5 Best International Banks for Worldwide Banking in 2025

Not all “international” banks offer true cross-border capabilities—look for features like multi-currency accounts, local payout networks, and FX tools. This article lists the international banks that get it right.

Many banks claim to be “international,” but that label rarely holds up when you try to send a cross-border payment, hold multiple currencies, or reach support after hours. That’s usually when most people realise that their banks are not the right bank for their needs.

For entrepreneurs, remote teams, and globally active businesses, these gaps aren’t just inconvenient; they can damage credibility, disrupt cash flow, and even hurt the bottom line.

That’s why choosing the right banking partner matters. In this article, I will share the five best banks in 2025 that are genuinely equipped for international banking, such as banks that combine global reach with practical features and reliability. If you’re managing money across borders, you won’t want to miss this!

What Is an International Bank?

An international bank is a bank that operates across different countries. Unlike local or national banks that focus on serving people within a single country, international banks help customers and businesses with financial needs across borders.

A bank could be considered “international” when it:

- Has offices, branches, or partnerships in multiple countries.

- Offers services in multiple countries and currencies.

- Helps customers manage money in more than one country.

- Supports international trade and global business banking.

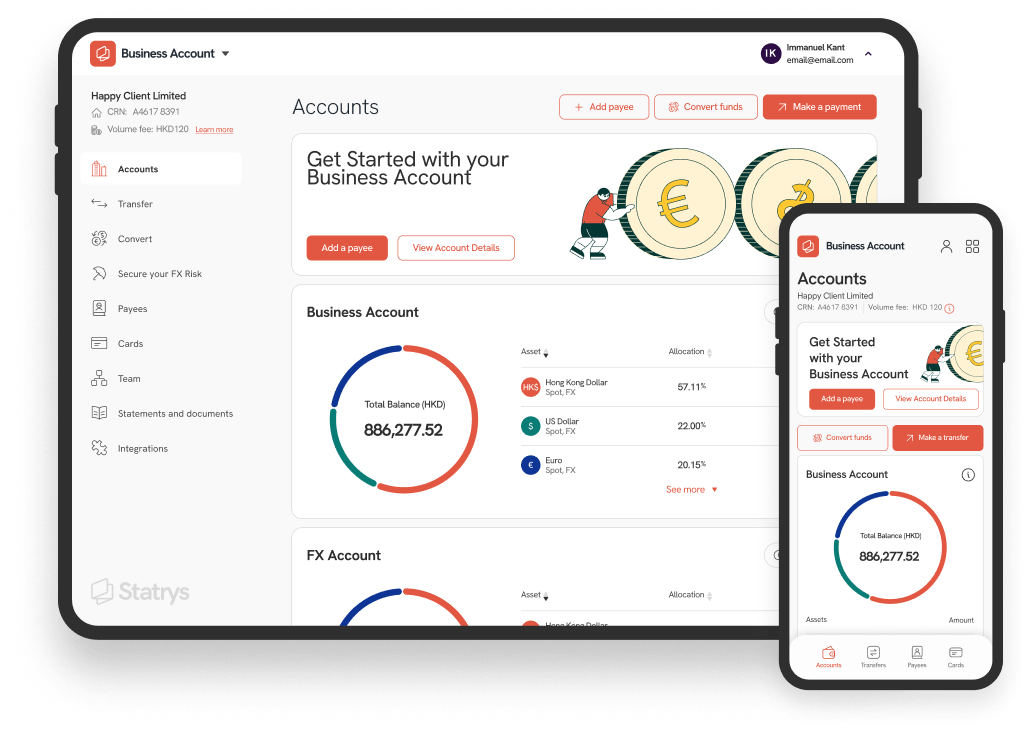

Open a Business Account in Hong Kong

Simplify international payments. Hold, send, and receive major currencies with ease. Completely online.

What Features to Look For In International Banks

When you look for a bank for international banking capabilities, here are some of the services you need to look for:

- Multi-currency Capabilities: A multi-currency account allows you to hold and use different currencies in one place—no more opening separate accounts or paying automatic exchange fees every time you get paid in euros or need to send yen. It helps you avoid unnecessary conversions and makes invoicing, paying suppliers, or holding reserves in multiple currencies easier.

- Local Payout Networks This is an alternative method to pay in foreign currencies. With the local network, you can transfer funds to businesses and individuals cheaper than traditional SWIFT transfers.

Tip: Here is an example of Statrys’ local payout capability.

- FX Tools: FX tools (like forward contracts or rate locks) help protect you from FX exposure and market fluctuations. These tools allow you to lock in favorable exchange rates and manage currency risk more effectively.

- Global ATM access: Upon arriving in a new country, accessing cash can become a challenge if your bank blocks transactions or imposes high withdrawal fees. To avoid such issues, choose a bank that offers global ATM access, enabling fee-free withdrawals at international ATMs or those partnered with global networks.

- Remote Account Opening: Look for a service that lets you open and verify accounts entirely online—no need to visit a branch. This is especially useful for digital nomads and busy executives.

If you find that a bank is missing one or two of these services, then it is not a suitable option as an international bank.

Simplify Your International Payments

Manage funds globally with a multi-currency business account — competitive FX rates and real human support

5 Best International Banks in 2025

Now that we’ve covered what to look for in a truly international bank, let’s take a look at the options. These are the banks that offer the right mix of global access, essential features, and reliable support for worldwide banking.

Disclaimer: The information provided is accurate as of April 23, 2025. For a deeper and up-to-date understanding of their services, we recommend visiting their official websites.

J.P. Morgan Chase & Co.

Best for: Large corporations seeking global trade financing, currency exchange, and treasury management services.

J.P. Morgan Chase, founded in 1799, is a multinational investment bank and financial services holding company headquartered in New York City, United States.

The bank serves both individual and corporate clients in over 100 countries, with offices located across Africa, the Americas, Asia Pacific, Europe, and the Middle East. It is particularly known for investment banking, commercial banking, asset management, and its credit card under the Chase brand.

According to its latest annual report in 2024, the bank holds total assets of about USD 4 trillion. In Q1 2025, the bank also reported revenue of USD 46.01 billion, exceeding expectations thanks to strong equity trading performance.

Since they are not focused on retail banking, there is limited information on their international ATM networks.

Pros and Cons of J.P. Morgan Chase & Co.

- Global Trade Solutions: Provides financing options to support global trade and reduce risk.

- International Business Expertise: Helps businesses expand globally with legal and compliance guidance.

- Not for everyone: Tailored for large corporations.

- High Minimum Balances: Requires substantial balances to avoid fees.

What is the difference between J.P. Morgan & Co. and J.P. Morgan Chase & Co.

Bank of America

Best for: US-based Small to medium-sized businesses with a global presence.

The Bank of America is an American multinational investment bank and financial services holding company, founded in 1904 and headquartered in Charlotte, North Carolina. They started as one of the biggest banks in America and have expanded internationally to a worldwide customer base, with local offices in 35+ countries, including Spain, Germany, and Japan, and more.

The bank serves personal clients, small businesses, and businesses & institutions. It offers commercial banking, investment banking, consumer banking, and wealth management. They also have a strong presence in small business lending.

According to Bank of America’s 2024 annual report, the company recorded a net income of USD 27.1 billion. For Q1 2025, revenue reached USD 27.51 billion, surpassing expectations of USD 26.99 billion.

Bank of America has international partner ATMs, but using them may still incur certain fees.

Pros and Cons of Bank of America

- Variety of Products: A range of checking and savings options, plus credits and loans.

- Access to currencies: Bank of America offers access to over 140 currencies in more than 200 countries and territories.

- Low Interest Rates: Savings accounts offer relatively lower interest rates compared to those at smaller banks.

- Slow Response Times: On review sites, customers often report long wait times to reach representatives.

CitiGroup

Best for: Individuals who travel frequently and seek versatile credit card rewards along with cross-border private banking services.

Citigroup is a global investment bank and financial services corporation formed through the merger of Citicorp and Travelers Group in 1998. It is one of the largest and most known banks in the world, being present in about 180 countries, with on the ground location in 90+ countries.

The bank specialises in consumer financial products such as credit cards, mortgages, personal and commercial loans, and international transactions through online wire transfer. They also offer free transfers between Citibank accounts in different countries via Citibank® Global Transfers, and cross-border private banking in over 160 countries through a service called “Global Client Service”.

According to Citi’s 2024 annual report, the bank’s revenues totaled USD 81.1 billion, with total assets amounting to approximately USD 2.35 trillion. For the first quarter of 2025, Citi reported revenues of USD 21.6 billion.

Citibank ATMs are available in more than 40 countries worldwide.

Pros and Cons of CitiGroup

- Multiple Credit Card Options: Choose from a variety of credit cards tailored to different needs.

- World Wallet®: A unique foreign currency exchange service with next-business-day home delivery.

- Fees: Accounts come with various fees, including monthly, transaction, and handling fees.

- Complexity: Products and pricing vary vastly by location, and website navigation can be complex.

HSBC

Best for: High-net-worth individual looking for wealth management globally or expats with high account balance looking for a multi-currency bank account.

HSBC (Holdings PLC) is a British multinational investment bank and financial services holding company founded in 1865. Today, HSBC has grown to become one of the biggest banks in the world

The bank’s core international segments include Wealth and Personal Banking (WPB) for individual customers and Commercial Banking (CMB) for domestic and international clients. HSBC is also famous for offering a multi-currency expat bank account and for a strong presence in the UK, China and Southeast Asia.

According to its 2024 annual report, HSBC operates in 58 countries and territories, serving approximately 41 million customers worldwide. The bank reported a total of USD 3.0 trillion in assets and a net interest income of USD 32.7 billion, with personal banking contributing 42% of total revenue.

HSBC provide access to over 55,000 ATMs worldwide.

Pros and Cons of HSBC

- Multi-Currency Accounts: Hold and manage multiple currencies in one account in selected regions, designed for expats.

- Remote Account Opening: You could start your application online (subject to conditions).

- Linked Accounts and Credits: Access HSBC accounts across countries and bring your existing credit history to your new country (where available).

- High Fees: Banking with HSBC will incur some relatively steep handling and service fees.

- High minimum balance: You may also need to keep substantial minimum balance to access its international services.

Tip: Are you a digital nomad? Check out this guide to the best banks and bank alternatives for digital nomads:

Standard Chartered

Standard Chartered is a multinational bank and financial services company based in London, UK. It was founded in 1969 through the merger of The Standard Bank of British South Africa and the Chartered Bank of India, Australia, and China.

The bank operates globally, with over 1,000 branches in over 50 markets, and provides services to individuals, businesses, and corporations. Known for its expertise in emerging markets, Standard Chartered has a particularly strong presence in Asia, Africa, and the Middle East.

According to Standard Chartered’s 2024 annual report, the bank reported an operating income of USD 19.7 billion.

Standard Chartered has an ATM network in the countries where it is present. However, international ATM levies may apply.

Pros and Cons of Standard Chartered

- Foreign Currency Accounts: Supports a variety of foreign currency options.

- Emerging Market Expertise: Strong track record in Asia, Africa, and the Middle East.

- High Fees: Especially for international transfers.

- Customer Service Concerns: Some users report inconsistent service quality.

How to Choose the Right International Bank for Your Needs

The ideal international bank depends on your specific financial goals and circumstances. However, to quickly assess whether a bank is the right fit, start by answering these four key questions:

- Do they serve your country/region? While international banks offer wide international reach, it’s crucial to confirm that they operate in or cover the specific country you’re visiting or doing business in. A strong regional presence—or partnerships with local institutions—can make cross-border banking more efficient and cost-effective.

- Can you hold and move money in the currencies you use? Some banks allow transfers in several currencies but limit which ones you can hold and require automatic conversions, which will increase costs. If you deal with multiple currencies, check that the bank supports both holding and transferring the ones you use. A foreign currency account or a multi-currency account is especially valuable as it can help you save more on conversion fees.

- Are their fees clear and fair? International banking often comes with layered fees—currency conversion markups, transaction fees, monthly maintenance fees, overseas ATM withdrawal fees, and more. Choose a bank that clearly discloses all costs and offers competitive rates in line with comparable institutions.

- Is customer support accessible and responsive? Dealing with different time zones, language barriers, and cross-border transactions can make banking complicated. You need a bank that’s easy to reach, whether it’s by phone, email, or live chat. Multilingual support and a dedicated relationship manager is a good addition.

Conclusion

Choosing an international bank isn’t just about having a global name on your account, but it’s about finding a partner that truly supports your cross-border needs. The five banks listed here stand out for their ability to combine reach, reliability, and real functionality. Whether you’re an entrepreneur, expat, or managing an international business, the right banking setup can help you move faster, pay less, and operate with confidence worldwide.

FAQs

Which bank has the best global coverage?

Citibank has some of the best global coverage, operating in around 180 countries and maintaining physical presence in about 90.

Can I open an international account online?

Yes, some global banks allow you to open an international account online, but many still require in-person ID verification. A few banks let you open an account 100% online if you’re an existing customer or meet specific criteria. That said, if you want a fully remote process, digital fintechs are an alternative worth considering.

What banks offer multi-currency accounts?

From our list, HSBC and Standard Chartered provide multi-currency accounts for clients. However, many banks also offer this type of account. Therefore, it’s best to check with each bank to see what account offerings they provide for international use.

Is it safe to use international banks?

Yes, international banks are generally safe to use, especially well-established ones. They often have strong security protocols, deposit insurance, and global reputations to maintain.

What’s the difference between international banks and digital fintechs?

International banks are traditional financial institutions operating globally with physical branches and full banking licenses. Digital fintechs are tech-driven companies offering financial services online, often focusing on speed, innovation, and user experience. Banks offer a wider range of banking services; fintechs are more agile but may have limited offerings.

Bertrand Théaud

Related article

11 Types of Banks, How It Works and Who They’re Best For

4 Best Business Banking Alternatives to Big Banks in 2025

What is a Foreign Currency Account?

Browse Banking Insights

Get your Hong Kong business account open in a few days

Best Payments Solutions 2024

Top 10 Fintech Startups in Hong Kong 2024

SME Payment Solutions of the Year – Hong Kong 2023

Best Payments Solution 2022

Statrys offers multi-currency payment services with a human touch. Statrys Limited is licensed as a Money Service Operator (No. 19-02-02726) in Hong Kong. Statrys UK Limited is a Small Payment Institution (FRM: 911226) registered with the Financial Conduct Authority in the United Kingdom (FCA).

The Statrys Payment Card and related services are offered and operated by Statrys UK Limited in the United Kingdom. The Statrys Prepaid Mastercard card is issued by AF Payments Limited in the United Kingdom pursuant to a licence by Mastercard International. AF Payments Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900440) for the issuing of electronic money and payment instruments. Mastercard and the Mastercard brand mark are registered trademarks of Mastercard International.

© Copyright 2019 – 2025 Statrys Ltd. All rights reserved.

Top 10 Leading American (US) Companies in India

US investments in India stood at USD 49 billion in the year 2023, and US companies are currently the third biggest foreign investors in India. US companies are operating in multiple sectors in India, such as technology, e-commerce, financial services, healthcare, renewable energy and more. Numerous US companies are looking at India as a favourable destination to shift their manufacturing bases and diversify supply chains in order to reduce dependency on China. There are multiple reasons behind the growing US investments in India. They include policy initiatives like Make in India and Product-Linked Incentives of the Government of India, a large consumer base and a growing middle class. Many globally known US companies are present in India and FDI inflow from US is set to grow in the coming years. Let’s have a look at the top 10 US companies in India for the year 2025.

1. Amazon Inc.

Amazon Inc., founded in the year 1994, is a multinational technology company with diversified business interests, including e-commerce, cloud services, artificial intelligence and more. It entered India in the year 2013 with the establishment of Amazon India. Amazon India is a major e-commerce platform in the country with a huge delivery network comprising of over 2 lakh stores and small businesses in more than 350 cities across the country.

Amazon India is also operating in other domains like digital entertainment, fintech services and more. In the year 2019, it became the first e-commerce company in India to partner with Indian Railways for movements of packages across the country.

2. Microsoft Corporation

Microsoft Corporation, founded in the year 1975, is an American multinational technology company specialising in a host of technology products, right from software and computer hardware to cloud computing and internet services. The company has been operating in India since the year 1990, and provides a number of tech products and services to the Indian consumers, including cloud-based technology solutions, ERP software, cybersecurity services and IoT and machine learning solutions.

Microsoft has a network of sales and marketing, research and development and customer services and support centres in 10 cities across India. Moreover, the company has three data centres in India for cloud services.

3. Google LLC

Google LLC, established in the year 1998, is a major American multinational technology company specialising in search engine technology, software development, cloud computing, artificial intelligence and others. Google has been operating in India since the year 2004, and its India operations span multiple domains like research and development, engineering, cloud computing, sales and marketing, advertising and more.

Google has offices in Mumbai, Bangalore, Gurgaon and Hyderabad with each office dedicated to specific operations. India, in fact, is the largest employee base for Google outside USA.

4. PepsiCo

PepsiCo, founded in the year 1965, is an American multinational food, snacks and beverage corporation, which has been operating in India since the year 1989 through its subsidiary, PepsiCo India. PepsiCo India is the owner of multiple popular food, snacks and beverage brands in India like Lays, Kurkure, Doritos, Quaker Oats, Pepsi, Mountain Dew, Tropicana, Gatorade, 7up and more.

PepsiCo India operates 36 bottling plants and three food plants in India. Furthermore, the company also partners with over 22,000 farmers across seven states in the country.

5. Walmart Inc.

Walmart Inc., founded in the year 1962, is an American multinational retail corporation owning and operating grocery stores, hypermarkets and discount department stores in USA and 23 other countries. The company operates in India through its subsidiary, Walmart India, established in the year 2009. Walmart India has a network of 28 retail stores in India.

Walmart India owns majority stakes in multiple companies in India, including Flipkart, Phone Pe and Myntra. The company’s technology teams in Gurugram, Bangalore and Chennai create engineering and product development solutions for global customers.

6. Morgan Stanley

Morgan Stanley, founded in the year 1935, is an American multinational investment bank and financial services company offering services related to institutional securities, wealth management and investment management to governments, institutions and individuals. The company has been operating in India since the year 2003 and provides multiple services across domains like capital markets, investment banking, equity, derivative products, research and more.

Morgan Stanley has 5 offices in Mumbai and Bangalore, including a global in-house centre in Mumbai. The company is an active investor in Indian infrastructure, real estate and private equity projects.

7. IBM Corporation

IBM Corporation, established in the year 1911, is an American multinational technology company which has been operating in India since the year 1951 through its subsidiary, IBM India Private Limited. IBM India operates in multiple IT domains in India through multiple businesses like India Software Labs, Linux Technology Centre, India Research Lab and more. The company has 15 facilities in multiple cities across India.

8. Amway

Amway, founded in the year 1959, is an American multinational FMCG direct selling company which is operating in India since the year 1996 through its subsidiary, Amway India. Amway India is one of the largest direct selling companies in India with over 140 types of consumer products across categories, from nutrition to skin care. The company has a network of 5.5 lakh distributors in India.

9. Citibank

Citibank, founded in the year 1812, is the banking subsidiary of the American multinational financial services corporation, Citigroup. Citibank entered India in the year 1902 and offers a broad range of financial products and services to its Indian customers. These include corporate and investment banking, brokerage, securities and fund services and trade services.

10. American Express

American Express, founded in 1850, is an American multinational financial services corporation and bank holding company specialising in payment cards. The company is operating in India since the year 1993 through its subsidiary, American Express India Private Limited. American Express India provides credit and other kinds of card services along with insurance and travel booking services. It is headquartered in Bangalore.

Conclusion

India is the fastest growing economy in the world, thereby providing a lot of opportunities to US companies for expansion in the country. Many American companies in India across sectors are witnessing double digit year-on-year growth.

https://statrys.com/blog/best-international-bankshttps://www.thebusinessscroll.com/american-us-companies-in-india/