Chapter 5 — Noncash Investing and Financing Activities

Copying or printing Roadmaps is currently disabled. If you are a DART subscriber, please log in to enable these features. Deloitte clients who are not DART subscribers may request printed copies of Roadmaps from their engagement teams.

Show contents

Chapter 5 — Noncash Investing and Financing Activities

Converting debt to equity.

Acquiring long-lived assets through the assumption of directly related liabilities (e.g., purchasing a building by incurring a mortgage to the seller).

Obtaining an asset through a finance lease (under ASC 842) and sale-leaseback transactions, when less than the full amount of the consideration is paid/received as of the closing date. (See Sections 7.6.1.1 and 7.6.3 for further discussion of seller financing and lease transactions.)

Receiving a building or other asset as a gift.

Exchanging noncash assets (e.g., inventory or accounts receivable) or liabilities for other noncash assets or liabilities.

A transferor’s beneficial interest obtained in a securitization of financial assets.

Example 5-1

Company A acquired 100 percent of the common stock of Company B in exchange for issuing 10,000 shares of A’s stock. Because the acquisition of B involved no cash consideration, the transaction should be disclosed as a noncash investing (acquisition of B) and noncash financing (issuance of A’s stock) transaction. Disclosure may consist of a narrative or be summarized in a schedule.

In addition, A would generally classify B’s acquired cash and cash equivalents, if any, as an investing activity in the statement of cash flows. In certain circumstances, however, the predominant source of cash acquired in a business combination may be more appropriately characterized as financing (e.g., if B had recently issued debt and the acquired cash balance largely comprised the proceeds from that borrowing). See Section 6.4 for a discussion of transactions with more than one class of cash flow.

To the extent that a transaction includes both cash and noncash components, an entity should disclose the noncash component of the transaction and present the cash component in the statement of cash flows.

As discussed above, acquisitions paid for by stock that are accounted for as business combinations under ASC 805 are considered noncash investing and financing activities and should be disclosed in a narrative or summarized in a schedule in the financial statements. Correspondingly, acquisitions paid for in part by cash and in part by stock are split between the cash and noncash aspects of the transaction. Only the cash portion is reported as an investing activity in the statement of cash flows. The stock portion is disclosed in a manner consistent with that discussed above. The amount of cash paid, net of the acquiree’s cash and cash equivalents, is presented as an investing cash outflow. Consider the following examples:

Example 5-2

Noncash investing and financing activity of $1 million.

Investing cash outflow of $100,000 for cash paid in acquisition, net of cash acquired.

Example 5-3

Company A divests one of its subsidiaries (Subsidiary B) to Company C in exchange for all shares that C owns in A. The fair value of C’s shares owned in A is $300 million, and B’s fair value is $150 million. Because the fair value of the treasury stock reacquired is greater than the fair value of the disposed-of business, A infuses an additional $150 million in cash into B before ownership of B is transferred to C. When combined with $10 million in cash already held by B, the total amount of cash transferred as part of B’s divestiture is $160 million. The $10 million of cash held by B before the $150 million cash infusion represents a normal level of (or regular) working capital cash used in B’s operations. Therefore, the substance of this transaction essentially consists of (1) an exchange of A’s shares held by C for the $150 million in cash (i.e., the amount of the cash infusion) and (2) the divestiture of B in exchange for the remaining shares of A’s stock held by C.

The $150 million in cash that is infused into B is considered a share repurchase of A’s stock from C and thus should be classified as a financing activity.

The $10 million in regular working capital cash held by B before the cash infusion and transferred to C in the divestiture should be classified as an investing activity.

The remainder — namely the noncash net assets of B transferred to C in exchange for the remaining number of A’s shares owned and held by C — should be treated as a noncash investing and financing activity and disclosed.

Confidential and Proprietary — for Use Solely by Authorized Personnel

This publication provides comprehensive guidance; however, it does not address all possible fact patterns, and the guidance is subject to change. Consult a Deloitte & Touche LLP professional regarding your specific issues and questions.

Your feedback will help us improve the FASB Accounting Standards Codification Manual. Please let us know what you think. Copyright © 2025 Deloitte Development LLC. All rights reserved.

FASB Accounting Standards Codification: Copyright © 2005 – 2025 by Financial Accounting Foundation, Norwalk, Connecticut.

Non-cash investing and financing activities

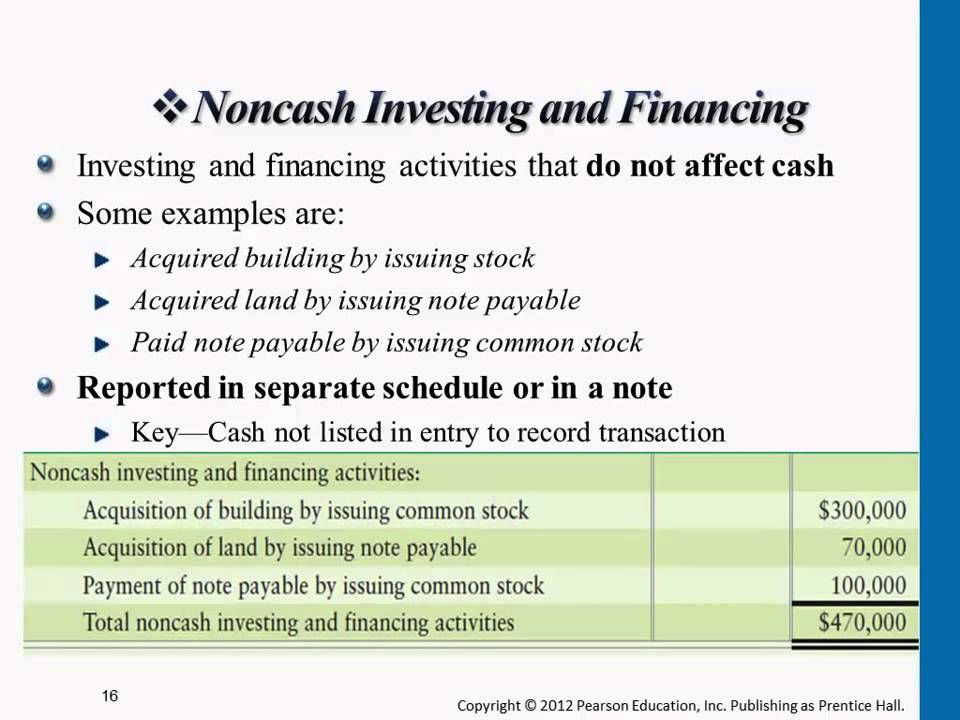

The statement of cash flows reports only those operating, investing, and financing activities that affect cash and cash equivalents. However, some non-cash investing and financing activities may be very important for the users of financial statements because they may have a significant impact on the entity’s current and future performance in terms of revenues, profits, and the ability to generate positive cash flows. Therefore, both IFRS and US GAAP require companies to disclose all significant non-cash investing and financing activities either at the bottom of the statement of cash flows as a footnote or in the notes to the financial statements.

Examples:

Some examples of non-cash investing and financing activities that may become significant for the users of financial statements are given below:

- Issuance of stock to retire a debt

- Purchase of an asset by issuing stock, bonds or a note payable.

- Exchange of non-cash assets.

- Conversion of debt to common stock.

- Conversion of preferred stock to common stock.

- Payment for services availed by issuing stock in lieu of cash

Disclosure of non-cash investing and financing activities

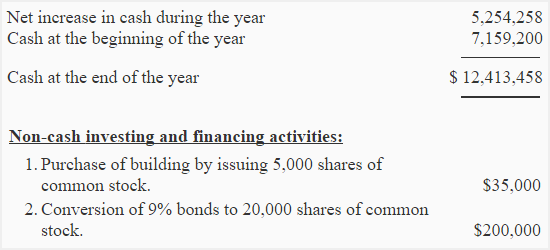

The general approach is to disclose a schedule of non-cash investing and financing activities at the bottom of the statement of cash flows. They can, however, also be included as a separate schedule or in the notes to the financial statements. Both approaches are in practice, and both are in accordance with IFRS and US-GAAP. The acceptable disclosure of these activities is illustrated below:

(1). Disclosure as foot note at the bottom of the statement of cash flows:

The following presentation shows a schedule of significant non-cash investing and financing activities at the bottom of the statement of cash flows:

(2). Disclosure in a separate note:

The following is an example of the disclosure of significant non-cash investing and financing activities as a separate note to the financial statements:

https://dart.deloitte.com/USDART/home/codification/presentation/asc230-10/roadmap-statement-cash-flow/chapter-5-noncash-investing-financing-activities/chapter-5-noncash-investing-financing-activitieshttps://www.accountingformanagement.org/non-cash-investing-and-financing-activities/