Students’ Perceptions of the Investment Portfolio Simulation Game

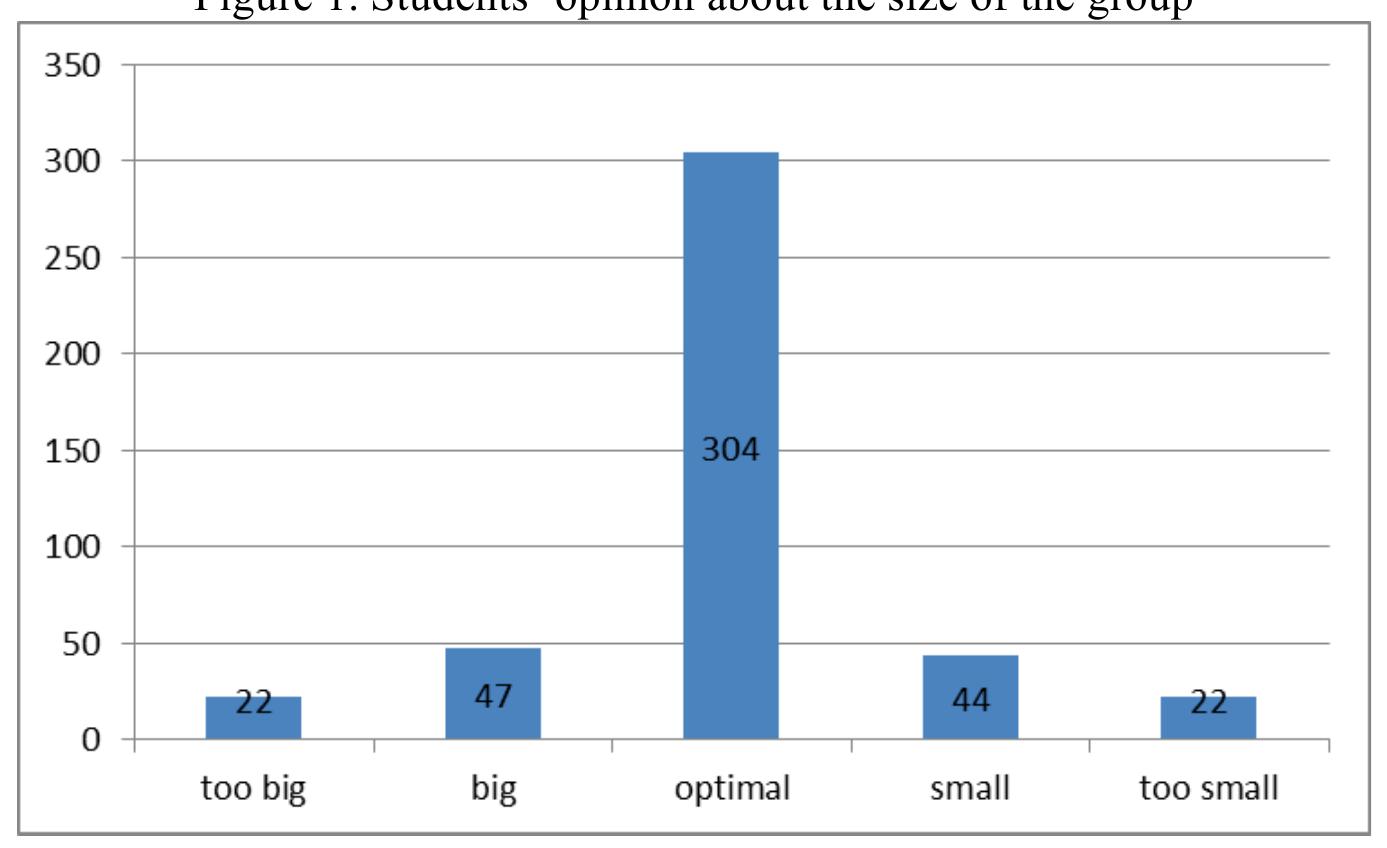

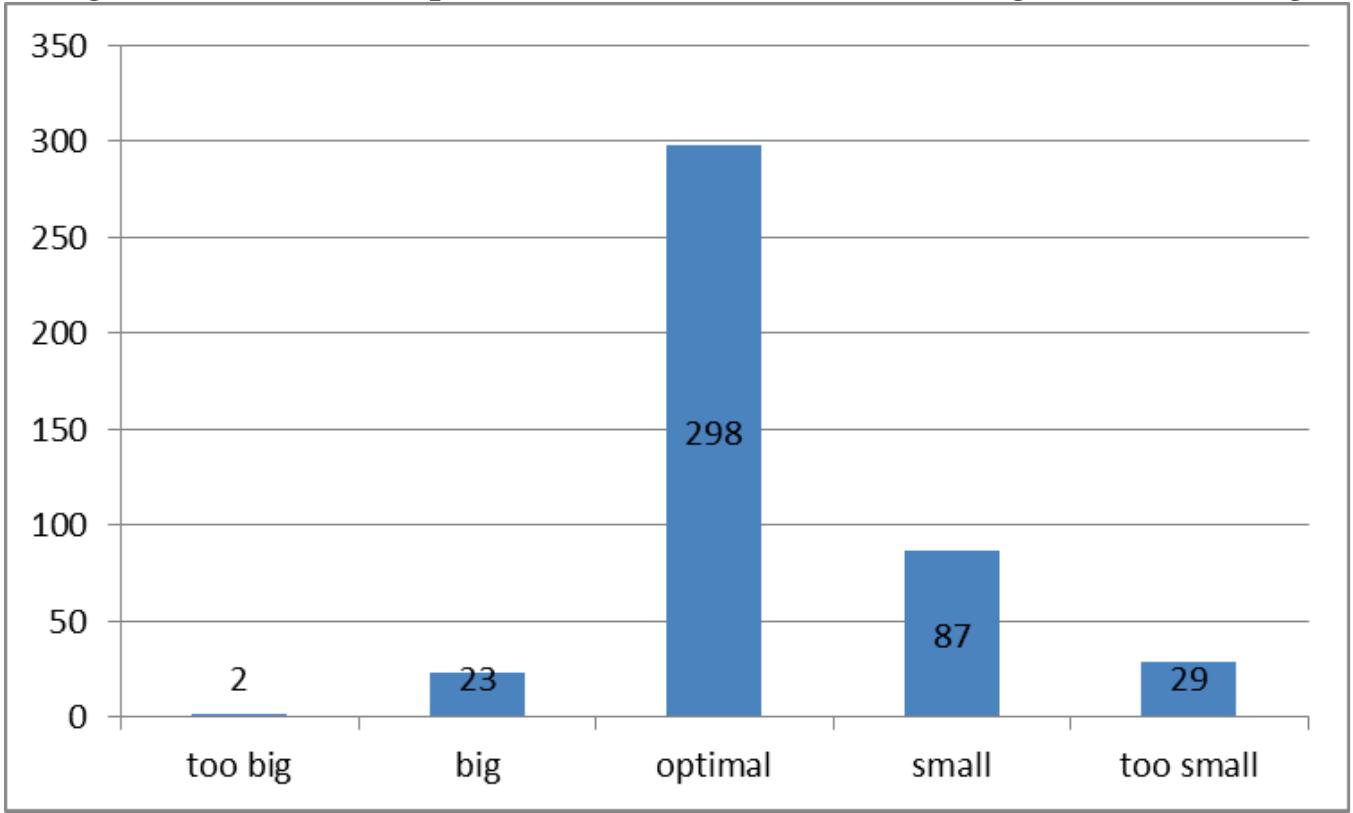

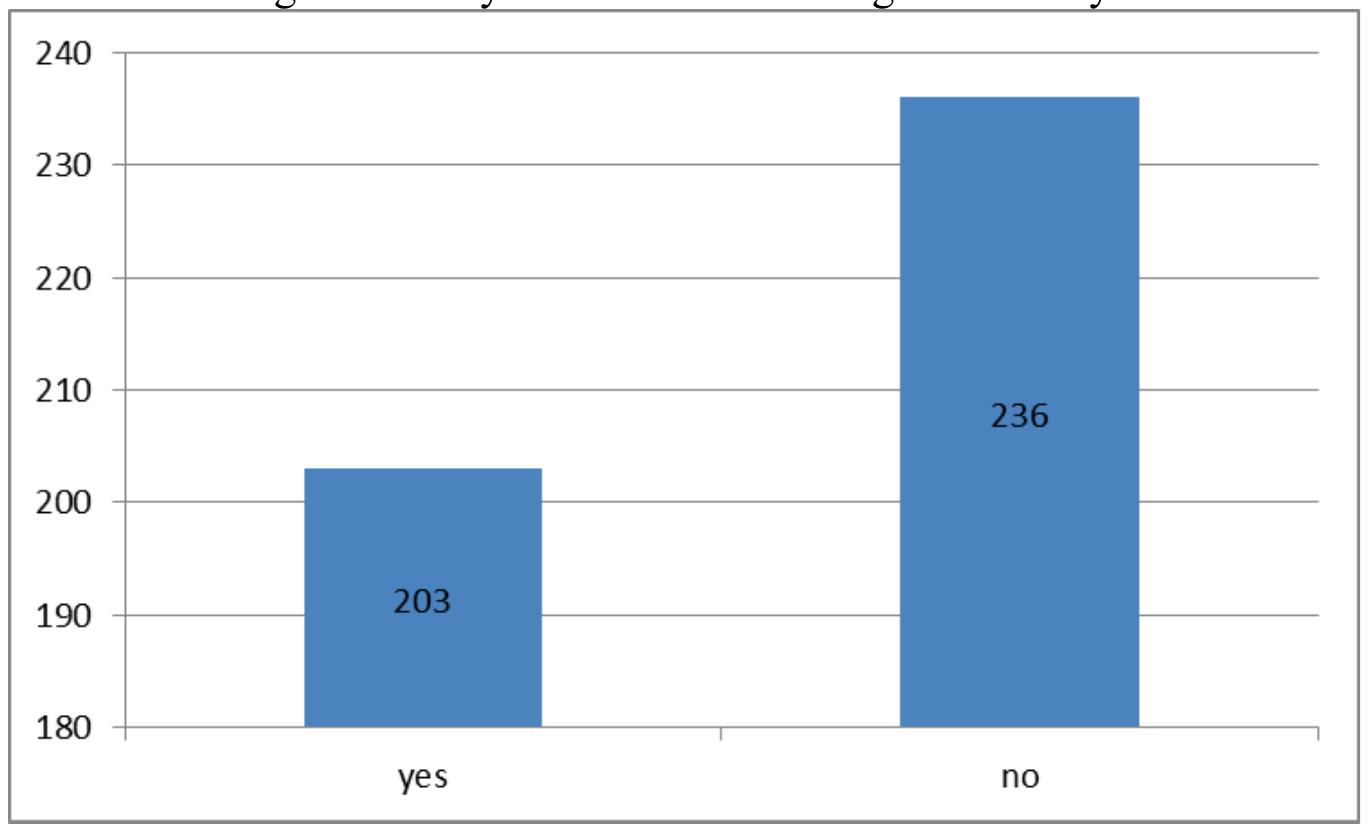

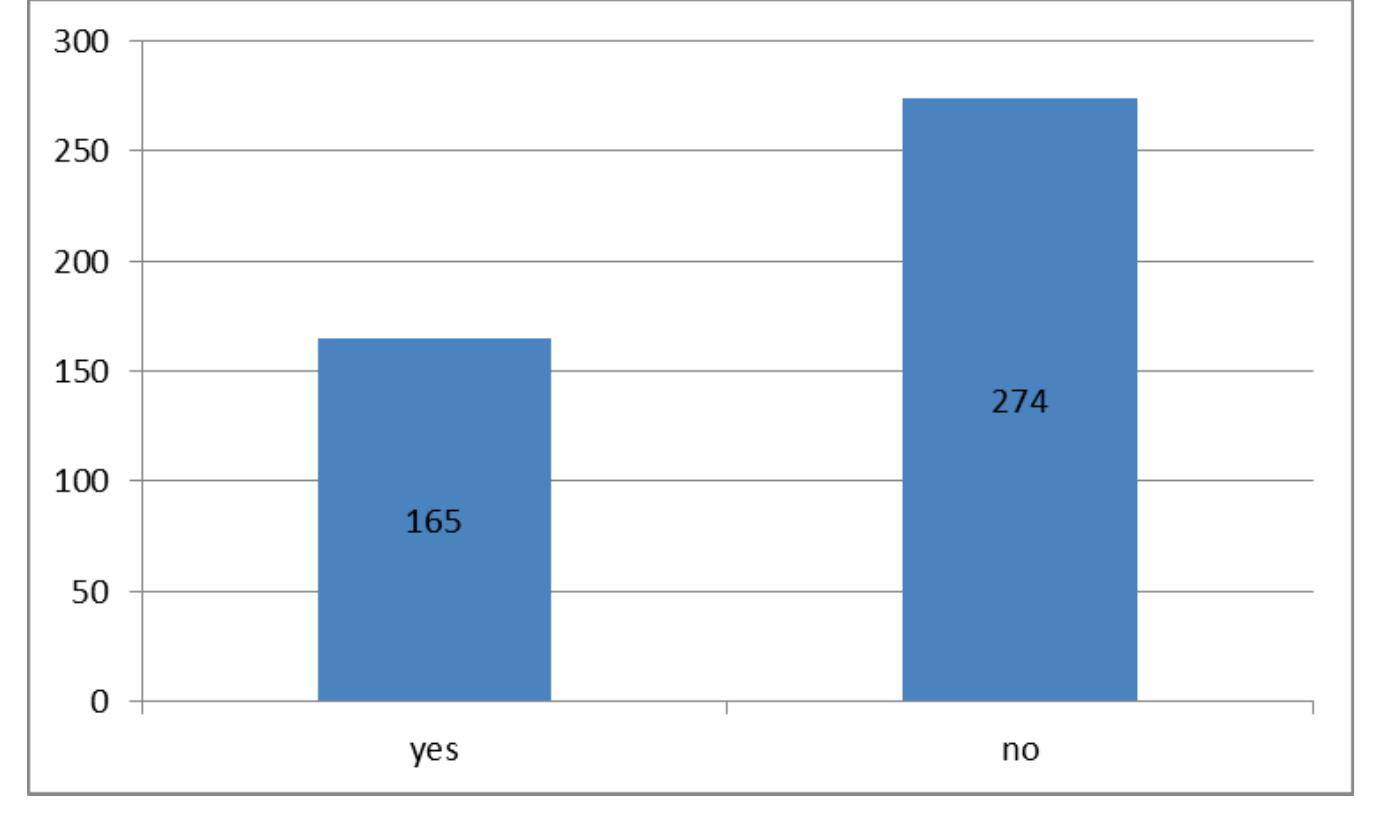

This paper reports the results of a survey of students’ perceptions of an investment portfolio simulation game. 439 students participated in the survey at the end of the spring semester at the University. A survey was conducted to find out if participation in investment portfolio simulations would motivate them to further their interest in investments; how much they applied their classroom acquired knowledge in the simulation game; whether or not they were motivated to increase their efforts in studying Investments, in other words, whether they find the investment simulation game valuable. We found that all together 293 students find the investment simulation game very valuable or valuable, but only 63 have been very much or somewhat involved in the simulation game; 49 of them applied classroom acquired knowledge, and simulation game motivated only 8 students to increase their efforts in studying Investments. The results are expected to serve to take the project “Investor” forward to include it as part of the students’ credits as well as promoting its educational purpose.

arrow_back_ios

arrow_forward_ios

Related papers

Journal of Marketing Education, 2013

Background and Rationale Marketing educators strive to provide students with an educational experience that prepares them for successful careers. Their education cannot simply involve the acquisition of a body of knowledge; it must also make them more employable by endowing them with work-relevant skills and competences (Gibson-Sweet et al 2010). In particular, marketing graduates need adequate numeracy skills because marketers are increasingly called upon to be accountable for their decisions. The premise of this study is that marketing simulation games provide an excellent opportunity to improve these skills; consequently, we hypothesize that simulation games are a good medium through which to deliver numerical and financial skills on a marketing degree programme. Numeracy skills are among the important skills needed by graduates. A study carried out by the Institute of Manpower found that over 85% of jobs required numeracy skills, and 75% needed numeracy skills higher than Foundation Level (Bynner & Parsons, 1997). While there are many definitions of numeracy, perhaps the definition provided by Lockett (1974) is still the most useful. He stated that a numerate employee is one who can make logical deductions, do basic arithmetic, and work with the relevant mathematical symbols, terms and formula used in the profession. These may appear to be quite basic skills and yet many studies have demonstrated that students in higher education today not only exhibit a weakness in basic arithmetic, but show a general fear of numbers and anything related to them. This does not bode well for their ability to succeed in marketing tasks involving setting budgets, interpreting numerical information on the business environment, competitors or customers, or undertaking even basic statistical analysis. Indeed, in line with these studies, our experience has taught us that marketing students, in general, do poorly on these tasks. Our own previous research has clearly demonstrated the ability of simulation games to engage students in the learning process while also developing a range of key skills and attitudes (reference withheld to preserve review process integrity). This study makes use of a marketing simulation game currently used in our third year marketing strategy module to determine the degree to which participation in such a game improves marketing students’ skills in numerical and financial analysis, as well as their perceived self-efficacy in those skills. Prior research into the educational value of simulation games suggests that they are good at developing key skills and giving participants a-valid representation of real world issues facing managers‖ (Wolfe and Roberts, 1993, p22) including enhanced skills in strategy formulation, analysis of multiple variables, integration of a range of marketing concepts and tools, manipulating financial concepts, problem-solving, communication and teamwork (

An excessive use of algebra and stochastic calculus in undergraduate finance courses is an impediment to learning because it shifts our attention from finance to mathematics; and also because, for most of our students, algebra serves to obfuscate rather than to clarify the basic concepts in finance that we are trying to teach. In this paper we demonstrate with examples, particularly on the subject of risk, that finance lectures may be given without algebra by replacing equations on a blackboard with simple interactive simulation computer screens integrated with the lecture.

The Polish educational system is undergoing substantial changes. Among others, one of those changes is the introduction of innovative and technologically enhanced teaching methods. The Center for Simulation Games and Gamification at Kozminski University in cooperation with external partners proposed a teaching program based on the computer simulation game for a new subject called "Economics in practice". This paper discusses the game project and the research conducted among Polish teachers and high school students. The research is aimed at recognizing barriers and preferences in using a simulation game as an educational tool. Teachers, (8) were selected based on previous experience with innovative teaching methods and geographic/demographic representation of north-eastern Poland, were participating in the focus group. The focus group with the teachers was aimed at identifying institutional and organizational barriers in the process of introducing a simulation game into th.

IGI Global eBooks, 2013

Revista Contabilidade & Finanças

The contribution from this study lies in its reflection on the factors that influence market efficiency, which requires a multidisciplinary view to analyze the intervening factors that impact results of the financial system. It also contributes by reflecting on the need for new approaches for training professionals who will go on to work in financial and related areas and preparing them by using different financial analysis techniques; by reflecting on the fact that analytical practices are influenced by social, cognitive, and emotional aspects, enabling the students to be better prepared to act in the financial market; by presenting various technical possibilities and providing more comprehensive knowledge to choose the one that best suits the object of analysis and their preferences; and by reflecting on different ways of perceiving investment opportunities and risk, which can be expanded on in other studies on the segmentation of clients according to their preferences in the inve.

Educational Innovation and Practice

This study investigated the effect of simulation games as an intervention strategy in the teaching-learning process to enhance performance of grade XII students in economics. The study adopted a mixed method research approach. A total of 27 (14 girls and 13 boys) grade XII students from one of the higher secondary schools participated in the study. The students were selected through non-probability convenient sampling techniques. The data sources include students class test score, narratives from the classroom observations and survey data. The findings revealed that the students were very positive about the use of simulation games as a classroom pedagogy. Simulation games help students comprehend concepts, ideas, and hypotheses easily besides making teaching-learning interesting, enjoyable, and fun as evident from the increase in mean marks in the class test 2 and high mean average score of 4.5 in the survey rating. However, the study also cautions that the simulation games are time.

American Journal of Business Education (AJBE), 2012

Business simulations serve as learning platforms that stimulate the gaming interest of students, that provide a structured learning environment, and that should help manage the time resources of faculty. Simulations appear to provide a context where students feel learning can take place. However, faculty perception of simulation research is lacking. This study focuses on perceptions of management and marketing faculty in U.S. business schools. Both groups perceive simulations as useful teaching tools for their undergraduate courses; however, neither group views simulations as offering learning opportunities that are superior to traditional methodologies, such as case studies, service learning, or in-class discussions.

Journal of College Teaching & Learning (TLC), 2011

While the literature supports the use of share market simulation as an educational tool we analyse the impact of a share market simulation on student self-efficacy and understanding. We find evidence of a statistically significant increase in self-efficacy through the use of the educational simulation. We also find that while self-efficacy at the start of the simulation is positively correlated with the level of self-efficacy at the end, the final level of understanding attained is positively related to both self-efficacy and the level of understanding that existed at the beginning of the simulation.

This paper discusses the role of computer based simulations in business education. It examines the learning approaches adopted by students using a simulation game. Results inform the development of causal-loop diagrams capturing representations of zero, single and double-loop learning within the study context. Actions are proposed to maximise the effectiveness of this form of learning technology.

Charles Schwab vs E*Trade

We’ve analyzed the best Online Stock Trading Platforms to help you find the right solution for your needs.

Monday, August 4th We evaluate products and services based on unbiased research. Top Consumer Reviews may earn money when you click on a link. Learn more about our process.

2025 Online Stock Trading Platform Reviews

Here you can see how Charles Schwab and E*Trade match up head-to-head in a battle for the Best Online Stock Trading Platforms in 2025.

Charles Schwab

- Trade with the award-winning Thinkorswim software, available on all platforms

- Schwab app

- Over 400 physical locations in the US

Charles Schwab has been around for over 50 years and is a trusted name in stock trading platforms. They became well-known early on for their quick trading practices and their low fees. They are welcoming to beginning traders and offer several plans that appeal to just about any level of experience. Seasoned traders really like the Thinkorswim trading platform, a product of Charles Schwab’s merger with TD AmeriTrade. Unfortunately, this merger seems to have gone a little less smoothly than desired, with many customers recently complaining of glitches, outages, and terrible customer service. While the platform is beautiful and offers many educational opportunities for beginners and experts alike, we can’t give it one of our top ratings due to the current growing pains Charles Schwab seems to be experiencing.

E*Trade

- Bonuses at sign-up

- Owned by financial giant Morgan Stanley

- Volume discount on options contract fees

Around for almost as long as the internet, E Trade was the pioneer of online stock trading platforms. It has several robust platforms to choose from and lots of plans with no minimums and $0 commissions. However, upon being acquired by Morgan Stanley, customer reviews indicate that the company’s platforms began experiencing crashes and glitches, and the company’s customer service decreased substantially. In addition, when trying to close accounts, customers get ignored or have to wait on hold for long stretches of time. Customers have complained of extra fees, being unable to withdraw their own money, and customer service representatives being incompetent. We cannot recommend E Trade as anything but a not-quite-average stock trading platform.

Read Full Reviews

Foreclosure Listing Services

Home Security Systems

Identity Theft Protection Services

Mortgage Refinance Companies

This can be an overwhelming question for beginning investors – but that’s a great place to start. First, ask yourself what level of skills or knowledge you have in investing and what your purposes for investing are. Are you brand new to the financial world of stocks, ETFs, fractional shares, and options? Are you trying to manage a large amount of wealth? Are you looking for a safe place to grow your savings over the next few decades?

Or, are you someone who has had a lot of experience in investing and wants to get back into the game or take your game to the next level? Are you wanting to take high risks, or are you more conservative in your approach? There are plenty of options out there and there are some who focus on everything and some who specialize in one or two niche markets.

For beginning traders, there are platforms that have devoted a big part of their online presence into education. Some have partnered with banks so you can do all of your investing along with your banking.

For active traders, the best platforms will have advanced charting capabilities, responsive customer service, robust toolkits, and they will also offer high-quality research resources. We highly recommend those platforms that allow for backtesting – a way to put in a particular strategy simulation and see how it might play out before committing to the trade in real life. Be sure to ask questions and double-check that whatever stock trading platform you use, they will have the tools that fit your particular needs.

For example, if you are going to be trading mostly on your mobile phone, you will want to make sure the stock trading company you choose has a strong mobile platform. Some companies do a bare-bones mobile app, and that would not be a suitable fit. Be sure to check if software platforms have a history of outages or glitches, too.

Are you the kind of investor who doesn’t want to actually pull the trigger on choosing which stocks to buy on your own? You might want to look into robo-advisors or a dedicated financial advisor or team of advisors. These accounts usually come with fees as a percentage of the total amount invested, but it can be well worth the cost if you don’t want to be involved in the day-to-day management and strategy on your account.

Most advisor accounts (robo or personal) involve you completing a questionnaire and/or a phone call that considers your time frame, financial goals, and risk tolerance. From there, the company will create a portfolio matching the information you gave. This portfolio will be rebalanced automatically, and you don’t have to do a thing. On those types of accounts, you can find options with no fees, and the ones that do charge fees are usually much less expensive than working with a human advisor one-on-one.

Keep in mind that most of today’s online stock trading platforms very proudly advertise that they charge “$0 fees.” That usually just refers to a $0 commission fee. There will definitely be at least one or two fees for most accounts. Whether it’s for withdrawal or broker-assisted transactions, there are going to be some extra costs associated with your account.

So, which online stock trading platform is best for you? Here are some of the criteria to keep in mind:

- Intended investment strategy. Are you an active day trader? A buy-and-hold investor? A conservative investor taking the slow and steady way to build a retirement? Are you willing to take risks? Are you a natural researcher or do you want someone else to do that for you?

- Ease of use. Is the website difficult to figure out? Is it easy to open an account, or do you have to go through a lot of extra hoops? Do you prefer to talk to someone on the phone, or is live chat your go-to way to communicate? Are there tutorials and online help for learning how to use the platform?

- Tools. Do you want lots of tools, or do you just want someone else to worry about it? Do you want to have an app that is integrated with your bank? Is there a mobile app? Is it web-based or downloadable? Can you connect with research resources that match your level of expertise?

- Customer service. What do other clients say about their experiences with the company? How are issues handled by customer service? Are the financial advisors helpful?

- Reputation. Is this a service with a long history in the financial industry or a relative newcomer? Is the company insured or backed by government or private agencies? Do they have a history of litigation or being fined by FINRA or other agencies? Are they transparent?

To help you make the most of your investments, Top Consumer Reviews has evaluated and ranked today’s most popular online stock trading platforms. We hope this information helps you reach your financial goals!

https://www.academia.edu/109646001/Students_Perceptions_of_the_Investment_Portfolio_Simulation_Gamehttps://www.topconsumerreviews.com/best-stock-trading-platforms/compare/charles-schwab-vs-e-trade.php