Portfolio analysis in strategic management, Meaning, Steps, Advantages

Portfolio analysis in strategic management plays a crucial role in optimizing investment decisions, managing risks, and aligning business objectives. As the financial landscape becomes increasingly complex, understanding the importance and benefits of portfolio analysis can empower investors to achieve their financial goals. This blog will explore the meaning, steps, advantages, and essential aspects of portfolio analysis in strategic management.

What Is Portfolio Analysis In Strategic Management?

Portfolio analysis in strategic management is a critical process that involves evaluating and managing a company’s collection of investments, products, or business units. This process helps organizations gain insights into their investments’ performance, identify potential risks and opportunities, and allocate resources effectively to achieve their strategic goals.

A. Definition and purpose of portfolio analysis

Portfolio analysis is an essential aspect of strategic management, as it enables organizations to assess their investments based on various factors, such as market share, growth potential, and profitability. By conducting a thorough portfolio analysis, companies can identify underperforming investments, discover new growth opportunities, and optimize resource allocation to enhance overall performance.

B. Role of corporate portfolio analysis in strategic management

Corporate portfolio analysis in strategic management plays a crucial role in helping organizations make informed decisions about their investments. It enables businesses to evaluate the performance of their business units or product lines and identify the most profitable and strategic investments. Corporate portfolio analysis also aids in determining the ideal resource allocation and formulating growth strategies to enhance the organization’s competitiveness and profitability.

C. Connection between business portfolio analysis and strategic management

Business portfolio analysis is a vital component of strategic management, as it allows organizations to assess their investments’ performance and align their resource allocation with their strategic objectives. By understanding the relationship between the two, companies can make better decisions about their investments, optimize resource allocation, and drive growth in line with their strategic goals.

Advantages of Portfolio Analysis in Strategic Management

Portfolio analysis in strategic management offers numerous benefits that can significantly improve the performance and success of businesses. By implementing portfolio analysis, companies can optimize their decision-making processes, allocate resources effectively, manage risks, align their goals and track performance, and enhance their competitive advantage.

A. Improved Decision-Making

One of the primary advantages of portfolio analysis in strategic management is the enhancement of decision-making processes. By thoroughly analyzing the performance of various investments and business units, companies can make informed decisions about which areas to invest in further, which to maintain, and which to divest. This data-driven approach helps businesses make strategic decisions that maximize value and drive growth.

B. Enhanced Resource Allocation

Resource analysis in strategic management plays a crucial role in the effective allocation of resources. Through portfolio analysis, businesses can identify the most promising investment opportunities and allocate their resources accordingly. This ensures that resources are directed towards the most profitable projects and units, ultimately leading to higher returns on investment.

C. Risk Management

Portfolio analysis in strategic management allows businesses to identify and mitigate potential risks associated with their investments. By analyzing the performance of various business units and investments, companies can identify patterns and trends that may indicate potential risks. This information can then be used to develop strategies to minimize potential losses and protect the company’s assets.

D. Goal Alignment and Performance Tracking

Corporate portfolio analysis in strategic management enables businesses to align their investments and projects with their overall objectives and goals. This ensures that all business units and investments are contributing to the company’s overall success. Additionally, portfolio analysis allows businesses to track their performance over time, enabling them to identify areas for improvement and adapt their strategies as needed.

E. Competitive Advantage

Lastly, portfolio analysis strategic management can provide businesses with a competitive advantage. By identifying the most profitable investment opportunities and allocating resources effectively, businesses can outperform their competitors and stay ahead in the market. This advantage can ultimately lead to increased market share, higher profits, and long-term success.

Reasons for Portfolio Analysis

Portfolio analysis in strategic management plays a crucial role in optimizing investment strategies and achieving financial goals. Understanding the reasons for conducting portfolio analysis can help investors make informed decisions and improve their overall financial performance. Let’s explore some key reasons for implementing portfolio analysis in strategic management.

A. Analysis of Current Investments

One of the primary reasons for portfolio analysis is to evaluate the performance of current investments. By examining the returns and risks associated with each investment, investors can identify underperforming assets and make necessary adjustments to their portfolio. This helps in maximizing returns and mitigating risks, ultimately leading to more efficient investment management.

B. Formulation of Growth Strategies

Portfolio analysis also assists in the formulation of growth strategies for businesses and investors. By analyzing the performance of various assets and sectors, investors can identify potential opportunities for growth and expansion. This can involve investing in high-performing assets, diversifying the portfolio, or reallocating resources to capitalize on emerging trends and opportunities.

C. Decisions Regarding Product Retention or Divestment

Another important aspect of portfolio analysis in strategic management is making decisions regarding product retention or divestment. By evaluating the performance and potential of each product or asset, investors can determine whether to continue investing in a particular product or divest from it in favor of more promising opportunities. This helps in optimizing the overall portfolio and ensuring that resources are allocated effectively to achieve the desired financial goals.

In conclusion, portfolio analysis in strategic management is a vital process that helps investors make informed decisions, formulate growth strategies, and optimize their investment portfolio. By understanding and implementing portfolio analysis, investors can improve their financial performance and achieve their long-term goals.

Process for Portfolio Analysis in Strategic Management

In order to effectively conduct portfolio analysis in strategic management, a structured and comprehensive approach is required. This process is broken down into several steps, which are outlined below.

Step 1: Identify Lines of Business

First, it is important to identify the various lines of business within the company. This includes understanding the different products, services, and market segments that the organization operates in.

Step 2: Group Lines of Business

Next, group the lines of business based on their similarities and differences. This can be done by considering factors such as market growth, profitability, and competitive advantage.

Step 3: Compare Core Businesses with Mission

Compare the core businesses and their performance with the company’s mission and overall strategic objectives. This helps determine if the current portfolio aligns with the organization’s goals and vision.

Step 4: Define Products in Each Line of Business

Within each line of business, define the individual products or services offered. This allows for a more detailed analysis of each offering and its contribution to the overall portfolio.

Step 5: Apply the Program Evaluation Matrix

Utilize a program evaluation matrix to assess the performance of each product or service within the portfolio. This can help identify areas of strength and weakness, as well as opportunities for growth or divestment.

Step 6: Determine the Alternatives

Based on the results of the portfolio analysis, determine the potential alternatives for each product or service. This may include options such as investing in growth, maintaining current operations, or divesting underperforming assets.

Step 7: Determine Program Fit

Lastly, evaluate how well the proposed alternatives align with the overall strategic objectives and mission of the organization. This ensures that the portfolio analysis results in a balanced and effective strategy that supports the company’s long-term goals.

In summary, portfolio analysis in strategic management is a critical tool for assessing and optimizing an organization’s investments and resources. By following this structured process, companies can make informed decisions about their portfolio, ultimately driving growth and maximizing value.

Corporate Portfolio and Resource Analysis in Strategic Management

In the realm of strategic management, a corporate portfolio is a collection of businesses or products owned by a company. Understanding the importance of corporate portfolios is crucial for making informed decisions about which businesses or products to invest in, maintain, or divest. A well-balanced corporate portfolio aids in minimizing risks while maximizing returns, aligning with the overall strategic objectives of the company.

Resource analysis is another key component of strategic management. It involves evaluating a company’s resources, such as financial, human, and technological assets, to identify strengths and weaknesses that can impact business performance. This analysis helps in determining the most effective allocation of resources to achieve the company’s goals and maintain a competitive edge in the market.

Integrating resource analysis with portfolio analysis in strategic management can significantly enhance decision-making and optimize business performance. By assessing both the corporate portfolio and the company’s resources, management can identify potential investment opportunities and areas for improvement. This holistic approach ensures that the organization’s resources are effectively utilized, and its portfolio remains balanced and aligned with the overall strategic objectives.

Investmates: Empowering Your Financial Future

In the realm of portfolio analysis in strategic management, Investmates is a powerful platform that can help you enhance your financial future. With a professional, confident, and empowering approach, Investmates provides a comprehensive education and training program for investors, offering courses, webinars, and tutorials to help you navigate the world of investing.

One of the key features of Investmates is its advanced trading tools and resources, which enable users to analyze market trends, identify potential investment opportunities, and execute trades with confidence. These tools are invaluable for those looking to engage in corporate portfolio analysis and resource analysis in strategic management, among other essential investment strategies.

Beyond its cutting-edge tools, Investmates also fosters a sense of community through its social trading feature. This enables users to connect with other traders and investors, discuss market trends, share trading ideas, and even copy the trades of successful investors. This collaborative approach helps users gain insights and expand their knowledge of strategic management and portfolio analysis.

Investmates’ user-friendly interface and diverse investment options make it an ideal platform for both novice and experienced investors. By offering a range of options, Investmates ensures that users can tailor their investment strategies to suit their individual needs and goals, making the most of their corporate portfolio and resource analysis in strategic management.

If you’re ready to take control of your financial future and harness the power of portfolio analysis in strategic management, visit Investmates.io today and discover how this platform can help you achieve your investment goals.

Empower Your Investment Strategy

Portfolio analysis in strategic management plays a vital role in optimizing investment strategies and achieving financial goals. As we have seen, it provides numerous benefits, such as improved decision-making, enhanced resource allocation, and effective risk management. By implementing portfolio analysis, investors can align their investments with their overall objectives and gain a competitive advantage in the market.

Investmates.io offers a comprehensive education and training program for individuals interested in investing and trading, providing advanced trading tools and resources to help analyze market trends and identify potential investment opportunities. Visit Investmates.io to take control of your financial future and harness the power of portfolio analysis in strategic management.

How to Build a Diversified Investment Portfolio (With 5 Examples)

We mention products and services that we think can be helpful for our users. Some or all of them may be from partners who compensate us. This can influence which topics we choose and how products are presented on the page, but it does not affect our opinions or conclusions.

While it may sound complicated, diversification is a relatively simple concept and is similarly easy to execute.

Diversification is a strategy of spreading investments across a variety of assets to reduce risk. This way, if one investment performs poorly, others may compensate.

For instance, if you only owned Apple stock and it dropped by 10%, your portfolio would fall 10%. But if you also owned Microsoft stock and it increased by 7%, your portfolio would only fall 3%.

Simply put, diversification is the concept of not putting all your eggs in one basket.

You can diversify further by owning multiple groups of assets simultaneously, like stocks and bonds. In general, bonds are more stable than stocks and may increase in value when stocks are performing poorly. By owning both, you may be able to create a more stable and balanced portfolio.

You can easily overcomplicate diversification, but it can be achieved with just 3–5 investments. If that sounds crazy, you don’t have to take my word for it — that’s how several billionaire investors recommend you invest (more on those portfolios below).

In this article I give a complete overview of how to balance risk and reward, a look at asset classes, and five examples of diversified portfolios.

Disclaimer: This is not investment advice. This article reflects my opinions based on my knowledge and experience. There are many nuances that I cannot cover in this article. Before investing, always do your own research and due diligence.

Risk tolerance and asset allocation

As an investor, your goal should be to balance risk and reward.

To accomplish this, many investors invest in a combination of stocks and bonds. An investor’s mix of investments is known as their asset allocation.

You can achieve higher returns by investing in stocks. But stocks also come with larger drawdowns and a greater chance of losing money.

Bond investments, on the other hand, are less volatile but come with lower returns.

Remember, the goal of diversification is to reduce the amount of volatility (big price changes up or down) in a portfolio, not to maximize returns.

You can shape your portfolio’s expected risk/reward by changing the amount of money you allocate to stocks and bonds.

The more you allocate to stocks, the higher your portfolio’s expected risk/reward. The more you allocate to bonds, the lower your portfolio’s expected risk/reward.

Because younger investors have longer investment time horizons, which give their portfolios more time to bounce back from stock dips, they can allocate higher percentages of their portfolios to stocks.

For those in or nearing retirement, the reverse is true.

Therefore, many investors shift their asset mix toward less risky investments as they get older. A simple rule of thumb is to allocate your age (in percentage terms) to bonds and invest the rest in stocks.

- A 20-year-old may invest 20% of their portfolio in bonds and 80% in stocks

- A 65-year-old may invest 65% of their portfolio in bonds and 35% in stocks

This isn’t a perfect formula — you should tailor your portfolio to suit your financial situation and risk tolerance — but it’s a good starting point.

What assets to invest in

As mentioned above, there are three main assets that make up the bulk of most investors’ portfolios: stocks, bonds, and cash.

There are two methods to diversify:

- Within asset classes

- Across asset classes

For example, if all the stocks you owned were U.S. companies, you could diversify by investing in some international companies (within asset classes).

Or, if you owned 100% stocks, you could diversify by investing some of that money in bonds (across asset classes).

To be properly diversified, you can use both of these methods.

1. Stocks

When you buy shares of a stock, you’re purchasing a part ownership in a company.

Stocks drive much of the growth and investment returns in portfolios. However, this greater potential for growth comes with greater risk and volatility, especially in the short term. To reduce this risk, investors diversify by owning multiple stocks.

To diversify properly, you can invest across a wide range of geographies (U.S., Canada, etc.), sectors (technology, consumer staples, etc.), sizes (large, medium, and small), and valuations (growth and value).

Instead of buying many individual stocks to achieve this level of diversification, you can also buy an exchange-traded fund (ETF). An ETF is a single investment that holds a basket of securities.

For example, VOO is an ETF that owns 500 of the biggest companies in the U.S. It follows the S&P 500 index, one of the most popular investments in the world.

By buying VOO, you own all 500 of these companies at once. It’s also very inexpensive — the expense ratio is 0.03%, or $3 (per year) for every $10,000 you invest.

If you also want to invest in international stocks, you may buy VT. This ETF holds shares in almost every major publicly traded company in the world.

2. Bonds

When you buy a bond, you’re lending money to a company and will be paid interest over time.

While stocks are the main drivers of growth in a portfolio, bonds are used to reduce risk and provide steady cash flows. The downside is that their returns are lower.

A portfolio containing both stocks and bonds will not fluctuate (higher or lower) as much as an all-stock portfolio.

As is the case with stocks, you can buy bonds one at a time or diversify across a broad range of bonds with an ETF. I like TLT, a long-term U.S. Treasury bond ETF, and SGOV, a short-term U.S. Treasury bill ETF.

3. Cash

Cash is any money you have in your checking or savings accounts.

This isn’t an investment per se, but you should have cash on hand to cover your monthly expenses and any unexpected emergencies.

Most financial advisors recommend having 6–12 months of living expenses in cash on hand for an “emergency fund.”

Many investors also keep a certain amount of cash on hand in case any investment opportunities present themselves. This cash allows them to act quickly and without needing to sell another investment to free up funds.

This cash can be deposited into a high-interest savings account.

Alternative investments

You can further diversify a portfolio by investing in alternative investments. These include commodities, real estate, cryptocurrencies, private credit, blue chip art, and more.

Alternative investments can generate high returns, but they typically come with equally high risk and volatility. For this reason, most investors (myself included) focus their portfolios on stocks, bonds, and cash.

Five investment portfolio examples

Below are five commonly used and frequently recommended investment portfolios.

All of these example investment portfolios are relatively simple to implement with a few ETFs, which I recommend in parentheses.

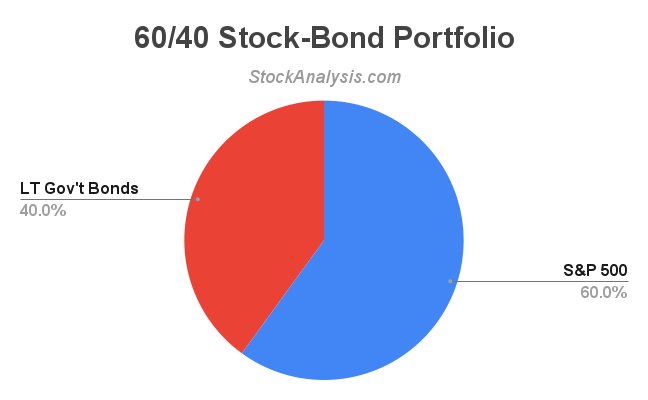

1. 60/40 Stock-Bond Portfolio

The 60/40 portfolio is one of the most popular asset mixes used by a broad range of investors, regardless of age.

As its name suggests, 60% of the portfolio is invested in stocks, and the remaining 40% goes to bonds. Most frequently, when deployed by a U.S. investor, the portfolio is split between the S&P 500 (like VOO) and 10-year U.S. Treasury bonds (like IEF).

This blended stock/bond portfolio is known for having moderate risk and generating moderate returns.

Potential drawbacks

This approach may be too conservative for younger investors and too risky for older investors.

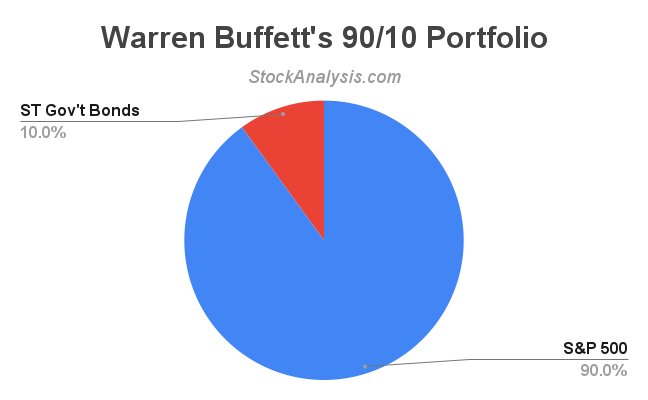

2. Warren Buffett’s 90/10 Portfolio

On page 20 of his 2013 letter to Berkshire Hathaway shareholders, Warren Buffett outlined the simple investment strategy he set out in his will for his wife’s trust.

- 10% short-term government bonds (like SGOV)

- 90% low-cost S&P 500 index tracker, specifically one of Vanguard’s (like VOO)

Not only is this an inexpensive (in terms of fees), well-diversified, and easy portfolio to manage, but he believes it will also outperform the vast majority of investors.

Buffett notes, “I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions, or individuals — who employ high-fee managers.”

Potential drawbacks

This portfolio is very stock-heavy and may not be appropriate for older or risk-averse investors.

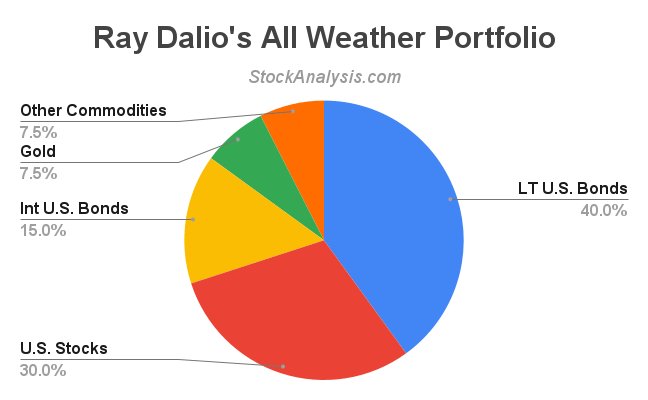

3. Ray Dalio’s All Weather Portfolio

Ray Dalio founded Bridgewater Associates, one of the largest hedge funds in the world.

Thinking about which assets perform well under the four economic environments — inflation, deflation, growth, and recession — Dalio and his team constructed a portfolio that you can “set and forget,” regardless of what the future holds.

To achieve this mix, consider the following ETFs:

The portfolio has largely achieved its goals of reducing volatility and performing pretty well regardless of the economic environment.

Potential drawbacks

Lower volatility comes with lower returns — the all-weather portfolio has not kept up with stock-only portfolios. Younger investors who can stomach volatility will likely have better results in a less conservative portfolio.

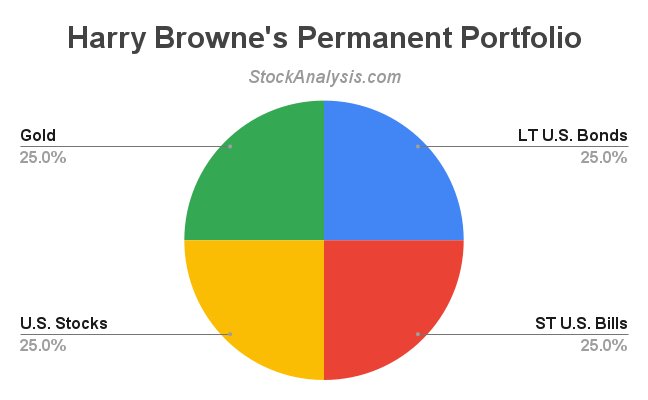

4. Harry Browne’s Permanent Portfolio

Harry Browne was an author and investment advisor who developed the permanent portfolio investing strategy.

The permanent portfolio has the same investment objective as the all-weather portfolio — to perform well under any set of market conditions — but utilizes one less fund.

The portfolio is made up of equal parts long-term U.S. Treasury bonds (like TLT), short-term U.S. Treasury bills (like SGOV), U.S. stocks (like VTI), and gold (like GLD).

Like Dalio’s, Browne’s portfolio is known for moderate returns and low-moderate risk.

Potential drawbacks

The relatively small portion of the portfolio allocated to stocks reduces the volatility of the portfolio but also limits its upside.

5. The Barbell Strategy

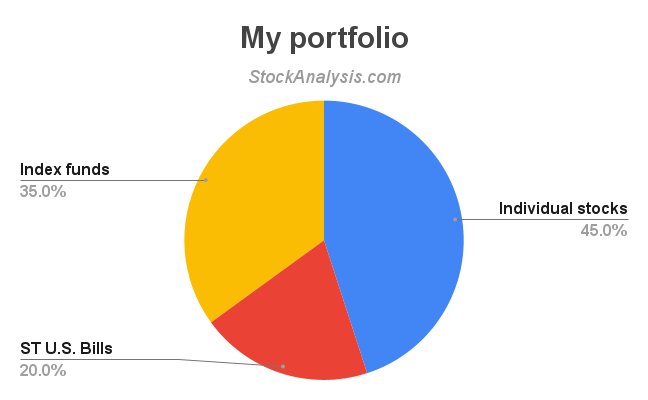

The Barbell Strategy is how we at Stock Analysis invest our money.

We like to invest in individual stocks, which gives us the opportunity to outperform the market, but we also believe Warren Buffett is right about investing passively in index funds.

So, we combined the two into the barbell strategy. My portfolio looks like this:

The bulk of my money is in index funds (primarily VOO and VT) and short-term U.S. Treasury bills (SGOV). The rest is in individual stocks.

Microsoft (MSFT), Netflix (NFLX), Alphabet/Google (GOOGL), Markel (MKL), and Shopify (SHOP) are my largest individual positions.

Potential drawbacks

Although it can generate higher returns, owning individual stocks can result in a more volatile portfolio than passive investing.

The takeaway

Diversification is a relatively simple concept that’s fairly easy to achieve.

Three expert investors — Warren Buffett, Ray Dalio, and Harry Browne — reinforced that message by recommending easily implementable, diversified portfolios that only require 2–5 ETFs each.

You can diversify further by adding additional asset classes to your portfolio, such as alternatives, or by being more specific about the sub-asset classes you invest in.

https://investmates.io/blogs/portfolio-analysis-strategic-management/https://stockanalysis.com/article/diversified-portfolio-example/