How does quickbooks record non cash investing and financing activities

What business activities are considered non-cash activities? In order to prepare a cash flow statement, we need to understand which items on our income statement and balance sheet may not involve the transfer of cash, thus will not have a place on our statement of cash flows.

These non-cash activities may include depreciation and amortization, as well as obsolescence. Property, plant and equipment resides on the balance sheet. These items are taken on the income statement in small increments called depreciation or amortization.

If we purchase a new dump truck, we don’t take the entire purchase price as an expense when we purchase it. We put it as an asset on our balance sheet, and then take depreciation expense over the life of the dump truck.

These non-cash items need to be properly recorded on the income statement, but disregarded for the cash flow statement.

Learn More

Visit Accounting for Management’s website for some additional information about non-cash investing and financing activities to keep in mind as we work through the cash flow statement process.

Cash and cash equivalents are those items on the balance sheet that are liquid assets. Cash can be spent, so it is the most liquid of the assets.

Cash equivalents might include money market accounts, treasury bills or commercial paper. It is essentially a place to sit money, to make a return on it. Cash sitting in a checking account may get no interest, but a money market account will earn interest while it sits. In this way, a company can put its idle cash to work.

These cash equivalents are pretty easy to move to a checking account if the cash becomes needed, but getting interest rather than just letting it sit there is a smart step!

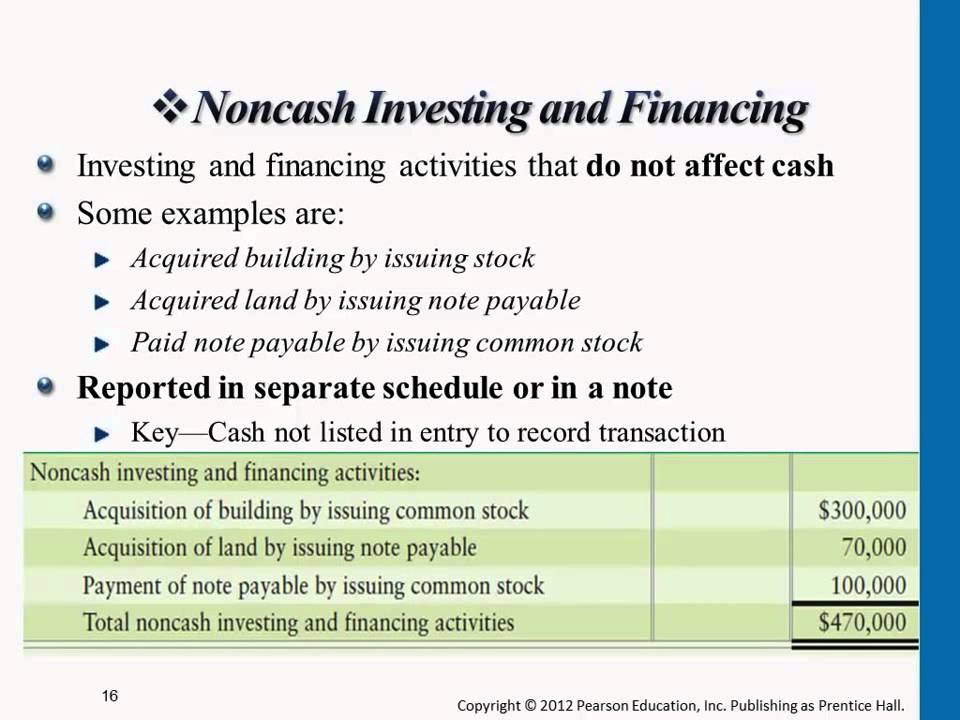

Noncash Investing and Financing Activities

Investing and financing activities that do not involve cash are not reported in the cash flow statement since there is no cash flow involved.

For example, capital items of property, plant and equipment are often acquired through non-cash investing and financing activities. An equipment is purchased (investing activity) which is financed by equipment-purchase financing (financing activity). This will increase the company’s productive capacity; however, it will not be reported as capital expenditure in the statement of cash flows.

These non-cash investing and financing activities are reported in a separate disclosure supplement to the statement of cash flows. Examples include stock issued to make an acquisition or items of property, plant and equipment acquired in transactions in which the seller provides debt financing. These transactions result in a transfer of assets, but no cash is involved.

Cash Flow Statement

Next Lesson

Cash Flow Statements: US GAAP Vs. IFRS

Data Science for Finance Bundle

Learn the fundamentals of R and Python and their application in finance with this bundle of 9 books.

https://courses.lumenlearning.com/wm-accountingformanagers/chapter/non-cash-activities/https://financetrain.com/noncash-investing-and-financing-activities