair Credit Reporting Act Regulates Credit Bureaus

Federal and state laws govern what can and cannot appear in your credit reports and who can request a copy of your credit report. The Fair Credit Reporting Act (FCRA) is one of the most important laws related to credit reporting. Some of its major rules include:

- Consumers can request a free copy of their credit report. You have the right to get a free copy from each credit bureau weekly through AnnualCreditReport.com.

- Negative information, such as late payments, generally must be removed from credit reports after seven years. However, certain bankruptcies can remain for 10 years.

- A person or company must have a “permissible purpose” to request a copy of a consumer’s credit report. These include when a consumer gives their permission and when a creditor is making a lending decision after receiving an application.

- Consumers have the right to dispute information in their credit reports. The credit bureau must investigate non-frivolous disputes and verify, correct or delete the disputed information.

The FCRA applies to all consumer reporting companies, not just the big three.

Why Do I Have Different Credit Scores for Each Bureau?

The credit score you see depends on three things: the credit scoring model, the credit report it’s scoring and when the report is scored.

Your credit scores could be different because:

- Your credit reports aren’t identical. Data furnishers are not required to share information with the credit reporting agencies, and when they do, they can choose to report to one, two or all three. Those differences in the information that appears on your credit reports from Experian, TransUnion and Equifax can result in different credit scores.

- You’re comparing different types of credit scores. There are hundreds of different credit scoring models, if not more. FICO and VantageScore ® develop scoring models that the credit bureaus use, and the credit bureaus also have their own scoring models. So, even if your three credit reports happen to be identical, you could have different scores depending on the model.

- You’re comparing scores from different time periods. If you use several programs to check your credit scores, you might find the scores differ even if they’re based on the same credit bureau report and score model. This can happen if the programs don’t update your credit report and score at the same time.

You won’t necessarily know which type of credit score or credit report a lender will use. However, rest assured that the steps you take to improve one credit score will generally help your other credit scores as well.

FAQs

What Is a Credit Bureau?

A credit bureau is a company that gathers and organizes information about consumers and businesses. They focus on identity and financial data, such as your name, address and your history with various loans and credit cards.

What Do Credit Bureaus Do?

Credit bureaus use the information they gather to create credit reports. Creditors often purchase credit reports and an accompanying score when making lending decisions and managing existing credit accounts. Credit bureaus also create, offer and sell related products and services, such as marketing, identity verification and fraud prevention tools that incorporate credit data.

How Can I Get a Copy of My Credit Report?

You can get a copy of your credit report from AnnualCreditReport.com, directly from one of the credit bureaus or from companies that purchase and resell credit reports. Requesting your credit report will never hurt your credit score.

Monitor Your Experian Credit Report for Free

You can check your Experian credit report for free with an Experian account. You’ll also receive a FICO ® Score Θ based on your credit report and free credit report and score monitoring. The account also offers insight into your credit report, such as the factors that are helping or hurting your credit, and allows you to easily manage who can access your credit report.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO ® Score for free.

No credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Explore more topics

- Report advice

- Score advice

- Establishing credit

- Improve credit

- Credit repair

- Life stages

Share article

Experian is a globally recognized financial leader, committed to being a Big Financial Friend—empowering millions to take control of their finances through expert guidance and innovative tools. As a trusted platform for money management, credit education, and identity protection, our mission is to bring Financial Power to All™.

- Security freeze

- Fraud alert

- Disputes

- Denied credit

- Identity theft victim assistance

- Active duty military

- Opt out of prescreen offers

- Upload a document to Experian

- Credit report & scores

- Fraud & identity theft

- Banking

- Credit cards

- Loans

- Insurance

- Mortgage

- Investing

- Personal finance

- News & research

- Free credit monitoring

- 3-bureau reports & FICO ® Scores

- Check credit

- Improve credit

- Establish credit

- Experian CreditLock

- Annual credit report

Experian’s Diversity, Equity and Inclusion

Data privacy

- Legal terms & conditions

- Privacy center

- U.S. data privacy policy

- Press

- Ad choices

- Careers

- Investor relations

- Contact us

To view important disclosures about the Experian Smart Money™ Digital Checking Account & Debit Card, visit experian.com/legal.

The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

^ Calculated on the VantageScore ® 3.0 model. Your VantageScore 3.0 from Experian ® indicates your credit risk level and is not used by all lenders, your lender may use a score that’s different from your VantageScore 3.0. Click here to learn more.

Θ Credit score calculated based on FICO ® Score 8 model. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author’s alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities, unless sponsorship is explicitly indicated. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies (“our partners”) from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

*For complete information, see the offer terms and conditions on the issuer or partner’s website. Once you click apply you will be directed to the issuer or partner’s website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms – and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

© 2025 Experian. All rights reserved.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

https://www.americacreditcare.com/credit-bureaushttps://www.experian.com/blogs/ask-experian/what-is-a-credit-bureau/