The #1 FREE

Stock Market Game

We offer a free stock market game featuring real-time stock prices and rankings that allows users to learn about the stock markets and practice investing in stocks, ETFs, bonds, and mutual funds.

Register and immediately receive $100,000 in virtual cash and get access to all the helpful lessons and videos in our Education Center. All users can create their own custom contests and challenge their friends, family or co-workers.

Featured on

Create Your Own

Custom Stock Market Game

Create your own private competition for your class or club. Set the contest dates that work best for your class schedule (have your students trade for one week, one month, one year-whatever works best for you!), choose the initial cash balance, and set other contest rules like commission rates.

To get your class started with our free stock market game, just register now and then follow the links to create your own contest.

- Set your own dates

- Choose your cash balance

- Customize trading rules

- Add reading assignments

Teachers, Professors & Investment Clubs

Here are some useful resources to help you get started on setting up your class or contest.

COLLEGE PROFESSORS: Learn more about our college stock market game.

Teacher Starter Guide

Teacher Tutorial Videos

How to Create Your Class

Using our Integrated Lessons

Lesson Plans by Class Subject

Discover our College Version

Available Teacher Reports

More Teacher Resources

The Only Free Stock Game For Schools!

Finding great resources for economics and personal finance classes can be tough – which is why we are here to help! HowTheMarketWorks is the only free stock game designed for the classroom. Your students can sign up with their own username, or you as the teacher can generate accounts to distribute to your class – requiring no personal information whatsoever!

We are compliant with:

- COPPA

- FERPA

- CSPA

- And work with other state- or district-level student privacy agreements!

The Stock-Trak Family

Make sure you set up your stock market contest in the right place!

We have different version of our platform depending on what type of contest you want to run.

Supported by advertising

Best for individuals learning on their own and investment clubs

- Create your own custom contests

- Trade US Stocks and Options

- Basic Research Tools

- 30 Built-in Investing Courses

- Regular Contests with Prizes

- Your free 100K practice portfolio

Supported by advertising

Great for K12 classrooms

- Create your own custom contests

- Trade US Stocks and Mutual Funds

- Basic Research Tools

- 50 Built-in Investing & Personal Finance Lessons

- National Contests every Semester with Prizes

- Your free 100K practice portfolio

Discounted site licences available

Perfect for classrooms Grade 6 to 12

- Create your own custom contests

- Trade International Stocks, Bonds and Mutual Funds

- 300 Built-in Investing, Personal Finance and more Lessons

- National Contests every Semester with Prizes

- Students can earn financial literacy certificates

- Budgeting Game for Personal Finance Classes

- Live Chat Support & Account Managers for Teachers

- Advanced Reporting Tools for Teachers

- Advanced Research Tools

Discounted site licences available

Perfect for universities & campus wide financial literacy challenges

- Create your own custom contests

- Trade International Stocks, Bonds, Mutual Funds, Options, Futures & Forex

- 300 Built-in Investing, Personal Finance & Career Development Lessons

- National Contests every Semester with Prizes

- Students can earn financial literacy certificates

- Budgeting Game for Personal Finance Classes

- Live Chat Support & Account Managers for Teachers

- Advanced Reporting Tools for Teachers

- Advanced Research Tools

Our Platform

- Starter Guide

- Lesson Plans

- How to Invest in Stocks

- Live Quotes & Charts

- Symbol Lookup

- Motley Fool Review

- Is Seeking Alpha Worth it?

Premium Version

- About PersonalFinanceLab.com

- Budgeting Game for High School Students

- Financial Literacy Curriculum

- Financial Literacy Certification

- Teachers: Try Our Premium Version

- Stock Simulation for Universities

- Corporate White Label Trading Platform

- White Label Financial Literacy Program

- Sponsorship Opportunities

Company

- Contact Us

- About Us

- Privacy Policy

- Terms and Conditions

- Advertise with Us

Family Sites

Connect with us

HowTheMarketWorks.com® is a property of Stock-Trak, Inc., the leading provider of educational budgeting and stock market simulations for the K12, university, and corporate education markets. Copyright © 2025 Stock-Trak® All Rights Reserved. All information is provided on an “as-is” basis for informational purposes only, and is not intended for actual trading purposes or market advice. Quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia. Neither Stock-Trak nor any of its independent data providers are liable for incomplete information, delays, or any actions taken in reliance on information contained herein. By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions.

Best Trading Simulators In The UK 2025

Christian is a UK-based investment writer who’s been actively trading an array of financial instruments for over 5 years. Having used most of the major brokers in the UK, Christian provides valuable insights on all things investing for British traders.

James Barra

James is a UK-based writer and investor with consultancy experience at some of Britain’s largest financial organisations. James authors, edits and fact-checks content for a row of investing websites.

Fact Checker

Michael MacKenzie

Michael is a UK-based investment writer with over 10 years of experience in the journalism industry. Michael has critically evaluated many of the largest investment brokers in the UK, offering authentic insights.

Looking to sharpen your investing skills without risking a penny? Free trading simulators let you practice in live market conditions using virtual funds—no deposit needed.

We’ve tested the best trading simulators in 2025, ranking them based on available assets, market realism, backtesting tools, and how smoothly they transition to real-money trading.

Top Trading Simulators In The UK

Based on our hands-on tests, these are the best brokers with trading simulators:

XTB

In our assessments, XTB’s demo accurately replicated its live xStation 5 platform, featuring over 5,000 assets like forex, indices, commodities, stocks, and crypto. Execution was rapid through CEC liquidity, with EUR/USD spreads starting at approximately 0.6 pips and minimal slippage. Setup required only an email, provided a $100,000 virtual balance, and the demo had no expiration.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

| Instruments | Regulator | Platforms |

|---|---|---|

| CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | xStation |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $0 | 0.01 Lots | 1:30 |

FXCC

In FXCC’s demo mode, trading mirrored live ECN conditions with rapid order execution, minimal slippage, and accurate MT4 data. Standard spreads began at 1.2 pips for EUR/USD, with no hidden fees. Setup needed just an email and came with $50,000 virtual funds, and the demo was unlimited—perfect for thorough strategy testing.

| Instruments | Regulator | Platforms |

|---|---|---|

| CFDs, Forex, Indices, Commodities, Crypto | CySEC | MT4, MT5 |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $0 | 0.01 Lots | 1:500 |

Vantage FX

In our tests, Vantage’s demo provided real-market ECN conditions through MT4/MT5/cTrader. EUR/USD spreads were between 0.0 and 0.2 pips, with a $3 round-trip commission. Execution was fast with minimal slippage. Setup required just an email, offered up to $500K in virtual funds, and never expired—ideal for realistic strategy development.

| Instruments | Regulator | Platforms |

|---|---|---|

| CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | FCA, ASIC, FSCA, VFSC | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $50 | 0.01 Lots | 1:30 |

IC Markets

In our thorough analysis, IC Markets’ demo replicated live Raw and Standard account conditions with extremely narrow spreads—EUR/USD from 0.0–0.1 pips and a $3.50 fee per lot on Razor. Execution was exceptionally swift with minimal slippage. Through MT4/MT5/cTrader, more than 1,300 instruments were accessible. Setup needed just an email; $50K virtual balance, no expiration.

| Instruments | Regulator | Platforms |

|---|---|---|

| CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA, CMA | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $200 | 0.01 Lots | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

Pepperstone

In our recent tests, Pepperstone’s demo reflected live spreads—EUR/USD averaged 0.1–0.3 pips with Razor accounts. Execution proved swift, with little slippage and over 1,000 assets available. The interface precisely mimicked the real trading environment. No personal information was needed, offering a 30-day trial with up to $50,000 virtual funds.

CFDs and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.1% of retail investor accounts lose money when trading CFDs.

| Instruments | Regulator | Platforms |

|---|---|---|

| CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $0 | 0.01 Lots | 1:30 (Retail), 1:500 (Pro) |

FXPro

When we assessed FxPro’s demo, it closely resembled live ECN/CFD conditions, with rapid order execution and narrow spreads—EUR/USD at 0.5 pips (raw) and 1.2 pips (standard). Accessible via MT4/MT5/cTrader, it includes 1,000+ assets. Slippage was minor. Registration requires just an email, provides $25,000 in virtual funds, and has no expiration.

| Instruments | Regulator | Platforms |

|---|---|---|

| CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting | FCA, CySEC, FSCA, SCB, FSA | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $100 | 0.01 Lots | 1:30 (Retail), 1:500 (Pro) |

IG

During our tests, IG’s demo provided a virtual balance of £10,000. Execution was quick with minimal slippage, and real-time market data was included. No time limit was imposed. Set-up needed just an email, and users could replenish their virtual balance anytime. Accessible on MT4, ProRealTime, L2 Dealer, and IG’s WebTrader. IG Academy offered superb educational resources.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

| Instruments | Regulator | Platforms |

|---|---|---|

| CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $0 | 0.01 Lots | 1:30 (Retail), 1:222 (Pro) |

Safety Comparison

Compare how safe the Best Trading Simulators In The UK 2025 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | 4.6 | ✔ | ✔ | ✔ | ✔ |

| FXCC | 3.3 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | 4.6 | ✔ | ✔ | ✘ | ✔ |

| IC Markets | 4.6 | ✘ | ✔ | ✘ | ✔ |

| Pepperstone | 4.6 | ✔ | ✔ | ✘ | ✔ |

| FXPro | 4.4 | ✔ | ✔ | ✘ | ✔ |

| IG | 4.9 | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Trading Simulators In The UK 2025 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Trading Simulators In The UK 2025 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | 4.7 | 4.1 | ✔ |

| FXCC | iOS & Android | 4.8 | 4.4 | ✘ |

| Vantage FX | iOS & Android | 3.6 | 3.9 | ✘ |

| IC Markets | iOS & Android | 3.1 | 4.2 | ✘ |

| Pepperstone | iOS & Android | 4.4 | 4.1 | ✘ |

| FXPro | iOS & Android | 4.7 | 4.3 | ✘ |

| IG | iOS & Android | 4.6 | 4 | ✔ |

Beginners Comparison

Are the Best Trading Simulators In The UK 2025 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | 4.3 | 3.8 |

| FXCC | ✔ | $0 | 0.01 Lots | 4.3 | 2.5 |

| Vantage FX | ✔ | $50 | 0.01 Lots | 4.4 | 4 |

| IC Markets | ✔ | $200 | 0.01 Lots | 4.5 | 3.5 |

| Pepperstone | ✔ | $0 | 0.01 Lots | 4.6 | 4 |

| FXPro | ✔ | $100 | 0.01 Lots | 4 | 4 |

| IG | ✔ | $0 | 0.01 Lots | 4.5 | 5 |

Advanced Trading Comparison

Do the Best Trading Simulators In The UK 2025 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | Open API | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Trading Simulators In The UK 2025.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | 4.6 | 4 | 4.4 | 4 | 4.3 | 4 | 4.3 | 4.1 | 3.8 |

| FXCC | 3.3 | 3.3 | 4.6 | 3 | 4 | 3.5 | 4.3 | 2 | 2.5 |

| Vantage FX | 4.6 | 4.3 | 3.8 | 4.5 | 4.4 | 4.5 | 4.4 | 4 | 4 |

| IC Markets | 4.6 | 4 | 3.7 | 3.5 | 4.6 | 4 | 4.5 | 4 | 3.5 |

| Pepperstone | 4.6 | 4.4 | 4.3 | 3.8 | 4.5 | 4 | 4.6 | 4.3 | 4 |

| FXPro | 4.4 | 4.3 | 4.5 | 4 | 4 | 3.8 | 4 | 4 | 4 |

| IG | 4.9 | 4.9 | 4.3 | 4.5 | 3.5 | 4 | 4.5 | 4.9 | 5 |

Our Take On XTB

“XTB emerges as an ideal option for novice traders, offering the impressive xStation platform, zero commission pricing, no required minimum deposit, and outstanding educational resources, many of which are conveniently integrated into the platform.”

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB ensures swift access to funds, providing fast withdrawals with same-day payments for requests made before 1 pm.

- XTB offers a diverse range of over 7,000 instruments, including CFDs on shares, indices, ETFs, commodities, forex, and cryptocurrencies. The platform also provides real shares, real ETFs, share dealing, and the latest addition, Investment Plans, serving both traders seeking short-term gains and investors focused on long-term growth.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

Our Take On FXCC

“FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account.”

Pros

- There are no limitations on short-term trading techniques such as trading and scalping.

- FXCC has introduced MT5, which in our evaluations, mirrored the trading conditions of MT4 by offering swift execution, improved charting, and market depth tools.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

Cons

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

- While the MetaTrader suite excels in technical analysis, its outdated design detracts from the overall trading experience, particularly when contrasted with contemporary platforms such as TradingView.

- FXCC’s exclusive MetaTrader platform is a limitation, especially when compared to more versatile options like AvaTrade, which offers five different platforms to cater to various trader needs.

Our Take On Vantage FX

“Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast.”

Pros

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- It’s unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Our Take On IC Markets

“IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders.”

Pros

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- In 2025, IC Markets earned DayTrading.com’s accolade for ‘Best MT4/MT5 Broker’ due to its top-tier MetaTrader integration. This achievement highlights the broker’s continuous refinement over the years to enhance the platform experience.

Cons

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

Our Take On Pepperstone

“Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support.”

Tobias Robinson

Reviewer

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the ‘Best Overall Broker’ in 2025 and was the ‘Best Forex Broker’ runner-up the same year.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn’t offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone’s demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

75.1% of retail investor accounts lose money when trading CFDs

Our Take On FXPro

“FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge.”

Pros

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro uses a ‘No Dealing Desk’ (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro’s Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

Cons

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

Our Take On IG

“IG offers a complete package with an intuitive online platform, top-tier beginner education, advanced charting tools through its TradingView integration, real-time data, and swift execution for seasoned traders.”

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our ‘Best Trading App’ award.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Top Independent Trading Simulators In The UK

In addition to the top brokers offering built-in trading simulators, we’ve identified three standout third-party platforms worth exploring:

- TraderSync:TraderSync’s market replay simulator lets you relive past trades with synced journal data, and performed excellently during testing with a superb level of detail.

- Edgewonk: Edgewonk’s trade simulator projects future performance scenarios based on your historical data, helping you assess risk and optimize trading strategies.

- Trademetria: Trademetria’s PnL simulator allows you to run simulations on past trades, offering insights into performance metrics and aiding in short-term strategy development.

How Did Investing.co.uk Choose The Best Trading Simulators In The UK?

We verified that each platform offers a trading simulator or similar mode account accessible to UK users.

We then ranked these providers by their overall ratings following our hands-on testing and structured data capture process, which evaluates factors like usability, features, and FCA regulation.

What Is A Trading Simulator?

A trading simulator is a platform that replicates real market conditions using virtual funds. It lets you practice buying and selling financial instruments, such as stocks, forex, or crypto, without risking your money.

It’s designed to help you build skills, test strategies, and gain confidence before committing to live trading.

A trading simulator isn’t just for beginners—experienced traders, myself included, use them to stress-test strategies under unusual or high-volatility scenarios that rarely occur in live markets. This lets you prepare for unpredictable conditions without financial risk.

Although the terms trading simulator and ‘demo account‘ are often used interchangeably, there are essential differences that you should be aware of.

For UK investors, using both tools in sequence—starting with a simulator and transitioning to a demo—can offer a smart path toward confident, informed trading.

Trading Simulator vs Broker Demo Account

An independent trading simulator is standalone software or a web-based tool not tied to any specific broker.

Its main purpose is education and strategy development. Products like TraderSync, Edgewonk and Trademetria, which we’ve run hands-on tests on, offer a flexible environment for practising across various markets and trading scenarios.

Trading simulators often include features like historical data, market replays, and the ability to simulate different trading conditions, making them ideal for beginners and experienced traders looking to experiment or refine strategies.

Independent simulators often let you replay past market events—like the 2020 crash or 2022 rate hikes—so you can practice responding to real historical volatility. Broker demos rarely offer this, making independent tools better for learning how to trade through extreme conditions.

A broker’s simulator, often provided as a demo account, is designed to replicate the broker’s actual trading environment. It lets you get comfortable with the platform’s layout, tools, pricing structure, and execution speed.

While the range of assets may be more limited than an independent simulator, the data is typically pulled directly from live market feeds, providing a more accurate representation of what to expect when trading with real money.

The key difference lies in intent and flexibility. Independent simulators are neutral and focused on broad learning, while broker simulators are often part of a pathway toward opening a live account.

Many traders use independent simulators to test strategies in a sandbox environment, then switch to a broker demo to prepare for real execution.

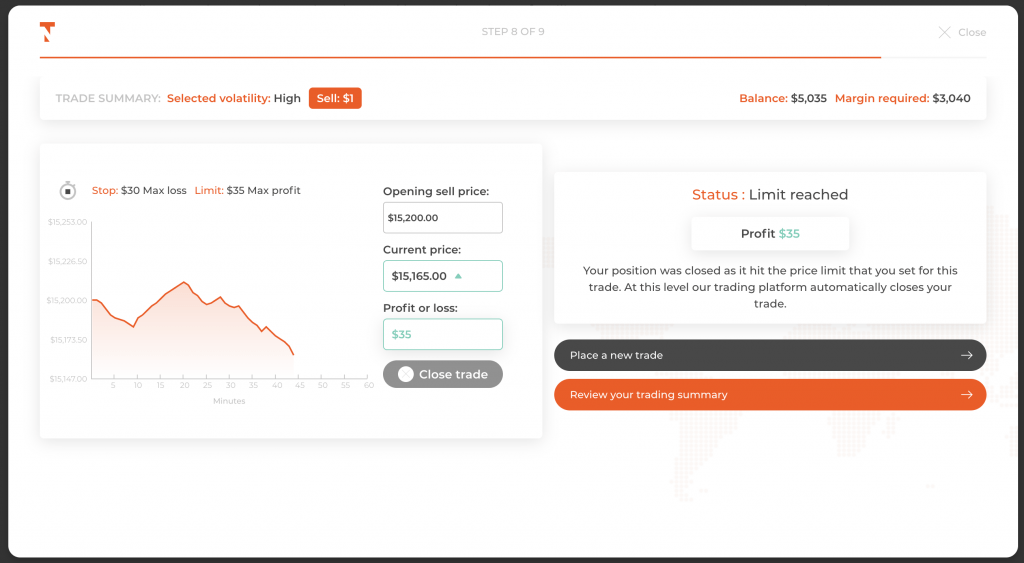

TradeNation’s free simulator offers a user-friendly environment to practice trading

Pros And Cons Of Using A Trading Simulator

Pros

- Trade with virtual money to build skills without risking capital

- Test and improve strategies in various market conditions

- Practice disciplined habits like stop-losses and risk limits

- Get familiar with real market behaviour and UK trading hours

- Build confidence in a safe, no-risk environment before going live

Cons

- Simulators don’t recreate the stress of real money trading

- Order fills are often too perfect, unlike live market execution

- Easy wins can create overconfidence when going live

- Independent simulators may not match your broker’s platform

- Free versions often limit data, markets, or usage time

Key Factors To Consider When Choosing A Trading Simulator

When choosing a trading simulator, you must go beyond surface-level features and focus on what will prepare you for real-world trading.

Here are the key factors to consider, broken down with practical insights tailored to UK assets and investing needs:

Realism Of Market Data And Execution

A good simulator should closely mirror live market conditions. This includes realistic spreads, order execution speed, slippage, and price movements.

Ensure the simulator reflects London Stock Exchange (LSE) trading hours. Simulators with delayed or overly simplified data can give a false sense of confidence that won’t hold up in real markets.

Asset And Market Coverage

Choose a simulator that includes the asset classes you intend to trade. For UK users, this may mean looking for access to domestic equities such as Barclays, BP, and Tesco, as well as major GBP forex pairs like GBP/USD or GBP/EUR.

It’s also essential to ensure the simulator covers key indices such as the FTSE 100 and FTSE 250. If your strategy involves broader diversification, access to UK-listed ETFs or bonds can also be beneficial.

The wider the range of available instruments, the more effective the simulator will be in helping you develop a well-rounded trading approach.

Strategy Testing Tools (Backtesting & Replay)

A quality simulator should allow you to test your strategies against historical data (backtesting) and replay past sessions. This is vital for learning how your trades would have performed during real events, such as the Brexit referendum, Bank of England rate decisions, or UK inflation spikes.

Look for simulators that offer replay features at various speeds so you can analyse your reaction time and decision-making.

When I used TraderSync during testing, what stood out immediately was how detailed the trade journaling is—I could tag each trade by strategy, setup, or mistake. The platform automatically generated performance analytics over time.

Uploading trades from my broker was seamless, and seeing visual breakdowns of my win rate by time of day or asset helped me spot patterns I hadn’t noticed before. The simulator mode also lets me replay trades with annotations, which makes reviewing my decisions feel more like coaching than just logging.

Christian Harris

Customisation And Risk Management Settings

Simulating different account sizes, leverage ratios, and risk parameters is paramount. UK brokers must comply with FCA leverage caps, especially for retail clients (e.g., 1:30 for major forex pairs), so ensure the simulator lets you reflect realistic constraints.

You should also be able to set stop-loss, take-profit, and trailing stop strategies to train your risk discipline.

User Interface And Learning Curve

An intuitive interface matters. If a simulator is too complex or basic, it may not serve your learning goals. Ideally, the platform should feel similar to what UK brokers like IG, FxPro, or XTB provide.

A clean layout, access to charting tools (such as candlesticks and indicators like RSI or MACD), and easy order entry help mimic the live experience more effectively.

Mobile And Desktop Compatibility

Many traders use mobile platforms during commuting hours to track the overlap between London and New York. A trading simulator with desktop and mobile versions allows you to practice on the go, using the same environment as in real-life trading.

Cost, Access And Time Limits

Some simulators we’ve investigated are free, while others are time-limited or part of a subscription. If you’re testing over weeks or months, check whether the simulator restricts your access after a trial. Free simulators can offer great value, but make sure they don’t lock features behind a paywall.

Transition To Live Trading

Finally, think about your long-term plan. If you’re likely to open a live account, it helps if the simulator aligns with a broker you trust. Look for platforms where your progress, saved strategies, or preferences can carry over to a live UK-regulated trading account with minimal disruption.

By weighing these factors, you’ll choose a simulator that helps you learn the basics and gives you real-world preparation tailored to the UK trading landscape.

Bottom Line

The best trading simulators provide a risk-free way to gain hands-on experience and build confidence before trading with real money. They can help you practice strategies, understand market movements, and manage emotions without financial pressure.

By simulating real trading scenarios, you can refine your approach, test new ideas, and learn from mistakes—all in a safe, controlled environment. They’re an valuable tool for sharpening your skills and preparing for the live markets.

FAQ

Are Trading Simulators Free?

Many trading simulators are free, especially those that brokers offer as part of a demo account. These typically include real-time data and basic tools at no cost.

However, more advanced simulators—featuring historical data, backtesting, or multi-asset support—may require a subscription or a one-time fee. Always check for time limits or feature restrictions on free versions before committing.

Article Sources

https://www.howthemarketworks.com/https://www.investing.co.uk/simulators