How one tweet wreaked havoc on the stock market

Amid a morning of pandemonium on Wall Street, a popular news aggregator on X, known as Walter Bloomberg, posted a false report declaring that President Trump was considering a 90-day pause on his controversial tariff proposal.

This news was not true, and yet, index funds like the Dow Jones whipsawed — rapidly rising, before reversing course minutes later. This type of volatility is more meaningful than a stock’s typical rise and fall throughout any given day, which is why the false report garnered so much attention.

Though the Walter Bloomberg account is not affiliated with any news organization and has no connection to Bloomberg News, the account has long been considered a reliable source of tech and business news. Rather than writing its own posts, Walter Bloomberg publicly posts news headlines as they hit the Bloomberg Terminal.

The Bloomberg Terminal is an expensive subscription-only service that financial professionals use for real-time market data, which includes breaking news headlines. Sometimes, the headlines from outlets like CNBC and Bloomberg hit the Terminal before the stories are published online, making accounts like Walter Bloomberg a useful follow for quick news.

On Monday, a series of reporting errors from CNBC and Reuters, which were then amplified by the Walter Bloomberg account on X, appears to have directly affected the stock market during an already chaotic day.

The headline posted by Walter Bloomberg, which was deleted since it is not true, said: “HASSETT: TRUMP IS CONSIDERING A 90-DAY PAUSE IN TARIFFS FOR ALL COUNTRIES EXCEPT CHINA.”

The White House’s rapid response team quote-tweeted the now-deleted Walter Bloomberg post and denied that Kevin Hassett, Trump’s director of the National Economic Council, made these statements.

How Donald Trump’s tweets influenced financial markets

Newly-elected and former US President Donald Trump’s tweets had significant power to move markets during his first presidency. Research shows specific topics could trigger market volatility and create trading opportunities.

Source: Adobe images

Chief Market Analyst

Article publication date: 2024-11-07T14:11:03+0000

The power of presidential tweets on market movement

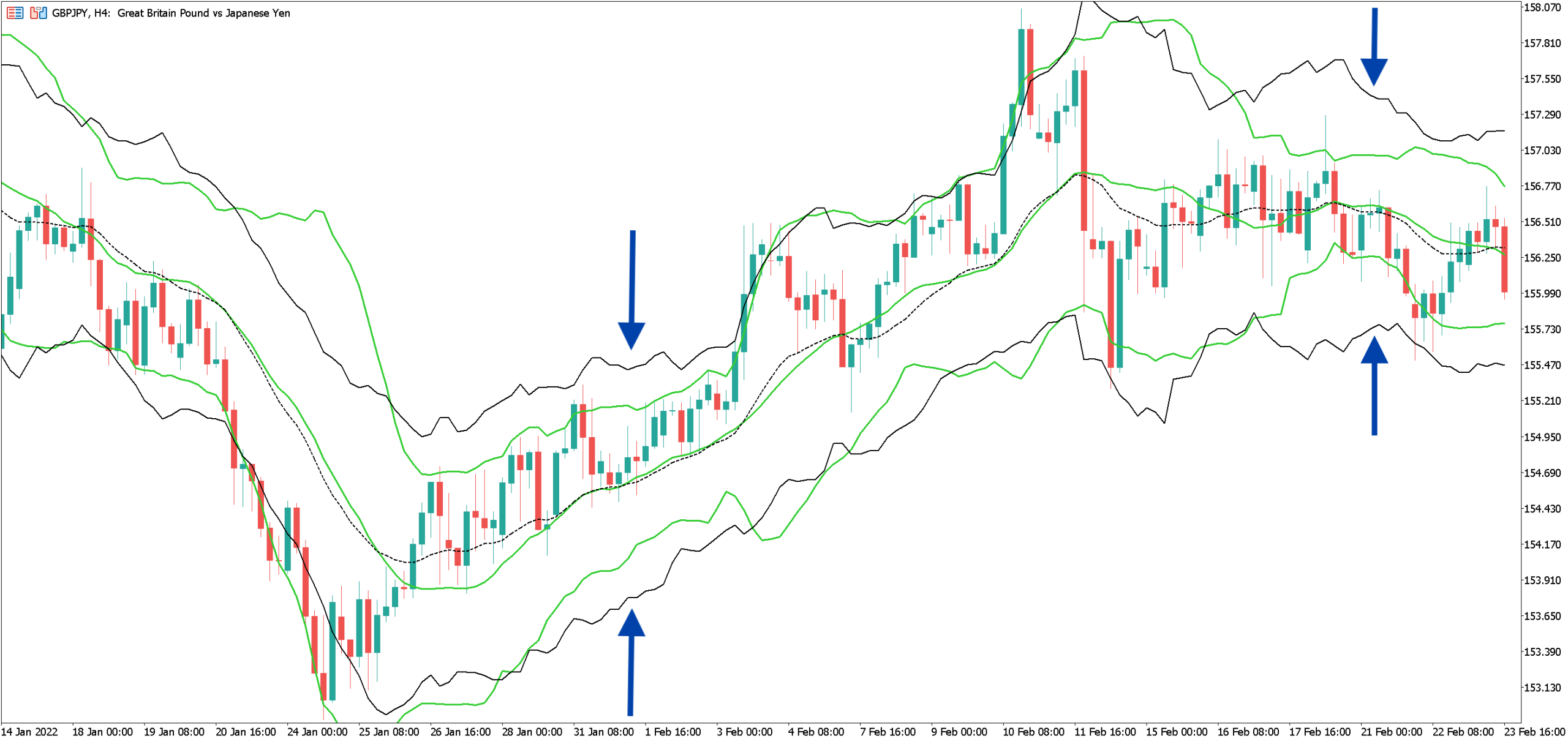

Trump’s social media posts demonstrated unprecedented influence over financial markets during his presidency, with research analysing over 8,000 tweets showing measurable impacts on major indices like the S&P 500.

The immediate effect of Trump’s market-moving tweets typically lasted around 30 minutes, creating short-term opportunities for active traders to capitalise on the volatility. Analysis shows these posts could trigger significant price swings across multiple asset classes.

Social media’s growing influence on markets has transformed how traders approach their strategies, with many now incorporating digital sentiment analysis into their decision-making process. This represents a fundamental shift in how information flows through financial markets.

Presidential communications have always moved markets, but Trump’s direct-to-market style via Twitter (X) created a new paradigm for traders to navigate. The immediacy and unpredictability of these messages posed both risks and opportunities.

Trade war tweets and their market impact

Tweets containing keywords like “tariff” or “trade war” had particularly strong effects on market sentiment, often leading to immediate declines in the S&P 500 and increased trading volumes.

The research shows that trade-related tweets frequently triggered moves in forex markets, especially for USD/CNH and other Asian currency pairs. These currency fluctuations reflected broader market concerns about global trade tensions.

During periods of heightened US-China trade tensions, Trump’s tweets could spark volatility in commodities markets, particularly affecting gold prices as investors sought safe-haven assets.

The impact often extended beyond US markets, with significant effects seen in Asian indices like the Hang Seng, demonstrating the global ripple effects of presidential social media communications.

Trading strategies based on presidential tweets

Research indicates that implementing a strategic approach to Trump’s tweets could have outperformed traditional buy-and-hold strategies. The key was quick reaction times and understanding which topics were most likely to move markets.

A basic strategy of selling the S&P 500 for 75 minutes following trade war-related tweets before buying back in showed promising results. However, successful execution required robust risk management.

Traders using this approach needed to maintain strict discipline with their stop losses and position sizing, as market reactions could be unpredictable and volatile.

The strategy’s success highlighted how social media monitoring could be integrated into modern trading approaches, though it required careful consideration of risk-reward ratios.

Market volatility and volume analysis

The Volatility Index (VIX), often called the fear gauge, showed consistent spikes following certain categories of presidential tweets. This created opportunities for traders using volatility trading strategies.

Trading volumes typically increased significantly in the 30 minutes following market-moving tweets, indicating heightened activity across both retail and institutional traders. This surge in volume often preceded major price moves.

Analysis showed that market reactions became more measured over time as traders adapted to the communication style. However, certain topics maintained their ability to trigger significant market responses throughout the presidency.

Volume analysis proved crucial for traders trying to validate the significance of market moves following presidential tweets, helping distinguish between minor fluctuations and more substantial trends.

Lessons for modern traders

Today’s traders must recognise social media’s growing influence on market movements, whether from political figures or other influential sources. This requires developing new skills in digital sentiment analysis.

Successful trading strategies now often incorporate real-time news monitoring and quick reaction capabilities, though this should always be balanced with thorough technical and fundamental analysis.

Risk management becomes even more critical in an era of social media-driven market moves. Traders need to consider using demo accounts to test strategies before trading real money.

Understanding how different asset classes react to various types of news can help traders build more robust portfolios and trading strategies for the modern market environment.

Now that Trump is set to become president once again, traders need to make sure they are prepared for the return of such volatility.

How to trade market-moving news

1. Research and understand the relationship between news events and market movements

2. Choose whether you want to trade or invest

4. Set up news alerts and monitoring systems

5. Place your trade with appropriate risk management

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Becca Cattlin, Publication date : 2019-01-17T17:36:00+0000

Axel Rudolph FSTA, Publication date : 2022-10-15T12:12:51+0100

Axel Rudolph FSTA, Publication date : 2022-09-08T12:57:59+0100

Joshua Warner, Publication date : 2022-08-26T16:41:11+0100

Jeremy Naylor, Publication date : 2022-07-11T08:39:37+0100

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

You might be interested in…

How much does trading cost?

Find out about IG

Plan your trading

Find out what charges your trades could incur with our transparent fee structure.

Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs.

Stay on top of upcoming market-moving events with our customisable economic calendar.

Markets

IG services

Trading platforms

Learn to trade

Help and support

Follow us online:

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Professional clients trading spread bets and CFDs can lose more than they deposit.

Options and futures are complex instruments which come with a high risk of losing money rapidly due to leverage. They’re not suitable for most investors. Before you invest, you should consider whether you understand how options and futures work, the risks of trading these instruments and whether you can afford to lose more than your original investment.

Trading stocks and shares ‘on margin’ within a US options and futures account – meaning that you only finance part of the cost of acquiring a position in a security – carries additional risks over buying securities on a fully funded basis and may result in losses exceeding your original investment. Trading on margin will also result in additional costs to you as the investor and any securities purchased using margin may be held as collateral by the lender, restricting both your rights as shareholder, and your ability to use the securities until the margin trade is closed. You should familiarise yourself with these risks before trading on margin.

The value of shares, ETFs and other ETPs bought through a share dealing account, a US options and futures account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results. Some ETPs carry additional risks depending on how they’re structured, investors should ensure they familiarise themselves with the differences before investing.

Share dealing and IG Smart Portfolio accounts provided by IG Trading and Investments Ltd, CFD accounts and US options and futures accounts are provided by IG Markets Ltd, spread betting provided by IG Index Ltd.

IG is a trading name of IG Trading and Investments Ltd (a company registered in England and Wales under number 11628764), IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. IG Markets Ltd (Register number 195355), IG Trading and Investments Ltd (Register Number 944492) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site isn’t directed at residents of the United States, Belgium or any particular country outside the UK and isn’t intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

https://techcrunch.com/2025/04/07/how-one-tweet-wreaked-havoc-on-the-stock-market/https://www.ig.com/uk/news-and-trade-ideas/how-donald-trump-s-tweets-influenced-financial-markets-241107