What counts as long-term asset under investing and financing activities

Cash flows from investing and financing are prepared the same way under the direct and indirect methods for the statement of cash flows. To put it simply, if we RECEIVE CASH in the transaction we ADD the cash amount received and if we PAY CASH in the transaction we SUTRACT the cash amount paid.

Investing Activities

Investing activities would include any changes to long term assets including fixed assets (also called property, plant and equipment), long term investments in notes receivable, or stocks or bonds of other companies, and intangible assets (patents, trademarks, etc.). Where would we find this information? We would look on the balance sheet. If there was a change in any long term asset (increase or decrease during the year), we need to account for that item in the Investing section. For our purposes, we will use the balance sheet and any additional information provided to us.

When analyzing the investing section, a negative cash flow is not necessarily a bad thing — you would need to look into the individual items of the investing section. We could have a negative cash flow if we purchased a new building for cash but this would be a good thing for our company and should not been determined to be bad since the cash flow from investing could be negative. Same if the reverse were true, what if we sold all of our long term assets and did not purchase any new assets — would this be a good thing for our company since we have a positive cash flow or a signal that something is going very wrong?

Here is a video to explain both investing and financing and then we will look at financing:

Financing Activities

Financing activities would include any changes to long term liabilities (and short term notes payable from the bank) and equity accounts (common stock, paid in capital accounts, treasury stock, etc.). We would get most of the information from the balance sheet, but it may be necessary to use the Statement of Retained Earnings as well for any information on dividends. As with investing, if there has been a change in a long term liability or equity (increase or decrease during the year), we must account for the item in the Financing section of the statement of cash flows.

When analyzing the financing section, just like with investing, a negative cash flow is not necessarily a bad thing and a positive cash flow is not always a good thing. Once again, you need to look at the transactions themselves to help you decide how the positive or negative cash flow would affect the company.

To summarize our investing and financing sections, review this chart (remember, use the wording “provided” if positive cash flow and “used” if negative cash flow):

| Cash flows from Investing activities: |

| + cash received from sale of long term assets |

| – cash paid for purchase of new long term assets |

| Net cash provided (used) by Investing Activities |

| Cash flows from Financing activities: |

| + cash received from long term liabilities |

| – cash paid on long term liabilities |

| + cash received from issuing stock |

| – cash paid for dividends |

| – cash paid to purchase treasury stock |

| Net cash provided (used) by Financing Activities |

Non-cash investing and financing activities

What happens if we purchase a building by signing a mortgage with no cash down payment? Or if we convert bonds payable to common stock, how would we account for these transactions? These transactions do not involve cash but they are significant enough for investors to need to know. We will report them in a separate section at the bottom of the statement of cash flows. For example, assume a company did purchase a $100,000 building by paying $20,000 down in cash and signed a note for the balance of $80,000. This would be reported as follows (note, the $20,000 down payment would be including in the investing section of the statement of cash flows):

| Noncash investing and financing activities: | |

| Purchased building for $100,000 by signing a note and a downpayment of $20,000 | $80,000 |

We will prepare a complete statement of cash flows in the next section.

Candela Citations

CC licensed content, Shared previously

- Accounting Principles: A Business Perspective. Authored by: James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by: Endeavour International Corporation. Project: The Global Text Project. License: CC BY: Attribution

All rights reserved content

- Cash Flow Statement: Investing and Financing Activities. Authored by: Note Pirate. Located at: https://youtu.be/VUbMq50rZGo. License: All Rights Reserved. License Terms: Standard YouTube License

Licenses and Attributions

CC licensed content, Shared previously

- Accounting Principles: A Business Perspective. Authored by: James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by: Endeavour International Corporation. Project: The Global Text Project. License: CC BY: Attribution

All rights reserved content

- Cash Flow Statement: Investing and Financing Activities. Authored by: Note Pirate. Located at: https://youtu.be/VUbMq50rZGo. License: All Rights Reserved. License Terms: Standard YouTube License

Cash Flow from Investing Activities

Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

What is Cash Flow from Investing Activities?

Cash Flow from Investing Activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period. Investing activities include purchases of long-term assets (such as property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities (stocks and bonds).

What are Investing Activities in Accounting?

Let’s look at an example of what investing activities include. In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting.

Investing activities can include:

- Purchase of property plant, and equipment (PP&E), also known as capital expenditures

- Proceeds from the sale of PP&E

- Acquisitions of other businesses or companies

- Proceeds from the sale of other businesses (divestitures)

- Purchases of marketable securities (i.e., stocks, bonds, etc.)

- Proceeds from the sale of marketable securities

There are more items than just those listed above that can be included, and every company is different. The only sure way to know what’s included is to look at the balance sheet and analyze any differences between non-current assets over the two periods. Any changes in the values of these long-term assets (other than the impact of depreciation) mean there will be investing items to display on the cash flow statement.

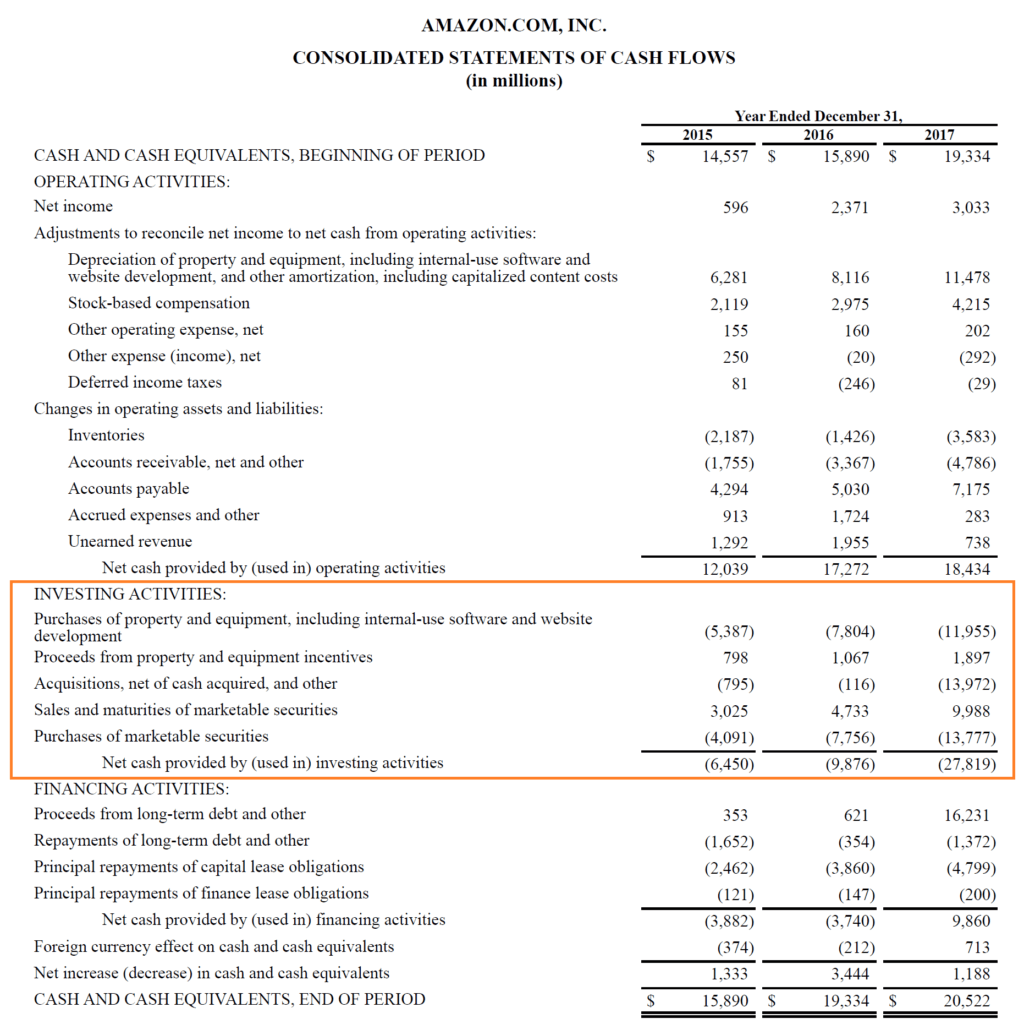

Cash Flow from Investing Activities Example

Let’s look at an example using Amazon’s 2017 financial statements. As you can see below, investing activities include five different items, which total to arrive at the net cash provided by (used in) investing. Let’s take a closer look at each of these items for Amazon.

Amazon’s investing activities include:

- Outflow: purchase of PP&E including software and website development

- Outflow: purchase of marketable securities

- Outflow: acquisitions, net of cash acquired

- Inflow: proceeds from the sale of property and equipment

- Inflow: proceeds from the sale of marketable securities

As you can see in Amazon’s numbers, the main uses of cash for investing have been in purchasing property/equipment/software/websites, acquiring other businesses, and buying marketable securities (stocks and bonds).

It’s also important to point out that the purchase of PP&E (CapEx) has been fairly proportional to depreciation, which indicates the company is consistently reinvesting to keep its assets in good shape.

What Do Investing Activities Not Include?

Now that you have a solid understanding of what’s included, let’s look at what’s not included.

Not included items are:

- Interest payments or dividends

- Debt, equity, or other forms of financing

- Depreciation of capital assets (even though the purchase of these assets is part of investing)

- All income and expenses related to normal business operations

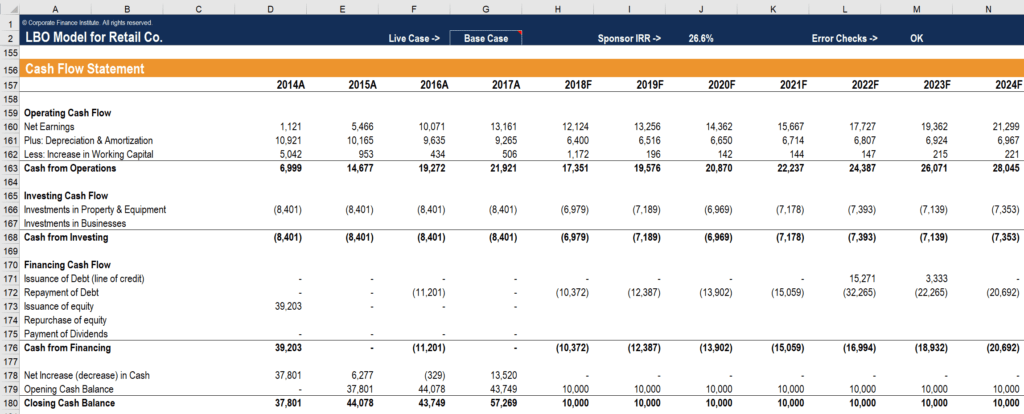

Applications in Financial Modeling

In financial modeling, it’s critical to have a solid understanding of how to build the investing section of the cash flow statement. The main component is usually CapEx, but there can also be acquisitions of other businesses. This section is usually pretty straightforward.

Below are an example and screenshot of what this section looks like in a financial model. Notice how every year the company has “Investments in Property & Equipment,” which are its capital expenditures. There are no acquisitions (“Investments in Businesses”) in any of the years; however, it is there as a placeholder.

Additional Resources

Thank you for reading this guide to Investing Activities. To continue learning and progressing in your career, these additional CFI resources will be helpful:

- Balance Sheet Items

- Income Statement Items

- Operating Cash Flow

- Types of Financial Models

- See all accounting resources

- See all capital markets resources

Get Certified for Financial Modeling (FMVA)®

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.

https://courses.lumenlearning.com/suny-ecc-finaccounting/chapter/cash-flows-from-investing-and-financing/https://corporatefinanceinstitute.com/resources/accounting/cash-flow-from-investing-activities/