How does quickbooks record non cash investing and financing activities

Accounting Dictionary – Letter N

are significant investing and financing activities that do not directly affect cash. These activities involve only long-term assets, long-term liabilities, and stockholders’ equity, and they appear at the bottom of the statement of cash flows. Examples of noncash investing and financing activities include issuance of common stock to retire long-term debt, purchase of equipment with a note payable, and issuance of stock to acquire land.

Don’t see the term you are looking for? Try searching our entire website:

Non-Cash Activities and other Required Disclosures

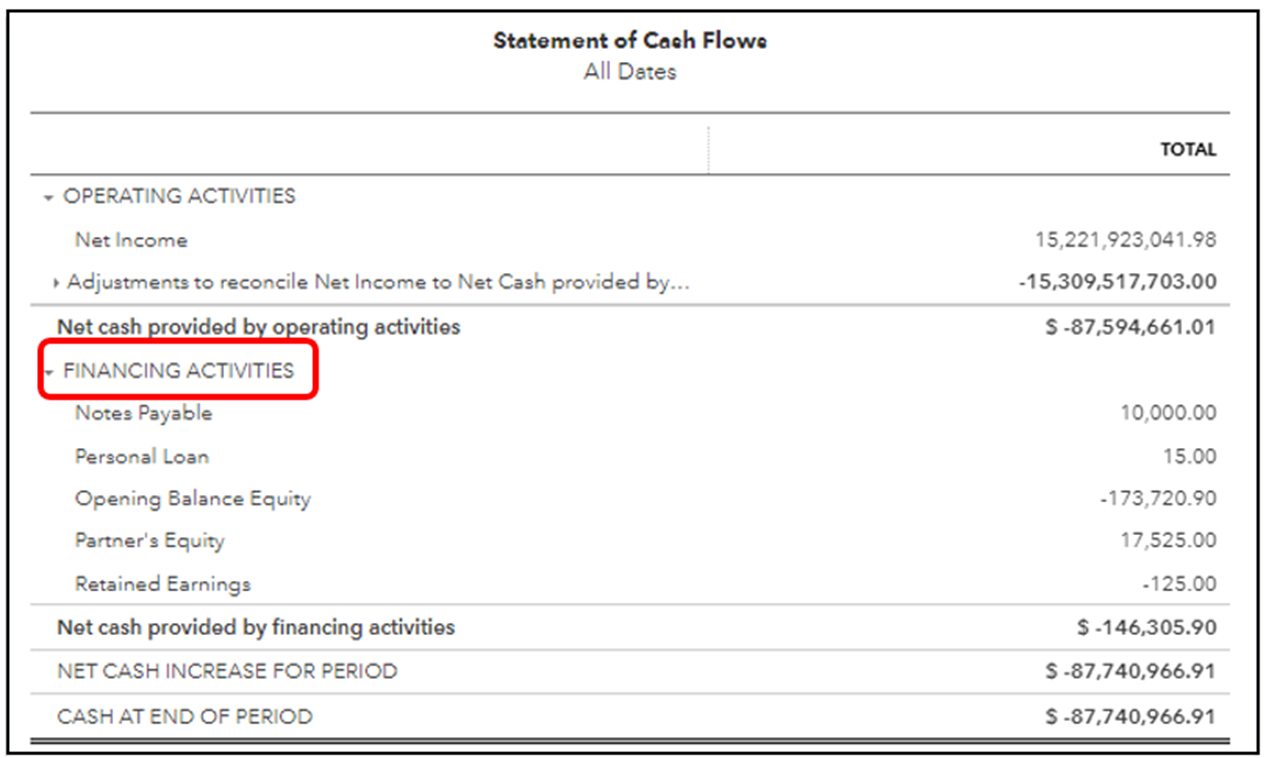

What happens if we purchase a building by signing a mortgage with no cash down payment? Or if we convert bonds payable to common stock, how would we account for these transactions? These transactions do not involve cash but they are significant enough for investors to need to know. We will report them in a separate section at the bottom of the statement of cash flows. For example, assume a company did purchase a $100,000 building by paying $20,000 down in cash and signed a note for the balance of $80,000. This would be reported as follows (note: the $20,000 down payment would be including in the investing section of the statement of cash flows):

| Noncash investing and financing activities: | |

| Purchased building for $100,000 by signing a note and a downpayment of $20,000 | $80,000 |

In addition to disclosing transactions that do not otherwise appear on the statement of cash flows (non-cash transactions), companies using the direct approach must supplement the cash flow statement with a reconciliation of income to cash from operations. This reconciliation may be found in notes accompanying the financial statements. For our Rumble Corp. example it would look like this:

| Reconciliation of net income to net cash provided by operating activities: | |

| Net income | $ 2,610 |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| Depreciation and amortization | 125 |

| Decrease in Accounts Receivable | 15 |

| Gain on sale of equipment | (90) |

| Increase in Accounts Payable | 32 |

| Increase in income taxes payable | 80 |

| Increase in other liabilities | 18 |

| Total adjustments | 180 |

| Net cash provided by operating activities | $ 2,790 |

As you can see, it’s basically just the top portion of the statement prepared using the indirect method.

Companies using the indirect method have to disclose cash paid for interest and income taxes, since those numbers are not apparent on the face of the statement as they were under the direct method.

https://simplestudies.com/accounting-dictionary/letter/N/noncash_investing_and_financing_activities.htmlhttps://content.one.lumenlearning.com/financialaccounting/chapter/non-cash-activities-and-other-required-disclosures/