Government Securities in India: What They Are and How to Invest

To foster new developments, the Reserve Bank of India (RBI) has collaborated with the National Stock Exchange of India (NSE) to enable retail investors to invest in government securities. As a result, now you may directly manage your investments made towards treasury bills (T-bills) and long-dated bonds.

Earlier, only banks and large financial institutions could invest in G-sec options. Today, individual investors can also enjoy guaranteed and attractive returns from understanding what are government securities and their key investing nuances.

What Are Government Securities in India?

Alternatively referred to as ‘G-Secs’, government securities form a vital part of the secondary market and contribute significantly to the Indian economy. The Government issues these debt instruments through the RBI to collect investments for different developmental projects. Thus, by investing in G-Secs, you can help the government in building various infrastructure projects, managing national debt and bridging several other budgetary gaps.

G-Secs are highly secure investments where the government guarantees the total repayment of your principal amount upon maturity, along with timely interest payouts. These are much similar to corporate bonds where the investment returns are paid out in a similar fashion. The RBI’s Sovereign Gold Bond Scheme is a conventional example of government securities.

What Are the Different Types of Government Securities?

Some of the most popular types of government securities in India are outlined below:

Treasury Bills

These are often termed as ‘T-bills’. The government issues these short-term debt securities for tenures ranging from a few days to one year. While purchasing them, you can acquire units at a discounted rate but you won’t receive any periodic interest payouts. Contrarily, you receive the full value of your investment on maturity.

Treasury Notes

T-notes are more suitable for investors looking for mid-term investment solutions. Their maturity periods typically range between 2-10 years. Being an investor in T-notes, you can expect a fixed semi-annual interest rate. Moreover, debt instrument experts consider these instruments to be generally safe.

Treasury Bonds

T-bonds or treasury bonds are offered by the relevant government bodies with maturity periods typically exceeding 10 years. You can expect a fixed coupon rate throughout your investment term and the interest amount is credited to your bank account twice a year.

Cash Management Bills (CMBs)

Again, it is another form of reliable short-term government securities that you can access occasionally through authorised online platforms. These government securities are issued to meet the government’s urgent cash needs on an as-needed basis. Typically, their tenures are less than 91 days long.

Savings Bond

Simply put, these are government bonds that primarily target retail investors. You can secure fixed-interest income from these securities, which makes it a great choice for risk-averse individuals who prioritise stability while investing.

Capital Indexed Bonds

These are specialised bond agreements where your principal amount is adjusted periodically to balance out the effects of inflation. It is a unique characteristic that helps retain the real value of your invested amount over time.

State-Development Loans

The different state governments issue these debt investment instruments for short durations to complete certain local developmental projects. These loans have a wide range of maturity periods and coupon rates, largely determined by the creditworthiness of the bond issuer.

Zero-Coupon Bonds

When investing in zero-coupon bonds, you do not get periodic interest, unlike traditional bonds. However, you can acquire them at a concessional price and expect the bond issuer to repay the entire face value when the bond matures.

Benefits of Investing in Government Securities

If you are seeking stability in your financial journey, government securities will appear to be a compelling prospect. As sound investors, it is essential to verify the different advantages & disadvantages of investing in government securities like any other instruments.

That being said, these are some key benefits of investing in G-Secs:

Guaranteed Returns

Most government securities offer fixed coupon rates. It results in a predictable source of income for the investors.

Portfolio Diversification

Incorporating government securities, such as capital-indexed bonds or savings bonds, can diversify your equity-heavy portfolio.

Tax Benefits

Specific government securities like tax-free government bonds ensure attractive tax exemptions. You do not need to pay income tax on profit earned from these instruments.

Liquidity and Marketability

Due to high demand Central Government securities offer excellent liquidity. Therefore, you can easily buy or sell them using a brokerage platform.

Disadvantages of Investing in Government Securities

Investing in government securities can have several drawbacks too, like:

Limited Returns

As government securities are much safer investments when compared to corporate bonds or stocks, they offer investors lower returns.

Slight Interest Rate Risk

Although government securities carry low risk, still the interest payments can occasionally vary when the values of existing assets fluctuate. This can result in temporary periods of low returns for an investor.

Inflation Risk

Despite being associated with safety, these investments are not completely insulated from market volatility. Certain political events, economic factors and additional elements can influence the value of government securities.

Final Word :

Government securities offer a reliable investment avenue with benefits like guaranteed returns and portfolio diversification. Despite its inherent safety, understanding what are government securities and selecting the right type requires assessing individual risk tolerance. It is crucial to weigh the cons of investing in a particular asset class against the set monetary objectives.

About the Author

Subhodip Das

With an experience of 13 years in the field of Digital Marketing, Subhodip Das specialises in Content. Writing and Marketing Strategies. He has worked with well-established organisations and startups helping them achieve increased search engine visibility. An avid researcher on market investment, Subhodip is also a passionate cook and foodie.

Open your FD now with Unity Bank for up to 8.25% interest

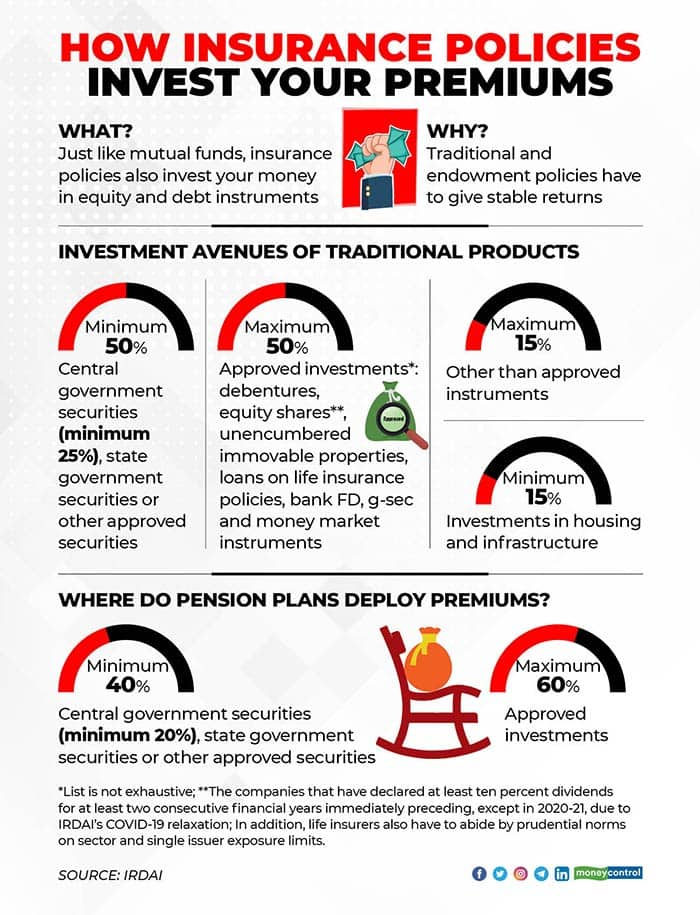

Explained: How life insurance policies invest your premiums

Life insurance policies have to adhere to IRDAI-mandated norms on deploying the collected premiums. Insurance policies cannot take credit risk

October 29, 2020 / 13:55 IST

Many life insurance policyholders often buy covers after looking at returns promised by insurance agents. Rarely do they delve deeper to find out how their premiums will be deployed. This is especially the case with endowment policies. These are relatively opaque as they do not disclose their portfolios or their NAVs (net asset values) daily unlike unit-linked insurance policies (ULIPs) or mutual funds. The reality is, insurance covers such as moneyback or endowment policies also invest the premiums that they collect from you.

The Insurance Regulatory and Development Authority of India (IRDAI) has put in place regulations on how your money can be invested by life insurers.

Story continues below Advertisement

In what kind of instruments do life insurers invest my premiums?

In the case of investment-cum-insurance products, it would depend on the type of product you choose. With Ulips, which offer market-linked returns, you have the freedom to take calls on how and where to invest – in equities, debt or a mix of both. “So, a large-cap or a mid-cap equity fund would have asset allocations in line with their filings in different categories of equity. Similarly, a debt fund would invest in government securities, corporate bonds and the money market as per its approved asset allocation. A balanced or hybrid fund would invest in debt and equity,” says Sandeep Nanda, Chief Investment Officer, Bharti AXA Life Insurance.

Traditional endowment policies can be participating and non-participating. In the case of the former, the insurer announces annual bonuses out of profits earned by its participating fund, besides terminal bonus at maturity. Non-participating plans offer guaranteed maturity corpus and returns. Traditional policies invest in government securities, corporate bonds and also equity.

Related stories

Buying insurance with a home loan is not compulsory. Should you still get it

Ask Wallet-wise | I fall sick every monsoon. Is there a health cover for frequent doctor visits?

TCS layoffs: How to retain your group health cover benefits while exiting

Does IRDAI prescribe rules about the quality of underlying investments?

The insurance regulator has a detailed set of conservative investment guidelines specifying the type of instruments and allocations to these. “The regulations try to ensure that both Ulip and traditional funds are managed in a prudent manner without too much risk. To avoid too much concentration, there are issuer limits (no more than 10 percent investment in a single issuer) and sector limits (15 percent cap on investment in a sector, with the exception of banking and financial services where it is 25 percent),” says Nanda. To contain credit risk – which has taken its toll on debt mutual funds in the last two years – insurers can only invest in corporate debt with rating of AA and above. Even here, securities with AA rating cannot exceed more than 25 per cent of the portfolio, with the rest having to be AAA-rated.

Story continues below Advertisement

“In the case of traditional funds, insurers are required to invest at least 50 percent in government securities and 15 percent in infrastructure and housing. This is to ensure that assets are in line with the long-term nature of the policy liabilities. This helps ensure that apart from concentration and credit risk, interest rate risk is also managed properly,” says Nanda.

Can insurance policies invest in equity? And do they have any restrictions?

Even in the case of equity funds, in the ‘approved investments’ basket, insurers are required to invest in companies that have declared dividends in two consecutive financial years immediately preceding the year of investment. According to this parameter, a company ought to have declared at least 10 per cent dividend in the preceding two financial years for it to be classified as an ‘approved investment.’

The IRDAI has, however, relaxed this requirement for making investments in the current financial year, factoring in the adverse impact of COVID-19 into account. “It has allowed insurers to buy and hold securities of companies that had declared dividends in at least two of the three immediately preceding financial years,” says Shyamsunder Bhatt, CIO, Exide Life. This was done after taking into account the extraordinary situation post the COVID-19 outbreak and the ensuing lockdown.” The RBI and IRDAI asked insurance companies to not declare any dividend last financial year. So, many blue-chip companies, particularly in the banking and insurance sectors, were not able to declare dividends for the financial year 2019-20,” says Bhatt. In other words, even if an underlying company did not declare dividend last year, it will not be classified as ‘other than approved’ security, as long as it has declared dividends in at least two of the three immediately preceding financial years. This means insurance companies can continue to hold them.

Else, stocks of several such blue-chip companies would have had to be re-classified as ‘other than approved’ securities as per the IRDAI’s criteria. “If it skips dividend payment in one out of these two financial years, it will be classified as ‘Other than approved.’ There are regulatory caps for investing in the latter category – 15 percent of assets under management in the case of traditional policies and 25 per cent for Ulips,” adds Bhatt.

Moreover, insurance pension funds are not allowed to hold any securities at all in the ‘Other than approved’ basket. The COVID-19-related relaxation helps such funds. “They can invest only in approved securities. So, they would not have been able to buy or hold securities of many blue-chip companies that might have had the ability to declare dividends, but got stalled by the regulatory diktat,” says Bhatt. If this leeway – valid for financial year 2020-21 – had not been granted, pension funds would not have had many leading Nifty blue-chip companies, especially from banking and finance sectors, in their portfolios. “They would have had to change their investment strategies to look for alternatives that might not have been as good. IRDAI’s move is in favour of policyholders too. Otherwise, their returns might have been adversely affected as insurers would not have been able to invest in several blue-chip companies,” Bhatt explains.

What is the rationale behind these regulatory caps?

Investment regulations’ objective is to protect policyholders’ interest by curtailing the risks that insurers can take. While Ulips are market-linked, policyholders expect a degree of assurance in terms of returns from traditional products. “Life insurance companies face greater stringency of investment regulations as they have shareholder funds (largely balance sheet surplus, and term and non-participating policy funds), policyholder funds (which are entrusted by policyholders as savings with returns to be added or given) and unit-linked funds,” says Joydeep K Roy, Global Health Insurance Leader and Leader, Insurance Practice, India, PWC India. In addition, they are also the custodians of any unclaimed funds of policyholders. The stringent regulatory oversight is aimed at ensuring prudent risk-taking so that the stakeholders of these funds do not suffer.

https://stablemoney.in/blog/government-securities-in-india-what-they-are-and-how-to-investhttps://www.moneycontrol.com/news/business/personal-finance/explained-how-life-insurance-policies-invest-your-premiums-6033561.html