How Credit Bureaus Collect Data: An In-Depth Explanation

Credit bureaus play a vital role in the modern financial ecosystem by collecting and analyzing data to assess creditworthiness. Understanding how credit bureaus collect data is essential for both consumers and financial institutions to navigate responsible lending practices effectively.

By examining the sources, methods, and regulatory frameworks that underpin data collection, this article provides a comprehensive overview of the intricate processes that ensure the accuracy and reliability of credit reports.

Table of Contents

The Role of Credit Information Bureaus in Data Collection

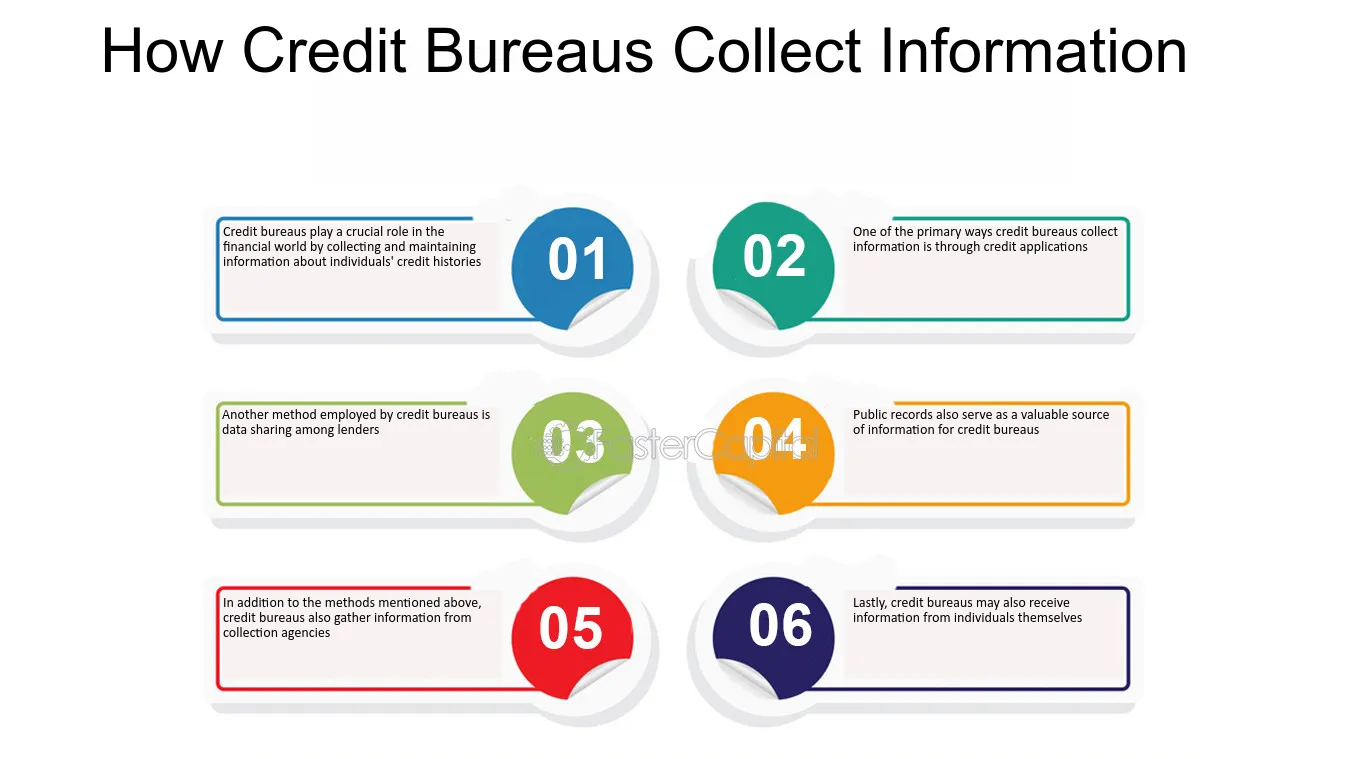

Credit information bureaus serve a vital function in the financial ecosystem by systematically collecting, maintaining, and distributing consumers’ credit data. Their primary role is to gather comprehensive information that lenders and financial institutions use to assess creditworthiness. This data collection process helps facilitate responsible lending and better financial decision-making.

These bureaus compile data from various sources, ensuring a complete profile of an individual’s credit history. Accurate data collection enables credit bureaus to provide reliable credit reports, which are integral to credit scoring models and risk assessments. Their effective role hinges on the accuracy and timeliness of the data they gather.

Furthermore, credit bureaus uphold strict standards to ensure data integrity and compliance with regulatory requirements. They continuously refine data collection practices to adapt to new data sources and technological advances, supporting transparency and fairness in credit reporting. This proactive approach fortifies the reliability of credit assessment processes.

Sources of Data for Credit Bureaus

Credit bureaus collect data from a diverse range of sources to compile comprehensive credit reports. Financial institutions and lenders are primary contributors, providing information about borrowers’ credit accounts, repayment history, and outstanding balances. These details are essential for assessing creditworthiness. Public records and legal proceedings also serve as significant data sources; they include bankruptcy filings, court judgments, and tax liens, which reflect a person’s financial reliability and legal obligations. Utility and telecommunication companies contribute data related to service accounts, payment history, and account status, offering additional insights into consumers’ payment behavior beyond traditional lenders.

In recent years, alternative data providers have gained importance, supplying information such as rental payments, insurance records, and even mobile phone usage. These sources help to build more inclusive credit profiles, especially for consumers with limited traditional credit history. By aggregating data from these varied sources, credit bureaus aim to create accurate and holistic credit reports that support lending decisions and consumer financial management.

Financial Institutions and Lenders

Financial institutions and lenders are primary sources for how credit bureaus collect data. They regularly report borrower information, including loan applications, credit lines, and repayment histories. This data contributes to a comprehensive credit profile for each individual.

Lenders provide critical data through automated reporting systems that ensure timely updates. These include banks, credit unions, mortgage companies, and card issuers, all of which furnish periodic reports detailing credit activity and payment status. Such consistent reporting helps credit bureaus maintain accurate data.

Key information collected from these institutions includes loan origination details, payment history, credit limits, and account balances. The accuracy of this data directly impacts credit scores, making reliable reporting essential. Lenders are also required to update or correct erroneous information promptly.

To facilitate efficient data collection, credit bureaus often use standardized reporting formats and secure technological infrastructure. Clear regulations govern how lenders supply data, emphasizing accuracy, confidentiality, and timely reporting. Ensuring data integrity from financial institutions and lenders supports fair and transparent credit assessments.

Public Records and Legal Proceedings

Public records and legal proceedings are important sources that credit bureaus utilize to collect data for credit reports. These records include court judgments, bankruptcies, liens, and civil suits. Such information provides a comprehensive view of an individual’s legal and financial standing.

See also Understanding the Credit Reporting Process Explained for Financial Institutions

Credit bureaus access these records through official government databases and court systems, which regularly update legal proceedings. This data helps lenders assess the risk associated with lending to potential borrowers based on their legal and financial history. Accurate reporting of legal actions ensures the reliability of credit information.

Legal and public records are submitted to credit bureaus under strict regulatory guidelines. They are verified for authenticity and accuracy before inclusion in credit reports. This process helps prevent errors and ensures consumers’ rights are protected under data privacy laws.

In summary, public records and legal proceedings significantly influence the quality of data collected by credit bureaus. They serve as vital indicators of an individual’s financial reliability, helping to ensure more informed credit decisions.

Utility and Telecommunication Companies

Utility and telecommunication companies are significant sources of data for credit bureaus in credit information collection. These companies provide reports on consumers’ payment histories related to essential services such as electricity, water, gas, internet, and mobile phone bills. Stable payment histories in these areas can reflect financial responsibility.

Data collection from these sources generally occurs through direct data sharing agreements between the companies and credit bureaus. They transmit information on timely payments, delinquencies, and account statuses, which help paint a comprehensive picture of a consumer’s creditworthiness.

Key aspects of this process include:

- Regular updates to the credit bureau with consumer account information.

- Use of secure electronic data transfer systems ensuring data privacy.

- Standardized reporting formats to ensure consistency across different service providers.

These practices enhance the accuracy of credit reports, enabling lenders to make informed decisions while consumers benefit from their utility and telecommunication payment histories being factored into credit scoring.

Alternative Data Providers

Alternative data providers are non-traditional sources that supply supplementary information to credit bureaus, enhancing credit profiles beyond conventional financial data. These sources can include various entities that hold relevant consumer information.

Commonly, credit bureaus obtain data from sources such as e-commerce platforms, rental payment records, and insurance companies. These sources can provide insights into consumer behavior that traditional credit data may not capture.

Key examples of alternative data providers include:

- Rental payment services that document on-time rent payments.

- Utility and telecommunications companies that report payment history.

- Companies offering employment or income verification services.

By integrating data from these providers, credit bureaus are better positioned to assess the creditworthiness of consumers with limited credit history. This practice aligns with efforts to promote financial inclusion and foster a more comprehensive credit reporting system.

Methods Used in Collecting Credit Data

The collection of credit data involves multiple methods employed by credit bureaus to gather accurate and comprehensive information. They primarily rely on data reporting from financial institutions and lenders, which submit account details, payment histories, and credit limits regularly. This information forms the core of credit reports.

In addition to commercial sources, credit bureaus also utilize public records, such as court judgments, bankruptcies, and tax liens, to assess legal and financial standing. Utility and telecommunication companies also contribute data related to bill payments, which can influence credit scores.

Some bureaus incorporate data from alternative providers, including rent payment histories and other non-traditional information sources. These methods help extend credit access for individuals with limited traditional credit histories. Data collection is supported by advanced technology and secure infrastructure, ensuring the integrity and confidentiality of the information gathered.

Verification Processes in Data Collection

Verification processes in data collection are vital to ensure the accuracy and reliability of the information compiled by credit bureaus. These processes involve cross-checking data against multiple sources to confirm its validity. Consistent verification helps prevent inaccuracies that could harm consumers’ credit profiles.

Credit bureaus typically employ automated systems and manual reviews to verify data. Automated algorithms analyze inconsistencies or anomalies, prompting manual validation when needed. Human oversight further strengthens data accuracy by resolving discrepancies and confirming details with originating institutions.

Additionally, verification often involves contacting data providers directly to affirm records. This proactive approach minimizes errors stemming from outdated or incorrect information. Due to the sensitive nature of credit data, these verification processes are crucial for maintaining compliance with legal standards and consumer rights.

See also An In-Depth Guide to the Different Types of Credit Information Bureaus

Data Collection Infrastructure and Technology

The data collection infrastructure and technology utilized by credit bureaus are fundamental to ensuring efficient and accurate gathering of credit information. They rely heavily on secure database systems and cloud computing platforms to store vast amounts of data from diverse sources. These systems enable rapid data processing and real-time updates, vital for maintaining current credit reports.

Advanced data management tools, such as data warehouses and data lakes, facilitate organized storage and easy retrieval of structured and unstructured data. Automation plays a key role, with software solutions that integrate data from multiple sources seamlessly while minimizing manual intervention. This enhances data accuracy and reduces operational errors.

Data security technologies are also integral to the infrastructure, including encryption, firewalls, and secure access controls. These measures protect sensitive consumer information from breaches, ensuring compliance with data privacy laws. Furthermore, credit bureaus increasingly adopt AI and machine learning algorithms to analyze data patterns and improve predictive accuracy in credit scoring models.

Overall, the integration of sophisticated technology and robust infrastructure forms the backbone of effective data collection, enabling credit bureaus to compile comprehensive and reliable credit reports. This technological framework supports transparency, accuracy, and compliance in the credit reporting process.

Legal and Regulatory Frameworks

Legal and regulatory frameworks are fundamental to how credit bureaus collect data responsibly and ethically. They establish standards that ensure data privacy, accuracy, and fairness in credit reporting processes. These laws also direct how credit bureaus share information with lenders and other authorized entities.

Compliance with data privacy laws, such as the General Data Protection Regulation (GDPR) or the Fair Credit Reporting Act (FCRA), is mandatory. These regulations protect consumers’ rights, requiring credit bureaus to handle personal data securely and transparently. They also prescribe procedures for correcting inaccurate data.

Regulations governing data sharing practices limit who can access credit information and under what circumstances. This safeguards consumer privacy and prevents misuse of sensitive data. Additionally, credit bureaus must implement measures to prevent identity theft and fraud during data collection and dissemination.

Consumer rights are embedded within these legal frameworks, allowing individuals to access their credit reports and dispute inaccuracies. Such rights foster transparency and accountability in credit data collection, reinforcing trust in credit reporting systems.

Compliance with Data Privacy Laws

Compliance with data privacy laws is fundamental to how credit bureaus collect data, ensuring that they operate within legal boundaries. These laws regulate the collection, storage, and sharing of personal information to protect consumer rights. Credit bureaus must adhere to regulations such as the General Data Protection Regulation (GDPR) in Europe and the Fair Credit Reporting Act (FCRA) in the United States.

The primary goal is to guarantee that all data collection practices are transparent and that consumers’ privacy is preserved. Bureaus are required to obtain consumer consent before collecting or sharing sensitive information. They also must implement strict security measures to prevent unauthorized access or breaches. These legal frameworks establish clear guidelines on data accuracy, consumer rights to access and correct their data, and procedures for handling disputes.

By complying with data privacy laws, credit bureaus not only foster trust with consumers but also avoid legal penalties. Non-compliance can result in significant fines, reputational damage, and loss of operational licenses. Ultimately, adherence ensures ethical data collection practices that uphold individual privacy rights within the credit reporting ecosystem.

Regulations Governing Data Sharing Practices

Regulations governing data sharing practices in credit bureaus are designed to ensure responsible handling of consumer information. These laws set clear boundaries on how credit bureaus can access, share, and distribute data. They aim to protect consumer privacy while maintaining the integrity of credit reporting.

Data sharing regulations typically require credit bureaus to obtain consent before releasing sensitive information. They also mandate secure data transmission methods to prevent unauthorized access. Strict record-keeping and audit trails further promote transparency and accountability in data exchanges.

Compliance with these regulations is essential to avoid penalties and preserve public trust. Credit bureaus must stay updated with evolving legal frameworks, such as data privacy laws like GDPR or the CCPA. These laws influence how data sharing practices are implemented across jurisdictions, ensuring protections align with consumer rights.

See also The Evolution of Credit Bureaus and Their Impact on Financial History

Consumer Rights in Data Collection and Correction

Consumers have the right to access the data that credit bureaus hold about them, ensuring transparency in the credit reporting process. This access allows individuals to review their credit reports and verify the information contained within.

If inaccuracies or outdated data are identified, consumers are entitled to request corrections or deletions. Credit bureaus are required to investigate such disputes promptly and amend records if errors are confirmed. This process safeguards consumer rights by maintaining data accuracy.

Regulations also grant consumers the ability to place fraud alerts or security freezes on their credit files, protecting against unauthorized use of their information. Additionally, consumers can opt out of certain data sharing practices that they find invasive or unwarranted under data privacy laws.

Overall, these rights empower consumers to take control over their credit information, promoting fair credit reporting and helping to build trust between credit bureaus and the public. Compliance with these rights is essential for credit bureaus operating within a legal and ethical framework.

Challenges in Data Collection for Credit Bureaus

Collecting data for credit bureaus presents several challenges that can impact the accuracy and completeness of credit reports. Variability in data sources often results in inconsistencies, making it difficult to compile a comprehensive credit profile. Discrepancies may occur due to outdated information or reporting errors.

Another obstacle involves data privacy laws and regulations, which restrict the types of information credit bureaus can access and share. Compliance requirements can limit data collection efforts, especially with increasing emphasis on safeguarding consumer privacy. Additionally, legal restrictions may delay or prevent data sharing from certain sources.

Obtaining data from non-traditional providers, such as utility or telecommunication companies, can also pose challenges. These entities may lack standardized reporting protocols, leading to gaps in data quality or availability. Furthermore, some organizations may be hesitant to share data due to concerns about security or competitive reasons.

Lastly, integrating data across diverse systems and formats requires advanced infrastructure and technology. Compatibility issues, data silos, and system limitations can hinder efficient data collection processes. Addressing these challenges is essential for credit bureaus to ensure reliable data for accurate credit assessments.

The Impact of Data Collection Practices on Credit Reporting

The impact of data collection practices on credit reporting is significant, as accurate and comprehensive data underpin reliable credit reports. When credit bureaus gather high-quality information, it results in fairer and more precise credit evaluations for consumers.

Conversely, incomplete or outdated data can lead to erroneous credit scores and unfair credit decisions. For example, missing account histories or faulty public records may negatively influence a person’s creditworthiness.

Key factors affecting credit reporting include:

- Data accuracy and completeness.

- Timely updates and verification processes.

- Proper handling of disputed or incorrect data.

These practices directly influence the trustworthiness and fairness of credit reports, affecting both consumers and lenders. Maintaining rigorous data collection and validation methods ensures transparency and minimizes the risk of errors.

Innovations and Future Trends in Data Collection

Emerging technologies such as artificial intelligence (AI) and machine learning are poised to transform how credit bureaus collect data. These innovations enable more accurate and efficient data analysis by identifying patterns and predicting credit behavior with greater precision.

Additionally, the integration of big data analytics allows credit bureaus to harness diverse data sources, including social media and online activity, to develop a more comprehensive credit profile. However, the use of such data requires careful adherence to privacy regulations to maintain consumer trust.

Blockchain technology also presents promising opportunities for future data collection practices. Its decentralized and transparent nature can enhance data security and integrity, reducing instances of fraud and inaccuracies. While adoption is still in its early stages, it could redefine how credit information is verified and shared across institutions in a secure environment.

Conclusion: Ensuring Reliable Data for Credit Assessments

Ensuring reliable data for credit assessments is fundamental for credit bureaus to accurately evaluate consumer creditworthiness. High-quality data collection practices foster trust among lenders, consumers, and regulators, ultimately supporting sound financial decisions. Accurate data hinges on rigorous verification processes and adherence to strong data privacy laws, minimizing errors and unauthorized disclosures.

Implementing advanced technology and infrastructure enhances data accuracy and integrity. Modern data management systems enable real-time updates and efficient integration of various sources, reducing discrepancies and ensuring comprehensive credit reports. Regular audits and compliance checks further strengthen the reliability of the collected data.

Robust legal and regulatory frameworks are vital to maintain transparency and protect consumer rights. These laws govern data sharing practices and ensure consumers can access and correct their information. Continuous oversight helps credit bureaus navigate complex legal environments, fostering responsible data collection. Focusing on these practices guarantees that credit reports remain precise and trustworthy, supporting fair credit evaluations.

Credit Reporting Agencies: What Are They & How Do They Work?

How does your credit score get calculated? Why do you have different scores in different places? Understanding what goes on your credit report and what impacts your credit score is one thing. But who takes these factors and compiles them into your credit report?

The answer lies in credit bureaus or credit reporting agencies.

Who Are Credit Reporting Agencies?

A credit bureau is a company that gathers data related to your credit and shares it with other companies, such as your bank or individuals like yourself. There are three main credit bureaus: Experian, TransUnion, and Equifax.

How is Your Credit Report Created?

Credit agencies compile your credit report based on a variety of factors including:

- Your lending history with other credit card companies and banks

- Your bank accounts and their balances

- Your debt repayment history

- Your current credit limits

- Outstanding debts from collection agencies

- Public records

Why Is My Score Different Across Credit Bureaus?

If you’ve checked any of these agencies or had a credit report pulled when trying to buy a car or rent an apartment, you might have noticed variations in your credit score depending on which bureau the inquiry was for. Each company gathers data individually and can even weigh factors differently. Your score doesn’t get updated simultaneously across bureaus, leading to discrepancies. Companies that report credit information may also not do so to all three agencies.

How Do They Get Their Information?

Credit bureaus use two scoring models to calculate your credit score. These models attach different percentages to various credit factors, resulting in your final score. They also obtain information about bankruptcy filings. The two scoring models used are FICO and VantageScore.

FICO

FICO is the most used model and has 5 key factors to determine your credit score, according to their website:

- Payment history – Making on-time payments accounts for 35% of your score.

- Amount owed – The total amount of your debts compared to your available credit limits is worth 30%.

- Credit history – The average age of your oldest and newest accounts is 15% of your credit score.

- Mix of credit – Having various types of loans, such as mortgages, car loans, or even student loans, will have a 10% impact on your credit score.

- New accounts – Any new account you open will impact your credit score by 10% due to the lack of history on the account and the hard inquiries that can come with opening new lines of credit.

VantageScore

This scoring model uses different percentages and variations on the FICO factors to calculate your credit score. These percentages are pulled directly from the VantageScore website:

- Payment history – An up-to-date payment history will significantly impact your credit score by 40%.

- Types of credit and account age – The variety of accounts on your report and how long they have been open will account for 21% of your credit score.

- Credit utilization – How much of your credit is used compared to your total limits accounts for 20% of your credit score.

- Credit balances – This is how much of your total limit is used on each account, like a credit card. It’s a lower factor at only 11%.

- Recent credit changes – Any new updates to your credit report will account for 5% of your score.

- Available credit – Your total amount of credit is worth 3% of your credit score.

What Are Credit Reports Used For?

Now that you understand how your credit score is calculated, you might wonder what your credit report is used for.

Many lenders check your credit report for a variety of reasons. Some of the most common include:

- Applying for a mortgage or lease

- Purchasing a car

- Applying for a loan

- Opening a credit card

Lenders check your credit report because they need to assess whether or not you qualify for their loan. This helps the lender comply with financial regulations, prevent fraud, and manage risk. Based on the risk you present the lender determines your line of credit’s interest rate and/or credit limits.

What Doesn’t Go on Your Credit Report

Of course, not all your information ends up on your credit report. Things like demographic information, medical history, and criminal records are not included. Financial information such as salary or investments is also excluded.

Some monthly bills don’t get reported either. Your utility and cell phone bills, streaming service payments, and other subscriptions do not affect your credit score. However, some programs can get these reported to the credit bureaus if you want to boost a bad credit score.

The Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) regulates the credit bureaus. This law ensures the information collected isn’t used maliciously. It restricts how credit reporting agencies use and access your data.

The FCRA also offers many benefits for consumers:

- You can access your information and learn what goes on in your credit report.

- You also have the right to a free copy of your credit report every week from sites like Annual Credit Report or through services like Credit Karma.

- If your information was used to deny your credit application, you have the right to be told it was used against you.

- Sometimes, your credit report may contain mistakes or incorrect information, and you have the right to dispute any errors that could lower your score.

- This law restricts other people’s access to your credit information. Only those with “permissible purpose” may inquire into your credit report for the purpose of approvals.

- You may opt out of prescreened credit offers.

- This law allows you to freeze your credit so that no one, including lenders, can access it without your permission.

Balance Credit Does Not Use Hard Inquiries

When you apply for a personal loan from us, you don’t have to worry about it affecting your credit score. We don’t perform hard inquiries, so your application will not appear on your credit report. You can apply online without worrying about a negative credit impact.

Check out our FAQs to learn more or contact Balance Credit today!

*The information contained in this post is for general educational and informational purposes only. It is not an offer of credit, does not fully describe the products that we offer or facilitate, and it is not specific to any individual. These products are an expensive form of credit, and you should ensure that they meet your unique financial needs. We are not a credit repair organization and make no representation that we or any loan will improve or attempt to improve your credit rating. We do not provide financial advice or assistance regarding your credit situation. These educational posts are not a substitute for individualized professional advice.

The Best Ways to Rebuild A Bad Credit Score

April 7, 2025

How Loan Payments Impact Your Credit Score

March 17, 2025

Recent Posts

Protected: What Can I Use a Personal Loan For?

Protected: The Top Benefits of Unsecured Loans

All About Installment Loans

©2025 SunUp Financial, LLC.

This loan is designed to help with short term, immediate financial needs. It could be considered a costly form of credit and may not be the best long-term solution for your personal situation. Make sure you understand the loan terms and can repay on time.

In AK, AR, AZ, FL, IN, KS, KY, LA, MI, MN, MT, OH, OK, SC, TN and TX, loans are provided by Capital Community Bank (or by one of its affiliates or divisions), a Utah Chartered bank, located in Provo, Utah, Member FDIC. All loans funded by Capital Community Bank (or by one of its affiliates or divisions) will be serviced by Balance Credit.

SunUp Financial, LLC, NMLS number 1331747.

AL Residents: Loans may be provided by either 1) SunUp Financial, LLC (License No. MC22640), or 2) Capital Community Bank (or by one of its affiliates or divisions), a Utah Chartered bank, located in Provo, Utah, Member FDIC. Your loan agreement identifies your lender.

DE residents: SunUp Financial, LLC is licensed by the Delaware State Bank Commissioner, License No.024137, expiring December 31, 2025.

* Rates & Terms vary by state. Balance Credit is not a lender in all states. Not all applications are approved.

** APPROVAL: In some cases, the decision may take longer; some customers applying for Balance Credit or third-party products may be required to submit additional documentation to verify application information. FUNDING: Applications processed and approved before 6 PM CT on business days and prior to 4:00 PM CT on Sundays are typically funded the next business day.

Customer testimonials and ratings reflect the individual’s own opinions and are not necessarily representative of all experiences.

USA PATRIOT ACT NOTICE: IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

©2025 SunUp Financial, LLC.

https://vaultoftrust.com/how-credit-bureaus-collect-data/https://www.balancecredit.com/finance/credit-reporting-agencies-what-are-they-how-do-they-work/