Understanding the Statement of Cash Flows

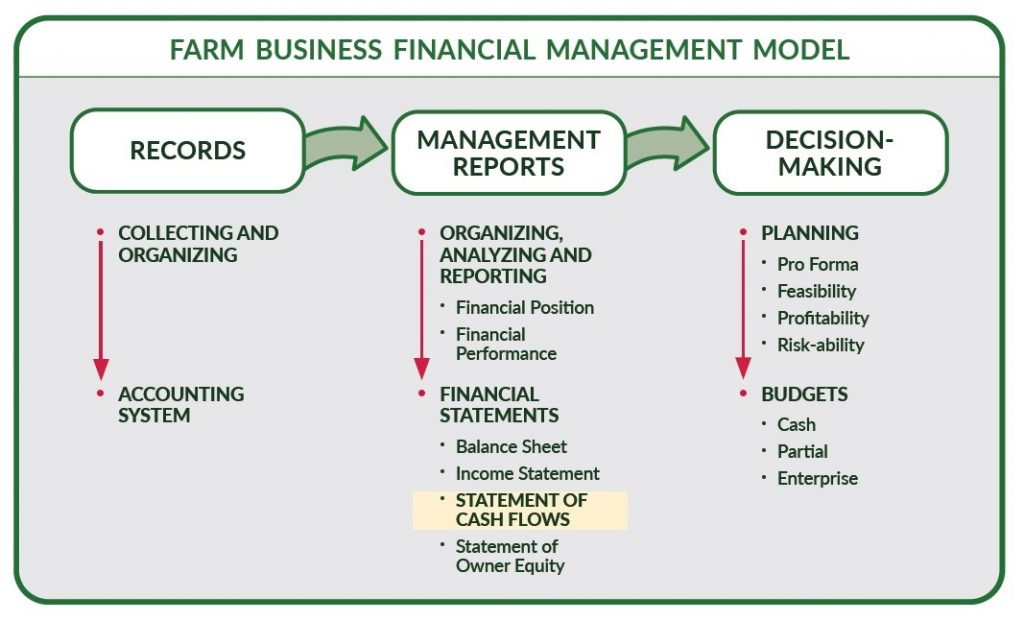

The statement of cash flows tracks the sources and uses of cash in the farm business in the past year. It also adds insight to the understanding of financial position and performance of the farm business.

Introduction

The statement of cash flows focuses on the “cash” activity of the farm business. The balance sheet is often associated with financial position, and the income statement with profitability of the farm business. The statement of cash flows is a value-added statement, giving additional insight to financial position and performance with respect to the cash activity coming into or exiting the farm business.

The statement of cash flows is a historical document summarizing cash activity over a certain time period (month, quarter, year). This statement is sometimes confused with the cash flow budget, which is a projection of future cash flows. The more general term, “cash flow statement,” is commonly used, and may refer to either the cash flow budget (planning future cash flows) or statement of cash flows (summarizing historical cash flows). The statement of cash flows and cash flow budget are different financial tools with different purposes and structures.

The statement of cash flows summarizes the cash activities into three areas of – operating, investing, and financing activities. These three activities might be thought of as three businesses, independent of each other, within the overall farm business. Ideally, the sum of their individual net cash balances should equal the change in the cash position between the beginning and ending balance sheet. If this doesn’t occur, it triggers an investigation into “why?”

The Farm Financial Standards Council (FFSC) provides the specific (and more rigorous) standards and structure for the statement of cash flows. This paper provides a concise and practical presentation of the statement of cash flows, while in compliance with the FFSC guidance.

Statement of Cash Flow Structure

The structure of the statement of cash flows is guided by the formula:

Cash (Jan. 1) + Cash Inflows – Cash Outflows = Cash (Dec. 31)

- Cash (Jan. 1 & Dec. 31) = checkbook balance, savings, etc.

- Cash Inflows = production sales, capital sales, borrowed funds, contributed capital, etc.

- Cash Outflows = operating expense, capital purchases, debt service, non-farm draws, etc.

Cash from Operating Activities

Operating activities include cash inflows and outflows associated with operating the farm business . Much of a farm business’ activities during the year are considered operating activities. Family living expenses, income and social security tax payments are part of this category.

Cash from Investing Activities

Investing activities include cash inflows from the sale of assets and cash outflows for the purchase of assets. How much cash did the farm business generate from the sale of breeding livestock, machinery, or land; and in turn, how much cash was used to purchase these assets? Often, the cash outflow exceeds the cash inflow, and as such, this imbalance is reconciled within the financing activities as additional debt (discussed below).

Cash from Financing Activities

Financing activities is the cash to and from external sources such as lenders, investors and shareholders. How is the business being funded? Incurring additional debt obligations or the repayment of an existing loan’s principal balance, are some of the activities that would be included in this section of the statement of cash flows.

The statement of cash flows may or may not be limited to the farm business. Cash may flow into the farm business as contributed capital, or flow out as withdrawals from the farm business. To the extent this occurs, it is noted within the financing activities.

Change in cash balances

The statement of cash flows shows the ending cash and cash related balances from the year-ending balance sheet (Dec 31). The ‘change in cash’ between the beginning (Jan 1) and ending balance sheets (Dec 31) should reconcile with the change in cash balances from operating, investing, and financing activities in the statement of cash flows.

Preparing Your Statement of Cash Flows

Statement of Cash Flow Tool

The Extension Statement of Cash Flow Tool consists of an excel worksheet that provides a means and help in developing the statement of cash flows. This tool consists of a main “tab” or worksheet “Statement of Cash Flows” with yellow shaded cells to be updated with user data.

Share your feedback on this tool by contacting our Extension team at farms@extension.wisc.edu

Summary

The statement of cash flows is a ‘cash’ concept, not ‘accrual’. It shows the cash inflows and outflows during a time period, regardless of when the earnings or expenses occurred. Therefore, the net cash position will not reflect profitability for the time period. A more thorough and rigorous statement of cash flows does afford the reconciliation of net income to net cash from operating activities. This is presented in the FFSC guidelines.

The statement of cash flows is also useful in comparisons with peers or past performance (i.e., previous years v. past year; debt payments planned v. actual payments).

The statement of cash flows does help the farm business understand the ‘use’ of cash.

- Where has cash left the farm business?

- How much cash was spent on an expense?

- Are there potential surplus or deficient periods during the year?

- Can the farm business estimate the minimum credit needs based on cash flow?

- When should loan payments be scheduled to match cash inflows?

- Is there sufficient cash for capital asset purchases?

Test your knowledge of statement of cash flows

True or False: The Statement of Cash Flows and the Cash Flow Budget are just two ways of referring to the same thing. That is, these two terms can be used interchangeably.

Answer: FALSE. The Statement of Cash Flows is sometimes confused with the Cash Flow Budget. However, they are very different. The Statement of Cash Flows looks backwards and tracks the sources and uses of cash that already occurred. The Cash Flow Budget is a planning document that is looking forwards and planning the sources and uses of cash in the month, quarter or year ahead.

True or False: The Statement of Cash Flows tracks incoming and outgoing cash in three different areas of business activity.

Answer: TRUE. The Statement of Cash Flows is structured into three business activities that each summarize sources and uses of cash within that area of activity – operating, investing, and financing.

This is one in a series to introduce you to the farm business financial management model. This presentation provides information on understanding your farm’s statement of cash flows. The statement of cash flows tracks the sources and uses of cash in your farm business and adds insight to the understanding of your financial position and performance. The statement of cash flows summarizes cash activity over a certain time period, such as a calendar year.

More Extension Farm Pulse Articles and Programs

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.

Financial Management

The University of Wisconsin-Madison Division of Extension Financial Management & Strategic Planning programs, information and resources intend to improve the farm financial and decision-making skills of Wisconsin agribusiness, farmers and farm managers, agricultural lenders and educators.

Farm Management Newsletter

To stay up to date on the latest information and upcoming programs from Farm Management, sign up for our newsletter.

Understanding the Financials of Venturing into a Livestock Business

Retirement opens opportunities to transition into a new career or business you are passionate about. Many retirees consider venturing into agriculture and livestock, believing farm life can be a relaxing and fulfilling experience compared to a conventional nine-to-five in the urban jungle.

As with any business venture you may undertake — do your due diligence.

The livestock industry offers many benefits. Some non-monetary rewards could be being close to nature, living in a slower-paced rural environment, working on an activity you enjoy, and having a flexible schedule.

Agriculture generates hundreds of billions of dollars for the US economy annually. Livestock supports the livelihoods of over 1 billion people around the world. Running a livestock business can be a rewarding and profitable endeavor. It’s a vital part of the agricultural economy, providing products like milk, eggs, and meat to domestic consumers. It also exports leather and wool to international markets.

Animals and animal products generate billions of dollars each year for the US. According to the Department of Agriculture, animal food sources contributed $258.5 billion to the US in 2022. In the same year, the USDA found that cattle and calves were the most profitable animals, accounting for $86.1 billion of that revenue.

Here, we discuss the financials of investing in and running a livestock business. Before you venture into livestock, you must understand the financial requirements of running a farm. You also need to understand the key numbers to meet to stay profitable.

Moreover, we will discuss best practices that lead to an efficient and thriving livestock business.

With better financial knowledge, transitioning into livestock farming in retirement will bring a fulfilling new career working with animals and the land, long-term security, and promising returns.

Table of Contents

Farm Financials: A Must for Agricultural Producers

The livestock sector is highly dynamic. It is a pillar of the national economy and global food system, and it contributes to food security, poverty reduction, and agricultural development.

Livestock are essential assets for all communities. Globally, people rely on livestock herding for food and income and as a way to store wealth. It can also be a form of collateral and a safety net in difficult times. Locally, these production systems help preserve biodiversity and could contribute to carbon sequestration via biomass and soils.

Additionally, livestock is the only way to convert natural resources into fiber and work power in harsh environments like drylands and mountains. It is a formidable contributor to local resilience. As a fast-growing sector, it must keep pace with demand, which increases with changing diets, rising incomes, and population growth.

With its vital role in fulfilling many needs and essential activities, livestock is undoubtedly an ideal business choice.

However, its financial aspects can be overlooked.

Would-be farmers need to study its financials in-depth, as it has many unique elements, including the inclusion of live animals, seeds, and plants under your assets.

Farm Financial Statements: Key Components

Whether starting a livestock farm from scratch or carrying on a tradition by returning to the family farm, it can be challenging to come to grips with the financial aspect of the business. The following vital measures help you establish a solid financial foundation:

1. Balance Sheet

Lenders often refer to a farmer’s balance sheet for a financial reference. To borrow capital for your business, you must provide a snapshot of your financial position. As an owner, the balance sheet helps you gauge your net worth.

Your net worth or equity is the dollar amount or total value of your reported assets. Even if you don’t need a loan to start or expand your livestock business, it’s always a good idea to track your growth and financial position at any given point as a reference for making decisions.

Farm Assets and Liabilities

As a livestock farmer, you must identify which business aspects fall under assets and liabilities. The knowledge will help you formulate your balance sheet and net worth statement.

What are your assets?

As a farmer, your assets comprise everything you own under the business. Examples of assets are cash, equipment, and real estate. You divide them into three categories:

Current assets

Current assets are items in your business that can be sold or used up within a year. These include fertilizer, seed, feed, crops in the ground, and feeder calves you must sell within the year.

Intermediate assets

These are the items your business owns that support production. They usually last 2 to 10 years. Examples of intermediate assets include vehicles, equipment, and breeding livestock.

Long-term or fixed assets

These assets are things you own that are permanent. They typically last for over ten years. Examples of assets in this category are shelters, barns, and real estate.

What are your liabilities?

As a business owner, you need to take stock of your liabilities. Liabilities are the things you owe. Examples of liabilities are mortgages, auto loans, and credit card debt. They fall under the following categories:

Current debts

You must pay these debts within a year, like an operating loan.

Intermediate-term debts

These are what you need to pay within 1 to 10 years, such as equipment loans.

Long-term debts

You must pay these business debts over ten years, like those involving real estate.

Creating your business balance sheet

Understanding your assets and liabilities, you are ready to create your balance sheet. A livestock business balance sheet has two columns—one for assets and another for liabilities.

Under current assets, you would typically list cash, feed, seed, supplies, prepaid expenses, investments in growing crops, crops intended for resale, market livestock, and other liquid assets of your business.

Under intermediate assets, you typically list dairy, vehicles, equipment, and breeding livestock.

Under fixed assets, you could list center pivots, buildings, and real estate.

Add the value for all three categories at the bottom of your assets column and document your total assets. The formula for calculating total assets is the sum of your current, intermediate, and fixed assets.

Under current liabilities, you can add accrued expenses, accounts payable, operating loans, loans with less than one year term, and the current portion of your term liability principal due within 12 months.

Under intermediate liabilities, you can include the business loans with a term between 1 and 10 years and your capital leases.

Under your long-term liabilities, you list your loans with a term greater than ten years.

Your total liabilities will be the sum of your current, intermediate, and long-term liabilities.

Computing the owner’s net worth or equity

To determine your net worth or equity, subtract your total liabilities from your total assets. Your net worth statement summarizes the property and financial assets owned, all the debts owed, and the net worth of your business at a point in time.

2. Income Statement

You use an income statement to report your farm’s financial performance over a specified period. Income statements are usually created to summarize the business’s cash flow for an entire calendar year.

To come up with the actual profit of your business operation, you create an income statement for all the income earned and expenses for a crop or product regardless of the calendar year, called accrual income.

Many farms use a fiscal year as their tax year to measure accrual income. The accrual income statement contains net farm income, one of the farms’ and livestock producers’ most important financial measures. It measures the actual performance of the farm during the year.

In a farm’s income statement, you focus on the following essential items:

Income

Income reflects money generated from product and service sales. This category includes crop sales, government payments, patronage income, livestock sales, and other farm income.

Gross income

This figure is the total income from the livestock operation in a given year. It does not show whether the business made a profit. The only way to determine profit is to deduct expenses.

Expenses

These are the costs incurred by the farm operation associated with growing crops or animals. Examples are seeds, the payroll or labor required, land rent, chemicals, fuel, medications, and breeding costs.

Profit margin or gross margin

This indicates the profit or loss of the year’s crop or livestock. This measure does not consider the fixed cost of the operation. It is understood that the business should have sufficient gross profit margin to cover its fixed costs.

Overhead or fixed costs

This figure reflects the costs to the operation regardless of its livestock production. Examples of business operations items that fall under this category are interest, repairs, salaries and living expenses of employees, equipment depreciation, insurance, taxes, utilities, and marketing expenses.

Net profit or net income

Your net income reflects the livestock business’s actual profit and loss picture. It shows whether the farm’s operating income is enough to cover its overhead and production expenses.

3. Value of farm production

The value of farm production benchmark is calculated by summing up the accrual gross revenue from a farm’s livestock, the gain or loss on the sale of breeding livestock, crop insurance proceeds, agricultural program payments, and other income. You subtract the cost of purchased grain, feed, and livestock.

In the agricultural industry, the value of farm production is a measure of gross income. Remember that net farm income is computed by subtracting the total expenses of the operation from the value of farm production.

4. Cash flow statement

You can create a monthly, bi-monthly, quarterly, or semiannual cash flow statement. The more detailed it is, the easier it is to understand how cash moves in and out of the business. You can also formulate a cash flow budget that predicts future flows, including expected payments.

The following items are included in a comprehensive cash flow statement:

Cash from operating activities

Under this entry, you include the sales receipts from selling market livestock. You also include other operating income from payments under the Price Loss Coverage (PLC) programs or Agricultural Risk Coverage (ARC).

You record all the expenses for the livestock business’s operating activities—all expenses the farm needs to run. These include any money spent on items intended to be resold, like feeder livestock or feeds. Operating expenses include money spent on fertilizers, fuel, seed, marketing, labor, and chemicals. You also include interest expenses in this section. This line is the interest paid on any loans. In addition, you record income taxes paid under this section.

Net cash income from operating activities

This section is all the cash earned from sales and other operating income subtracted from the costs of running the farm.

When evaluating cash flow, pay attention to the parts of the year when your incoming cash is higher than your expenses. Likewise, identify the months when the incoming money is lower than expenses.

Cash generated by investing activities

This section refers to all the cash earned or spent on investment items. An investment item is anything used for over one year in the business. These include the purchases or sales of breeding livestock.

You also include any sales or purchases of equipment or real estate here. You commute the net cash from your investing activities by deducting cash spent on investment items versus money earned from investment items.

Cash from financing activities

This section of your cash flow statement reflects all the cash generated by financing activities—anything received from term debt financing or operating loans. You also include non-farm income used to pay for farm expenses. Gifts or inheritances are also included in this section, plus cash from sales of personal assets, retirement accounts, and investment income.

Under this section, you record all cash used for financing debt, which means any payment on the principal of finance leases, operating and CCC loans, and term debt. Moreover, all owner withdrawals for unpaid labor and management fees should be included.

Cash flow summary

Your business’s cash flow summary reflects all the cash received from investing, financing, and operating activities deducted from all monthly expenses. You state the beginning cash balance in this part of the cash flow statement. It is the amount of cash available at the start of each month.

Under the ending cash balance, you take the beginning cash balance and add the month’s net cash income. The net cash income refers to cash from investing, operating, and financing activities.

The net change in your business’s cash will show you the most profitable months.

Values That Help Understand Farm Financials

Knowing how to create a balance sheet is not enough. You need to know the values that help you understand your business’s financial health.

The farming business has risks, but there are ways to avert or prevent these risks. You need to augment your management skills by identifying financial and production projections. These values are crucial in decision-making. For example, they predict sales of farm products or calculate the investment amounts for livestock purchases or acreage.

Farm financial benchmarks and ratios

In livestock production, financial ratios will show you how every aspect of your operations relates to one another through assets and liabilities. These ratios can be used to assess how you measure up against industry-specific standards. This way, you can see whether you are in step, lagging, or ahead of the game compared to the rest of the producers in the livestock industry.

Working capital

Working capital—net working capital or NWC—is the difference between your livestock company’s current assets and liabilities.

As previously explained, current assets are owned assets that can be sold within a year. These may include accounts receivable or unpaid customer bills, cash, raw materials inventories, and finished goods. The business’s current liabilities include its debts and accounts payable.

Working capital is a valuable measure of your livestock company’s short-term health. You can also define it simply as the money to fund your daily operations. A positive working capital value indicates that your livestock business can pay its short-term obligations immediately.

In this specific industry, this can look like dollars per acre or dollars per cow.

Current ratio

Your current ratio can also be called your working capital ratio. It measures your business’s capability to meet short-term obligations due within a year.

This ratio considers the weight of your total current assets versus your total current liabilities. As a livestock business owner, you must aim for a minimum 1:1 ratio. This minimum guarantees you have enough assets soon convertible to cash or cash to pay your bills for the reported period—one year.

It is another measure of your company’s financial health and how it can maximize the liquidity of its current assets to settle payables and debt.

The formula for the current ratio is:

Current ratio = Current Assets / Current Liabilities

You could develop benchmarks for a strong, mediocre, “needs improvement,” or “critical level” current ratio. For example, a solid current ratio for your business would look like a value of 2 and over. A mediocre current ratio could be between 1.3 to 2. A critical level or “needs improvement” current ratio would be a value of less than 1.3. By that point, you could take swift intervention.

When your current ratio needs improvement, you have several options. You could sell non-return-generating capital assets like unused equipment. You could also retain net profits in cash to improve your ability to pay for current liabilities. Your net farm profits can also be used to pay debt.

You could also look at cash or profits for long-term asset investments like equipment or land. Pull back on these purchases if your current ratio is insufficient.

If you find that the operating loan of your farm is close to its maximum principal, or if your business has some operating debt carried over from last year, you could opt to refinance some of your farm’s operating debt and shift to longer-term refinancing to make your burden bearable.

Liquidity

Liquidity is the ability of your livestock business to meet its debts or financial obligations as they become due. It determines whether you have enough near-cash or cash assets to cover short-term obligations without interrupting or disrupting your everyday operations.

Working capital and current ratio are both measures of liquidity. A good formula for calculating liquidity is working capital as a percentage of your business’s annual expenses, expressed as the following:

Liquidity = (Current assets – current liabilities)/ Livestock farm expenses

A value of over 50 percent generally indicates a comfortable position. It means you can maintain over half of your yearly farm expenses with your current funds for your daily operations. A value of 20 to 50 percent means you need to monitor your finances more closely and be ready to devise a backup plan.

The next question in every business owner’s mind is how to improve liquidity. The solution can be challenging because the sale of assets and building cash reserves take time. The quickest way to improve liquidity is to run a lean and profitable business, retaining net farm profits as cash.

When you keep your net farm income as cash reserves, you forgo using the funds to purchase new assets, investments, or reduce debt.

You could also look into selling non-vital assets. Old equipment is an example of something you can sell for cash. Look for sprayers, planters, tractors, or harrows sitting idly and largely unused.

The final option is borrowing money. Farms commonly use operating loans to increase their liquidity. However, taking out a loan on long terms is not advisable simply to hold cash on your balance sheet. This practice may have a severe negative impact on equity and debt servicing.

Profitability

The profitability ratio is essential for a livestock business because it helps you decide whether you are ultimately making money from your assets. What assets do you own, and are they earning for you? Is there an opportunity to sell or repurpose assets such as vehicles, livestock, or equipment to put your business in better standing?

You use the Return on Assets (ROA) formula to determine the percentage of your assets’ profitability—how good they are at generating revenue. The formula for calculating is:

ROA = (Net income + interest)/ Total assets of the livestock farm

To improve your profitability, you consider both income and expenses. You must find a way to maximize each commodity you produce. Your yield should pull its weight in terms of profit. As you evaluate your overall profitability, note all your costs and income for every acre of your farm or per farm if you have multiple farms.

You need to ask essential questions targeted toward the analysis and improvement of specific aspects of the operation:

- Can you plant other crops or varieties that produce higher yields?

- Do you have lands that are under-producing?

- Must you consult a commodity expert to help guide you on product pricing?

- Are you overpaying for rent?

- Are there less expensive suppliers of livestock feed, such as cooperatives?

- Are there ways to increase farm yield and reduce costs without compromising profitability?

Like in any well-run business, a livestock farm owner must know how every dollar spent affects the operation’s final yield on a per-head or per-field basis. Not every acre or field has the same degree of profitability, but you do need to understand the performance of every section of your farm.

Efficiency

Efficiency measures the amount of money you can make versus your expenses. You must ensure you pay your expenses and make money on top of your costs.

The formula to determine efficiency is the Operating Expense Ratio (OER). This shows the relationship between your farm’s operating expenses and gross revenue. The formula for OER is:

OER = Farm expenses/Farm income

As efficiency is a measure of profitability, you improve efficiency by using the same strategies to improve profitability.

Master Farm Financials To Run a Successful Livestock Business

The livestock business presents many opportunities for retirees. However, if you’re not careful, it is also a minefield of hidden costs, seasonal challenges, and debt traps.

When you venture into livestock, understand you are dealing with a unique product—high demand and consumed daily. You are also dealing with unique pressures to produce, market, compete, and earn as much as possible and ensure that you have invested in the right assets to make it happen.

It is easy to get lost in farm operations and fail to see the big picture. By mastering farm finances, you become better at management and troubleshooting. You can spot problems before they become unsurmountable.

By understanding financial indicators, you know what you are working with, can track your progress as you go, and, more importantly, know which levers to pull to improve your profitability. Again, due diligence.

Beyond the love of nature, raising animals, and creating a meaningful business, you must be ready to deal with the numbers to maximize your investment. By being skilled at creating balance sheets, understanding and managing cash flow, and interpreting critical benchmarks, you are better equipped to become a successful livestock entrepreneur.

Featured Image Credit: Photo by Samet Kaplan; Pexels

About Due’s Editorial Process

We uphold a strict editorial policy that focuses on factual accuracy, relevance, and impartiality. Our content, created by leading finance and industry experts, is reviewed by a team of seasoned editors to ensure compliance with the highest standards in reporting and publishing.

https://farms.extension.wisc.edu/articles/understanding-the-statement-of-cash-flows/https://due.com/understanding-the-financials-of-venturing-into-a-livestock-business/