Investment Holding Companies

An investment holding company can claim deduction of expenses that are incurred to produce the investment income. The expenses may be incurred directly, indirectly, or in accordance with statutory and regulatory provisions.

On this page:

What is an Investment Holding Company

An investment holding company refers to a company that owns investments such as properties and shares for long term investment and derives investment income (‘non-trade income’) such as dividend, interest or rental income. The company’s principal activity is that of investment holding.

An investment holding company is different from an investment dealing company. An investment dealing company refers to a company that owns investments such as properties and shares as trading stock to derive trade income from the purchase and sale of these investments (e.g. gain on sale of real properties and shares). Unlike an investment holding company, the company’s principal activity is that of investment dealing.

All investment income of your investment holding company is assessed on a financial year basis. As a guide to work out the income that is chargeable to tax for your investment holding company, you may refer to the following templates:

- Basic Format of Tax Computation for an Investment Holding Company (PDF, 579KB)

- Basic Format of Tax Computation for an Investment Holding Company that Also Provides Routine Support Services to its Related Parties (PDF, 224KB)

Deductions Allowed

Expenses that are attributed to the investment income may be deductible. These may be incurred in the course of your company’s operations or in accordance with statutory and regulatory provisions.

Direct Expenses

These are expenses directly incurred to earn investment income and are deductible against the respective source of investment income.

Some examples are:

- Cost of collecting rent (for rental properties)

- Interest expenses (on loan taken to acquire investments such as shares and property)

- Insurance (for rental properties)

- MCST management fees (for rental properties)

- Property tax (for rental properties)

- Repair and maintenance (for rental properties)

Expenses incurred before the investment starts to produce income are not deductible. For example, interest incurred on a loan taken to acquire shares or properties that have not commenced to produce any dividend or rental income is not deductible.

Statutory and Regulatory Expenses

These are expenses incurred in accordance with statutory and regulatory provisions, such as the Companies Act.

Some examples are:

- Accounting fees

- Annual listing fees

- Audit fees

- Bank charges

- Income tax service fees

- Printing and stationery

- Secretarial fees

Other Allowable Expenses

Other than statutory and regulatory expenses and direct expenses, in some cases, your investment holding company may incur the following expenses:

- Administrative and management fees

- Directors’ fees

- General expenses

- Office rental

- Office telephone charges

- Office utility charges

- Staff salaries, allowances, bonus and approved provident fund contributions

- Transport expenses (excluding motor vehicle expenses on S-plated cars which are not deductible)

As your investment holding company is not carrying on a trade and derives only non-trade income, only a reasonable amount of such other expenses is allowable. As a guide, the total amount of such expenses allowable should not exceed 5% of your company’s gross investment income.

Deductions/ Claims Not Allowed

Capital Expenses and Expenses on Non-Income Producing Investments

Expenses that are capital in nature and expenses attributable to investments that do not produce any income are not deductible.

Some examples are:

- Cost of new assets for the investment property such as refrigerator, air-conditioner, washing machine, furniture and fittings

The cost to acquire the initial new assets is capital in nature and not deductible. The subsequent cost of replacing the assets is deductible for properties already yielding investment income, as the expense is for an income-producing investment. - Stamp duty and legal fees incurred for the purchase of investments

Stamp duty and legal fees incurred for the purchase of investments are capital in nature and therefore not deductible. - Interest expense incurred to acquire shares that have not yielded dividends

When shares have not yielded any dividends, they are non-income producing investments. Any expense incurred before the investment produces income is not deductible.

Excess Expenses from 1 Source of Investment

Expenses are deductible against their source of income. For instance, property tax expenses incurred on an investment property is deductible against the rental income generated by the same property.

When the expenses exceed the income generated by the investment, the excess expenses from this source of investment are not deductible against income from another source of investment. For example, any excess of expenses over rental income cannot be deducted against dividend or interest income.

As a concession, the deficit arising from a block of shares may be set-off against the net dividend income from other blocks of shares within the same group. Learn more about the concessionary ‘group’ tax treatment for dividend income.

Capital Allowance Claims

Your investment holding company is not entitled to claim capital allowances as it is not carrying on a trade or business. Only fixed assets purchased to replace existing fixed assets can be claimed as deductible expenses.

Unutilised Losses

Your investment holding company cannot carry forward any unutilised losses to set-off the income of future Years of Assessment (YAs).

Group Relief Claims

Your investment holding company cannot transfer (to other companies in the same group) current year unutilised losses arising from the excess of expenses over investment income under the Group Relief system.

However, your company may transfer current year unutilised Industrial Building Allowance, Land Intensification Allowance and donations to other companies in the same group under Group Relief system.

Tax Exemption for New Start-Up Companies

Your investment holding company is not eligible to claim the tax exemption for new start-up companies.

However, your company is still eligible for the partial tax exemption. Learn more about the partial tax exemption scheme.

FAQs

Does my investment holding company need to file Estimated Chargeable income (ECI)?

Your investment holding company is required to file ECI within 3 months from its financial year end.

However, your company can qualify for the ECI filing waiver if both criteria are met:

- Annual revenue is $5 million or below for the financial year; and

- ECI is nil for the YA.

Learn whether your company needs to file ECI.

Is income distribution from Real Estate Investment Trusts (REITs) taxable for my investment holding company?

The nature, tax treatment and applicable period/ YA of each REIT distribution are reflected in the Annual Distribution Statement issued by the Central Depository Pte Ltd (CDP).

A REIT distribution is taxable in the relevant YA as reflected in the CDP statement, unless stated otherwise (e.g. distribution is tax-exempt or distribution is a return of capital). Where the distribution is taxable, your company is required to report the gross income indicated in the CDP statement, as taxable income in the Corporate Income Tax Return for the relevant YA.

Learn more about the income tax treatment of REITs (PDF, 603KB) (refer to the section on Tax Treatment of the Unit Holder).

Are expenses incurred to secure the first tenant for a new property deductible for my investment holding company?

Expenses incurred in securing leases of immovable properties are capital in nature and hence, not deductible.

Prior to YA 2022

For the first property acquired by your investment holding company, all expenses incurred to secure the first tenant for the property cannot be deducted against the rental income of that property.

As a concession, if your investment holding company acquires another property, the commission, advertising, legal fees and stamp duty incurred to secure the first tenant for the additional property can be deducted against the rental income of that property.

With effect from YA 2022

Section 14ZE of the Income Tax Act 1947 provides that a deduction may be given for certain expenses incurred to grant, renew or extend a lease 1 of an immovable property that is deriving rental income taxable under Section 10(1)(f).

Hence, for the first and any additional property acquired by your investment holding company, the commission, advertising, legal fees and stamp duty incurred to secure the first tenant for the property can now be deducted against the rental income of that property, subject to Section 14ZE.

1 Section 14ZE does not apply to the following specified leases:

- Any lease, or any renewal or extension of a lease for a term that (excluding any option for the renewal or extension of the lease) exceeds 3 years;

- Any acquisition, grant, novation, transfer or assignment of a lease because of any acquisition, sale, transfer or restructuring of any business; or

- A lease under an arrangement where the immovable property is sold by and leased back to the seller of the immovable property.

Portfolio Company

Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

What is a Portfolio Company?

A portfolio company is a company (public or private) that a venture capital firm, buyout firm, or holding company owns equity. In other words, companies that private equity firms hold an interest in are considered portfolio companies. Investing in a portfolio company aims to increase its value and earn a return on investment through a sale.

Summary

- Companies that private equity firms hold an interest in are considered portfolio companies.

- A financial sponsor and investors are required to create a private equity fund that invests in companies.

- Common approaches to investing in a portfolio company include leveraged buyout, venture capital, and growth capital.

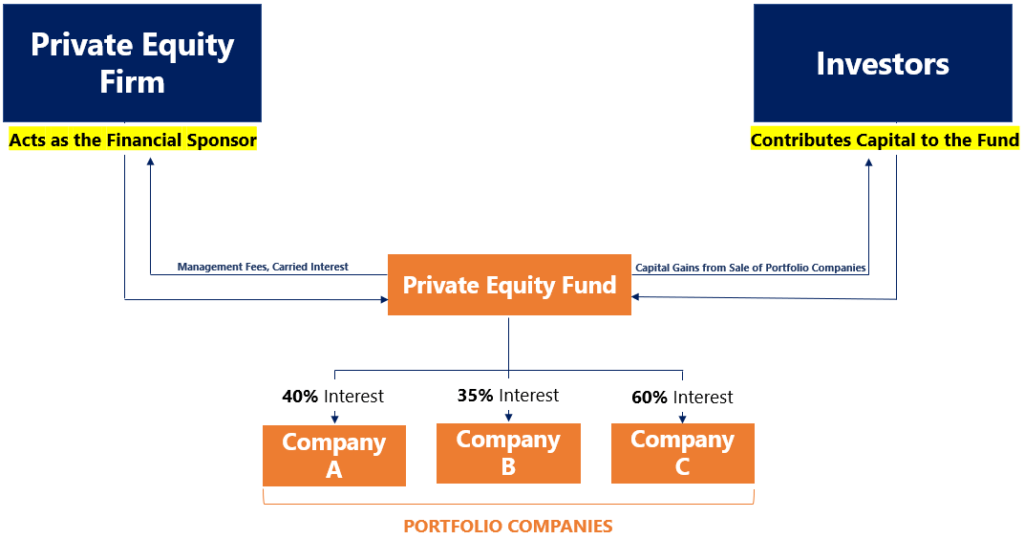

The Private Equity Structure

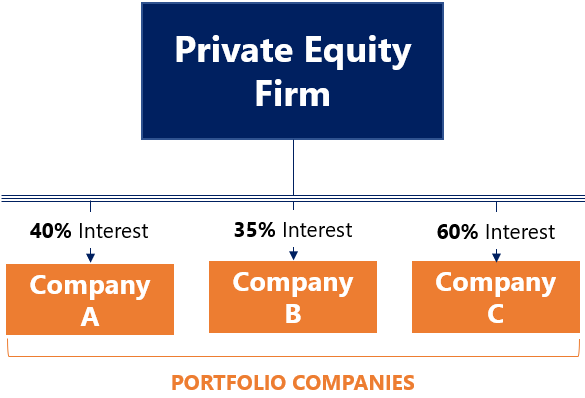

The private equity structure can be summarized in the simple graphic below:

Creating a private equity fund, which invests in companies, requires two different parties: (1) a financial sponsor, and (2) investors.

1. Financial Sponsor

The financial sponsor is generally called the general partner. The financial sponsor manages the private equity fund and receives management fees and carried interest as compensation. Management fees are fees tied to the capital raised, while carried interest is a share of the fund’s profits.

2. Investors

The investors provide the capital required for the fund to invest in companies. Investors include high net worth individuals, family offices, endowments, insurance companies, pension funds, foundations, funds-of-funds, sovereign wealth funds, etc. Investors generate a return from their investment through the private equity fund selling portfolio companies at a higher price than the initial investment cost.

Approaches to Investing in Portfolio Companies

There are numerous methods of investing in a portfolio company. Below, we outline three common methods.

1. Leveraged Buyout (LBO)

A leveraged buyout (LBO) is extremely common in private equity transactions. An LBO involves using primarily debt (hence “leveraged” buyout) and a small equity injection to finance the company’s buyout. The debt is typically raised through using the portfolio company’s assets as security.

2. Venture Capital

Venture capital refers to the provision of capital by private equity funds to start-up companies that require early-stage funding in exchange for an equity stake.

3. Growth Capital

Growth capital refers to providing capital to established businesses to help expand business operations. The capital can be used to help a business develop a new product, restructure operations, finance an acquisition, or expand into new markets.

Common Types of Exits for Portfolio Companies

Investors in private equity funds generate a return through portfolio companies’ exit in the private equity fund. Private equity firms typically acquire companies for a specific period (usually five to seven years), with the end goal of exiting the investment through a sale above the initial investment price. Common exit strategies include the following:

1. Initial Public Offering (IPO)

An initial public offering of a portfolio company generally provides one of the highest valuations, compared to other exits, provided that public market conditions are stable and that there is strong demand. A key disadvantage with an IPO exit is the high transaction costs and potential restrictions placed on existing investors, such as a lock-up period requirement.

2. Strategic Sale

A strategic sale, also called a trade sale, is the sale of a portfolio company to a strategic buyer that can realize material synergies or achieve a strategic fit through the acquisition. Strategic buyers often pay a premium for the portfolio company due to the preceding sentence’s reasons.

3. Secondary Buyout

A secondary buyout is the sale of a portfolio company to another private equity firm. There may be many reasons to engage in a secondary buyout, such as the desire to get rid of the portfolio company or the portfolio company’s management wanting to find another private equity firm to operate with.

Examples

Prominent private equity firms in Canada include ONEX Partners and Novacap Investments, to name a few. The portfolio companies of ONEX Partners and Novacap Investments can be found here and here, respectively.

Additional Resources

Thank you for reading CFI’s guide to Portfolio Company. To keep learning and advancing your career, the following resources will be helpful:

- Management Buyout (MBO)

- Exit Strategies

- IPO Process

- Venture Capital

- See all management & strategy resources

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

- Careers

- CFI’s Most Popular Courses

- All CFI Resources

- Finance Terms

The Financial Modeling Certification

Analyst Certification FMVA® Program

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

- Careers

- CFI’s Most Popular Courses

- All CFI Resources

- Finance Terms

The Financial Modeling Certification

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

https://www.iras.gov.sg/taxes/corporate-income-tax/specific-industries/investment-holding-companieshttps://corporatefinanceinstitute.com/resources/management/portfolio-company/