Public sector investment opportunities

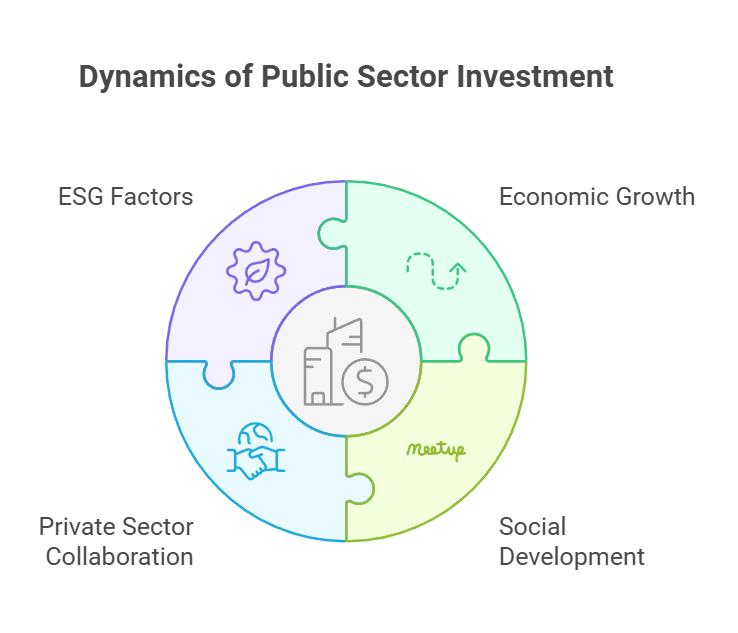

Public sector investment plays a crucial role in driving economic growth and social development. The UK government is actively seeking ways to modernise education through technology and improve public services. This creates exciting opportunities for private investors to partner with the public sector and contribute to meaningful projects.

The public sector spent over £385 billion on procurement in 2022-2023, making up nearly a third of all public spending. This massive expenditure presents a wealth of investment possibilities across various sectors. From education technology to infrastructure and renewable energy, there are numerous areas where private capital can make a significant impact.

Environmental, social, and governance (ESG) factors are becoming increasingly important to private investors. The public sector is well-positioned to align with these priorities, offering projects that deliver both financial returns and positive societal outcomes. By fostering collaboration between public and private entities, the UK aims to create a robust investment climate that benefits all stakeholders.

Key Takeaways

- Public sector investment opportunities span various sectors, including education, infrastructure, and technology

- Collaboration between public and private entities can drive economic growth and social development

- ESG considerations are shaping investment priorities in the public sector

The Role of Public Investment in Economic Development

Public investment plays a crucial part in driving economic progress and national prosperity. It shapes infrastructure, fosters innovation, and creates opportunities for sustainable growth across sectors.

Stimulating Economic Growth

Public investment acts as a powerful engine for economic growth. It boosts GDP and job creation by funding large-scale projects like transport networks, energy systems, and digital infrastructure. These investments reduce business costs and increase productivity.

Government spending on education and healthcare improves human capital. This leads to a more skilled workforce and higher labour productivity. Public research funding sparks innovation in key industries.

During economic downturns, public investment can provide a vital stimulus. It maintains demand and supports employment when private sector spending falls. This helps stabilise the economy and speed up recovery.

Advancing National Wealth Fund Goals

National wealth funds use public investment to grow long-term assets. They invest in domestic projects and global markets to build financial reserves. These funds aim to generate returns that benefit future generations.

Many funds focus on strategic sectors like energy, technology, and infrastructure. They may take stakes in promising companies or fund major development projects. This approach helps diversify the economy and reduce reliance on single industries.

Wealth funds also invest abroad to spread risk and gain exposure to global growth. They often seek stable, long-term returns from a mix of assets. This strategy helps preserve and grow national wealth over time.

Supporting Sustainable Growth Initiatives

Public investment is key to achieving sustainable development goals. It funds clean energy projects, green transport, and eco-friendly urban planning. These initiatives cut carbon emissions and protect natural resources.

Investments in water management and sustainable agriculture boost food security. They help communities adapt to climate change impacts. Public funds also support research into new green technologies.

Social investments promote inclusive growth. They improve access to education, healthcare, and housing. This reduces inequality and creates a more stable economic foundation. By focusing on sustainability, public investment helps build a resilient, future-proof economy.

Public and Private Sector Synergy

The collaboration between public and private sectors creates powerful opportunities for economic growth and development. This partnership combines governmental resources with private sector innovation and capital to drive progress.

Leveraging Private Investment

Private sector investment plays a crucial role in supporting public sector initiatives. Companies are increasingly seeking ways to align their investments with environmental, social, and governance (ESG) frameworks.

Public projects often attract private funding due to their potential for long-term returns and social impact. For example, infrastructure developments like roads, railways, and renewable energy projects can benefit from private capital.

By tapping into private investment, the public sector can accelerate project timelines and reduce the burden on taxpayers. This approach also brings in private sector expertise and efficiency to public endeavours.

Blended Finance Models

Blended finance combines public and private capital to achieve development goals. This model helps mitigate risks for private investors while ensuring public objectives are met.

Key elements of blended finance include:

- Risk-sharing mechanisms

- Concessional funding

- Technical assistance

These structures enable projects that might otherwise struggle to secure funding. For instance, green energy initiatives often use blended finance to attract investors while promoting sustainability.

Blended finance can also address market failures and support projects in emerging markets where traditional financing might be scarce.

Venture Capital and Institutional Investment Partnerships

Venture capital and institutional investors are increasingly partnering with the public sector to drive innovation and economic growth. These partnerships often focus on sectors like technology, healthcare, and clean energy.

Government programmes can provide seed funding or matching investments to attract venture capital to early-stage companies. This approach helps nurture start-ups and emerging industries.

Institutional investors, such as pension funds, are also exploring public-private partnerships. They seek stable, long-term returns from infrastructure and other public projects.

These collaborations can lead to:

- Job creation

- Technological advancements

- Improved public services

By working together, the public sector and institutional investors can achieve both financial returns and societal benefits.

Sector-Specific Investment Opportunities

The UK public sector offers diverse investment prospects across key areas. These opportunities aim to boost economic growth, improve public services, and address societal challenges.

Infrastructure and Transport

The UK government has committed over £100 billion to public sector investment in infrastructure and transport. This includes:

- High-speed rail projects like HS2

- Road network improvements

- Port and airport expansions

- Digital infrastructure upgrades

Private investors can participate through public-private partnerships (PPPs) or by investing in companies involved in these projects. The focus is on enhancing connectivity, reducing travel times, and supporting regional development.

Healthcare and Education

Healthcare and education sectors present significant investment opportunities:

- New hospital construction and modernisation

- Medical research facilities

- School building programmes

- University expansion projects

These investments aim to improve public services and support the UK’s knowledge economy. Private capital can fund innovative technologies, such as telemedicine platforms or e-learning solutions.

Housing and Urban Regeneration

The housing and urban regeneration sector offers various investment avenues:

- Affordable housing developments

- Brownfield site redevelopment

- Town centre rejuvenation projects

- Mixed-use urban developments

Investors can engage through real estate investment trusts (REITs) or direct property investments. These projects often align with environmental, social, and governance (ESG) factors, which are increasingly important to private investors.

Defence and Security

Defence and security investment opportunities include:

- Cybersecurity infrastructure

- Advanced military equipment

- Border control technologies

- Emergency response systems

Private investors can participate by investing in defence contractors or technology firms specialising in security solutions. These investments support national security and often drive innovation in dual-use technologies.

Clean Energy and Environmental Sustainability

The clean energy sector offers substantial investment potential:

- Offshore wind farms

- Solar power projects

- Green hydrogen production

- Energy storage solutions

The UK’s Green Prosperity Plan aims to attract private capital into clean energy industries. Investors can benefit from government incentives and growing demand for renewable energy solutions. These projects contribute to the UK’s net-zero carbon emissions target and support job creation in emerging green industries.

Implementing Strategic Initiatives

The UK government has launched key programmes to boost economic growth and reduce regional inequalities. These initiatives focus on levelling up, industrial innovation, and local development.

The Levelling Up Agenda

The Levelling Up agenda aims to spread opportunity more evenly across the UK. It targets areas like education, health, and infrastructure. The programme includes:

• £4.8 billion for town centre regeneration

• £26 billion for road improvements

• £5 billion for bus services and cycling

Skills development is a key focus. The government is investing in technical education and apprenticeships. This helps local workforces adapt to changing industries.

The New Hospitals Programme is part of this agenda. It will build 40 new hospitals by 2030. This improves healthcare access in underserved regions.

UK’s Industrial Strategy and Innovation

The Industrial Strategy supports key sectors and emerging technologies. It aims to boost productivity and create high-value jobs. Focus areas include:

• Artificial intelligence and data

• Future of mobility

The strategy invests in research and development. It encourages collaboration between universities and businesses. This helps turn innovative ideas into commercial products.

Local Enterprise Partnerships play a crucial role. They identify regional strengths and direct funding to promising projects.

Local Economic Growth and Devolution

Devolution gives local areas more control over economic decisions. Combined authorities and elected mayors have new powers over:

The UK Shared Prosperity Fund supports local growth projects. It replaces EU structural funds after Brexit. Local governments can use this money for:

• Small business support

City deals provide tailored funding packages. They target specific local needs and opportunities. This approach recognises that different regions face unique challenges.

Regulatory Framework and Investment Climate

Public sector investment opportunities are shaped by legal structures, government support, and economic conditions. These factors create a foundation for successful investments and drive economic growth.

Ensuring Rule of Law and Transparency

The UK government has put measures in place to uphold the rule of law and boost transparency in public sector investments. These efforts aim to build trust and attract investors.

Clear legal frameworks protect investor rights and assets. They also set out dispute resolution processes. This gives investors confidence their interests will be safeguarded.

Transparency initiatives include public disclosure of climate-related financial risks by large companies and financial firms. This helps investors make informed decisions about climate impacts.

Regular audits and reports on public projects further enhance transparency. They allow scrutiny of how public funds are used and the outcomes achieved.

Investment Support by Government Bodies

The UK has established dedicated bodies to support and guide public sector investments. These organisations play a crucial role in facilitating projects and attracting capital.

The Office for Investment, for example, works to identify and promote investment opportunities. It acts as a single point of contact for investors, streamlining the process.

Other bodies provide expertise in specific sectors like infrastructure or green energy. They help develop project pipelines and connect investors with suitable opportunities.

These support structures aim to reduce barriers to investment and improve project outcomes. They offer guidance on regulations, funding sources, and best practices.

Planning and Regulation Reforms

Recent reforms have aimed to streamline planning processes and update regulations. These changes seek to speed up project approvals and reduce unnecessary red tape.

Digital planning tools have been introduced to make the system more efficient. They allow for faster processing of applications and better data sharing between agencies.

Regulatory updates focus on balancing investor needs with public interests. New rules in areas like environmental protection aim to provide clear guidelines while promoting sustainable development.

Efforts are also being made to harmonise regulations across different regions. This creates a more consistent investment environment throughout the country.

Economic Stability in Post-Covid-19 Scenario

The UK economy has shown resilience in the face of Covid-19 challenges. Recovery efforts have focused on creating a stable environment for public sector investments.

Fiscal policies have been adjusted to support key sectors and maintain economic stability. This includes targeted spending on infrastructure and green initiatives to drive growth.

Monetary policies have helped manage inflation and maintain low interest rates. This creates favourable conditions for long-term investment projects.

The government has also introduced measures to boost skills and innovation. These efforts aim to enhance productivity and competitiveness in the post-pandemic economy.

Climate-related investment frameworks are being developed to guide future spending. This ensures public investments align with long-term sustainability goals.

Fostering Collaboration and Partnerships

The UK government is actively promoting partnerships to drive investment in infrastructure and boost economic growth. These efforts involve key institutions, stakeholders, and international cooperation.

The Role of the UK Infrastructure Bank

The UK Infrastructure Bank plays a crucial role in fostering public-private partnerships. It provides:

- Financing for large-scale projects

- Advisory services to local authorities

- Support for innovative green technologies

The bank aims to crowd in private investment by taking on some of the risks associated with major infrastructure initiatives. This approach helps to unlock capital and expertise from the private sector.

Engagement with Stakeholders and Developers

Effective collaboration requires strong engagement with various stakeholders. The government works to:

- Hold regular consultations with industry experts

- Create forums for knowledge sharing

- Develop clear guidelines for project proposals

Developers benefit from this engagement through:

- Better understanding of policy priorities

- Access to public sector resources

- Opportunities to shape future infrastructure plans

This collaborative approach helps ensure that projects align with both public needs and private sector capabilities.

Facilitating International Trade and Investment

The Department for Business and Trade leads efforts to attract inward investment and promote UK expertise abroad. Key initiatives include:

- Trade missions to showcase UK infrastructure capabilities

- Support for UK firms bidding on international projects

- Streamlined processes for foreign investors

Despite economic uncertainty, the UK remains an attractive destination for infrastructure investment. The government’s commitment to stability and innovation helps maintain investor confidence.

Programmes and Initiatives for Investment

The UK government has launched several key programmes to boost public sector investment. These initiatives aim to drive economic growth, create jobs, and support sustainable development across the nation.

National and Local Growth Plans

National and local growth plans form the backbone of the UK’s investment strategy. The government has set out ambitious targets for regional development and economic renewal.

These plans focus on reducing disparities between different parts of the country. They aim to create high-skilled jobs and improve living standards in underperforming areas.

Local authorities play a crucial role in implementing these plans. They work closely with businesses and community groups to identify investment priorities.

Key sectors targeted for growth include technology, green energy, and advanced manufacturing. The plans also emphasise the importance of improving transport links and digital infrastructure.

Infrastructure Projects Delivery

The delivery of large-scale infrastructure projects is vital for the UK’s long-term economic success. The government has committed significant funds to upgrade the nation’s transport, energy, and digital networks.

Major projects include:

- HS2 high-speed rail network

- Crossrail in London

- Offshore wind farm developments

- 5G network rollout

These projects create thousands of jobs and provide opportunities for UK businesses. They also help to attract private investment into the public sector.

The government has established specialised units to oversee project delivery. These units work to ensure projects are completed on time and within budget.

The British Business Bank and Job Creation

The British Business Bank plays a key role in supporting small and medium-sized enterprises (SMEs). It provides finance and advice to help businesses grow and create jobs.

The bank offers a range of programmes, including:

- Start Up Loans for new entrepreneurs

- Enterprise Finance Guarantee to help SMEs access bank loans

- Regional funds to support businesses in specific areas

These initiatives have helped create thousands of jobs across the UK. They have been particularly important in supporting businesses during economic downturns.

The bank also works to improve access to finance for innovative and high-growth companies. This helps to drive productivity and competitiveness in key sectors.

Carbon Capture and Storage Investment

Investment in carbon capture and storage (CCS) is a crucial part of the UK’s strategy to reach net-zero emissions. The government has committed significant funds to develop this technology.

Key CCS projects include:

- The East Coast Cluster in Teesside and Humberside

- HyNet North West in Liverpool Bay

- Acorn Project in Scotland

These projects aim to capture millions of tonnes of CO2 annually. They will help to decarbonise heavy industry and create new jobs in the green economy.

The government is working with private investors to fund these projects. This partnership approach helps to share risks and accelerate technology development.

Evaluating Economic and Social Impacts

Assessing the outcomes of public sector investments involves examining both economic and social factors. These evaluations help determine the effectiveness and value of government spending across various areas.

Measuring Productivity and Growth

Public sector investments can boost productivity and economic growth. Key metrics include:

- GDP growth rates

- Job creation figures

- Industry expansion data

Economists track these indicators to gauge the impact of government spending. For example, infrastructure projects often lead to increased economic activity and job opportunities.

Productivity improvements may stem from better transport links or enhanced digital connectivity. These investments can reduce business costs and improve efficiency across sectors.

Social Benefits and Public Services Improvement

Evaluating social impacts focuses on how investments enhance public welfare. This includes:

- Healthcare outcomes

- Education attainment levels

- Crime reduction rates

Measuring social value in public projects helps quantify non-financial benefits. For instance, improved healthcare facilities may lead to better patient outcomes and reduced waiting times.

Investments in public transport can increase mobility for disadvantaged groups. This might result in better access to jobs and services, improving overall quality of life.

Investment and Skills Enhancement

Public sector investments often aim to boost workforce skills and capabilities. This can involve:

- Funding for vocational training programmes

- Support for apprenticeships

- Investments in higher education facilities

The impact of these initiatives can be measured through:

- Skill level assessments

- Employment rates in targeted sectors

- Wage growth in related industries

Developing a skilled workforce supports long-term economic growth and competitiveness. It can also lead to innovation and productivity gains across various sectors of the economy.

Frequently Asked Questions

Public sector investment opportunities offer various ways for individuals and organisations to engage with government-funded projects. These initiatives span multiple sectors and regions, providing diverse options for potential investors.

What constitutes a public sector investment opportunity?

A public sector investment opportunity involves putting money into projects or ventures backed by the government. These can include infrastructure developments, social programmes, or economic growth initiatives. The Ayrshire Growth Deal is an example, with £251.5 million committed to boost sectors like aerospace and tourism.

How can individuals participate in investment opportunity funds in the UK?

Individuals can take part in UK investment funds through various channels. Some options include buying government bonds, investing in public-private partnerships, or contributing to local authority investment schemes. It’s crucial to research and understand the risks and potential returns before committing funds.

What are the characteristics of investment zones, and how do they affect public investment?

Investment zones are designated areas that receive special economic incentives to attract businesses and boost growth. These zones often feature tax breaks, simplified planning processes, and targeted funding. They aim to stimulate local economies and create jobs, which can lead to increased public and private investment in the area.

What role does the National Wealth Fund play in public sector investments?

The National Wealth Fund is a government-backed entity that manages and invests in strategic assets. It focuses on long-term economic growth and stability. The fund can support large-scale public projects, invest in emerging industries, and help diversify the nation’s economic portfolio.

Can you outline the four main types of investment opportunities in the public domain?

The four main types of public investment opportunities are:

- Infrastructure projects (e.g., transport, energy, telecommunications)

- Social programmes (e.g., healthcare, education, housing)

- Research and innovation initiatives

- Environmental and sustainability projects

Each type offers different risk profiles and potential returns for investors.

What sectors are currently experiencing significant growth and present viable public investment opportunities?

Several sectors are showing strong growth and investment potential in the public domain. These include:

- Renewable energy and green technologies

- Digital infrastructure and smart cities

- Healthcare and life sciences

- Advanced manufacturing and aerospace

These sectors often benefit from government support and funding, making them attractive for public sector investment.

Understanding Sector Investing: A Guide to Industry-Specific Opportunities

Sector investing is a strategy that involves focusing on specific industries or sectors within the broader market. This approach allows investors to capitalize on the unique opportunities and trends that may be present in particular areas of the economy. By honing in on sectors, investors can potentially enhance their returns and manage risk more effectively. However, understanding the nuances of sector investing is crucial for making informed decisions.

To begin with, it’s important to recognize that sectors are broad categories that group companies based on their primary business activities. Common sectors include technology, healthcare, financials, consumer goods, and energy, among others. Each sector has its own set of characteristics, growth drivers, and risks. For instance, the technology sector is often driven by innovation and rapid advancements, while the healthcare sector may be influenced by regulatory changes and demographic shifts.

One of the key advantages of sector investing is the ability to target specific economic trends. For example, if you believe that renewable energy will see significant growth in the coming years, you might choose to invest in the energy sector, specifically focusing on companies involved in solar, wind, or other renewable sources. This targeted approach can help you align your investments with your economic outlook and personal beliefs.

Moreover, sector investing can provide diversification benefits. While it may seem counterintuitive, focusing on multiple sectors can actually help spread risk. By investing in a variety of sectors, you can reduce the impact of poor performance in any single area. For instance, if the technology sector experiences a downturn, strong performance in the healthcare or consumer goods sectors can help offset those losses. This diversification can be particularly valuable during periods of market volatility.

However, it’s essential to be aware of the risks associated with sector investing. One major risk is the potential for overexposure to a single sector. If you concentrate too heavily on one area, you may be vulnerable to sector-specific downturns. For example, if you had invested heavily in the financial sector during the 2008 financial crisis, you would have faced significant losses. To mitigate this risk, it’s important to maintain a balanced portfolio and avoid putting all your eggs in one basket.

Another consideration is the cyclical nature of certain sectors. Some industries are more sensitive to economic cycles than others. For instance, the consumer discretionary sector, which includes companies that sell non-essential goods and services, tends to perform well during economic expansions but may struggle during recessions. Understanding these cycles can help you make more informed investment decisions and time your entries and exits more effectively.

In addition to economic cycles, sector performance can be influenced by various external factors such as regulatory changes, technological advancements, and geopolitical events. Staying informed about these factors and how they might impact different sectors is crucial for successful sector investing. Regularly reviewing industry news, analyst reports, and market trends can provide valuable insights and help you stay ahead of potential risks and opportunities.

Lastly, it’s worth noting that there are various tools and resources available to assist with sector investing. Exchange-traded funds (ETFs) and mutual funds that focus on specific sectors can provide a convenient way to gain exposure without having to pick individual stocks. These funds are managed by professionals who conduct thorough research and analysis, which can be particularly beneficial for those who may not have the time or expertise to do so themselves.

In conclusion, sector investing offers a way to capitalize on industry-specific opportunities and align your investments with your economic outlook. While it comes with its own set of risks, a well-diversified and informed approach can help you navigate these challenges and potentially enhance your returns. By staying informed and leveraging available resources, you can make more strategic decisions and take advantage of the unique opportunities that different sectors have to offer.

Top Sectors to Watch: Industry Trends and Investment Strategies

Sector investing, which involves focusing on specific industries or sectors within the broader market, has become an increasingly popular strategy among investors looking to capitalize on industry-specific opportunities. By honing in on particular sectors, investors can potentially benefit from trends and developments that may not be as apparent in a more diversified portfolio. As we navigate the ever-evolving landscape of the financial markets, several sectors stand out as particularly promising, each driven by unique trends and offering distinct investment strategies.

To begin with, the technology sector continues to be a powerhouse of innovation and growth. With advancements in artificial intelligence, cloud computing, and cybersecurity, tech companies are at the forefront of transforming how businesses operate and how individuals interact with the digital world. Investors looking to tap into this sector might consider focusing on companies that are leaders in these cutting-edge technologies. For instance, firms specializing in AI and machine learning are poised to revolutionize industries ranging from healthcare to finance, making them attractive investment targets. Additionally, the ongoing shift towards remote work and digital collaboration tools further underscores the importance of tech companies that provide essential infrastructure and services.

Transitioning to another dynamic sector, healthcare remains a critical area of focus, especially in light of recent global health challenges. The pandemic has underscored the importance of robust healthcare systems and the need for continuous innovation in medical research and pharmaceuticals. Investors might find opportunities in biotech firms developing groundbreaking treatments and vaccines, as well as companies specializing in telemedicine and digital health solutions. The aging global population also drives demand for healthcare services and products, making this sector a long-term play for those looking to invest in essential and growing industries.

Meanwhile, the renewable energy sector is gaining momentum as the world increasingly prioritizes sustainability and environmental responsibility. Governments and corporations alike are committing to reducing carbon footprints and investing in clean energy solutions. This shift presents a wealth of opportunities for investors interested in companies involved in solar, wind, and other renewable energy sources. Additionally, advancements in energy storage technologies and electric vehicles are creating new avenues for growth within this sector. By focusing on firms that are leading the charge in green energy innovation, investors can align their portfolios with the global push towards a more sustainable future.

On a different note, the consumer discretionary sector offers intriguing possibilities as well. This sector includes companies that produce non-essential goods and services, such as luxury items, entertainment, and travel. As economies recover and consumer confidence rebounds, there is potential for significant growth in this area. Investors might look at companies that are well-positioned to benefit from increased consumer spending, particularly those that have adapted to changing consumer behaviors and preferences. For example, e-commerce giants and digital entertainment platforms have seen substantial growth as more people shop and consume content online.

Lastly, the financial sector remains a cornerstone of the global economy, encompassing banks, insurance companies, and investment firms. With the rise of fintech innovations, traditional financial institutions are evolving to meet the demands of a digital-first world. Investors might consider companies that are at the forefront of this transformation, offering innovative financial products and services. Additionally, as interest rates fluctuate and regulatory landscapes shift, there are opportunities to capitalize on the changing dynamics within this sector.

In conclusion, sector investing allows investors to target specific industries that are poised for growth based on current trends and future potential. By focusing on technology, healthcare, renewable energy, consumer discretionary, and financial sectors, investors can strategically position themselves to benefit from industry-specific opportunities. As always, it’s essential to conduct thorough research and consider the broader economic context when making investment decisions.

Benefits and Risks of Sector Investing: Maximizing Returns in Specific Industries

Sector investing, which involves focusing on specific industries or sectors of the economy, can be a compelling strategy for investors looking to maximize returns. By zeroing in on particular areas such as technology, healthcare, or energy, investors can potentially capitalize on the unique growth opportunities and trends within those sectors. However, like any investment strategy, sector investing comes with its own set of benefits and risks that need to be carefully considered.

One of the primary benefits of sector investing is the ability to leverage specialized knowledge. Investors who have a deep understanding of a particular industry can use that expertise to identify promising companies and trends before they become widely recognized. For instance, someone with a background in biotechnology might be better positioned to spot emerging medical technologies or pharmaceutical breakthroughs. This specialized knowledge can provide a significant edge over more generalized investment strategies.

Moreover, sector investing allows for targeted exposure to high-growth areas of the economy. Certain sectors, such as technology or renewable energy, may experience rapid growth due to innovation, regulatory changes, or shifts in consumer behavior. By concentrating investments in these high-potential areas, investors can potentially achieve higher returns than they might through a more diversified portfolio. For example, the tech boom of the last decade has rewarded those who invested heavily in companies like Apple, Amazon, and Google.

However, it’s important to recognize that sector investing also comes with heightened risks. One of the most significant risks is the lack of diversification. By focusing on a single sector, investors are more vulnerable to industry-specific downturns. For instance, an investor heavily invested in the energy sector might face substantial losses if oil prices plummet or if there is a significant shift towards renewable energy sources. This lack of diversification can lead to greater volatility and potential losses compared to a more balanced portfolio.

Another risk associated with sector investing is the potential for regulatory changes. Industries such as healthcare, finance, and energy are often subject to significant government regulation. Changes in laws or regulations can have a profound impact on the profitability and viability of companies within these sectors. For example, new environmental regulations could increase costs for energy companies, while changes in healthcare policy could affect the revenue streams of pharmaceutical firms.

Additionally, sector investing requires a higher level of ongoing research and monitoring. Investors need to stay informed about industry trends, company performance, and broader economic factors that could impact their chosen sector. This can be time-consuming and may require a greater commitment than more passive investment strategies. However, for those willing to put in the effort, the rewards can be substantial.

In conclusion, sector investing offers a unique opportunity to maximize returns by focusing on specific industries with high growth potential. The ability to leverage specialized knowledge and target high-growth areas can provide significant advantages. However, the strategy also comes with increased risks, including lack of diversification, regulatory changes, and the need for ongoing research. By carefully weighing these benefits and risks, investors can make informed decisions about whether sector investing aligns with their financial goals and risk tolerance. Ultimately, for those with the expertise and dedication to navigate the complexities of specific industries, sector investing can be a powerful tool in their investment arsenal.

Case Studies in Sector Investing: Success Stories and Lessons Learned

Sector investing, which involves focusing on specific industries or sectors within the broader market, has become an increasingly popular strategy among investors seeking to capitalize on industry-specific opportunities. By zeroing in on particular sectors, investors can potentially benefit from trends and developments unique to those industries. To illustrate the potential of sector investing, let’s delve into a few case studies that highlight both success stories and valuable lessons learned.

One notable success story in sector investing is the technology boom of the late 1990s and early 2000s. Investors who recognized the transformative potential of the internet and digital technologies were able to reap substantial rewards. Companies like Amazon, Microsoft, and Apple saw their stock prices soar as they revolutionized their respective markets. Early investors in these tech giants experienced exponential growth in their portfolios. This period underscored the importance of identifying emerging trends and being willing to take calculated risks on innovative companies within a burgeoning sector.

However, the tech bubble also serves as a cautionary tale. The rapid rise in technology stocks led to speculative excesses, with many companies being overvalued based on unrealistic growth expectations. When the bubble burst in 2000, it resulted in significant losses for investors who had not diversified their portfolios or who had invested in companies without solid fundamentals. This episode highlights the importance of conducting thorough research and maintaining a balanced investment approach, even when a sector appears to be on an unstoppable upward trajectory.

Another compelling example of sector investing can be found in the renewable energy sector. Over the past decade, there has been a growing global emphasis on sustainability and reducing carbon emissions. Investors who recognized this shift early on and allocated funds to renewable energy companies have seen impressive returns. Companies like Tesla, which has become synonymous with electric vehicles, and NextEra Energy, a leader in wind and solar power, have delivered substantial gains. The success of these investments underscores the value of aligning investment strategies with long-term societal and environmental trends.

Nevertheless, the renewable energy sector also presents its own set of challenges. The industry is heavily influenced by government policies and subsidies, which can be unpredictable and subject to change. For instance, changes in tax incentives or regulatory support can significantly impact the profitability of renewable energy projects. Investors must stay informed about policy developments and be prepared for potential volatility. This case study teaches us the importance of staying agile and adaptable when investing in sectors that are closely tied to regulatory environments.

The healthcare sector offers yet another intriguing case study. The COVID-19 pandemic brought unprecedented attention to healthcare companies, particularly those involved in vaccine development and distribution. Companies like Pfizer and Moderna saw their stock prices surge as they played pivotal roles in combating the pandemic. Investors who had positioned themselves in the healthcare sector prior to the pandemic benefited from this unexpected catalyst. This scenario highlights the potential for sector-specific events to drive significant investment returns.

However, the healthcare sector is also characterized by its complexity and regulatory scrutiny. Drug approvals, patent expirations, and changes in healthcare policies can all have profound impacts on company valuations. Investors must navigate these complexities with a keen understanding of the sector’s dynamics and a willingness to stay informed about ongoing developments.

In conclusion, sector investing offers both exciting opportunities and inherent risks. Success stories from the technology, renewable energy, and healthcare sectors demonstrate the potential for substantial gains when investors identify and capitalize on industry-specific trends. At the same time, these case studies also provide valuable lessons about the importance of thorough research, diversification, and staying informed about regulatory and policy changes. By learning from these examples, investors can better position themselves to navigate the complexities of sector investing and achieve their financial goals.

https://www.publicsectorexperts.com/blog/public-sector-news-insights-and-analysis-1/public-sector-investment-opportunities-882https://www.momentslog.com/investment/sector-investing-focusing-on-industry-specific-opportunities