How to Calculate Enterprise Value (EV)

Enterprise Value (EV) is one of the most important metrics in corporate finance. It tells you the total value of a company — not just what shareholders own, but also what a buyer would need to pay to acquire the entire business.

In this article, we’ll explain how to calculate enterprise value, what it includes, and provide a calculator to help you estimate it quickly.

Table of Contents

♀️ What Is Enterprise Value?

Enterprise Value represents the full value of a business, including its equity, debt, and cash. It shows how much it would cost to purchase the entire company, including debt obligations and cash reserves.

It’s widely used in:

- Mergers and acquisitions

- Valuation modeling

- Ratio analysis like EV/EBITDA and EV/Sales

Use the calculator below to instantly estimate enterprise value based on market cap, debt, and cash.

⚙️ Enterprise Value Calculator

Cash and Cash Equivalents ($):

Calculate Enterprise Value Reset

Powered by onesdr.com

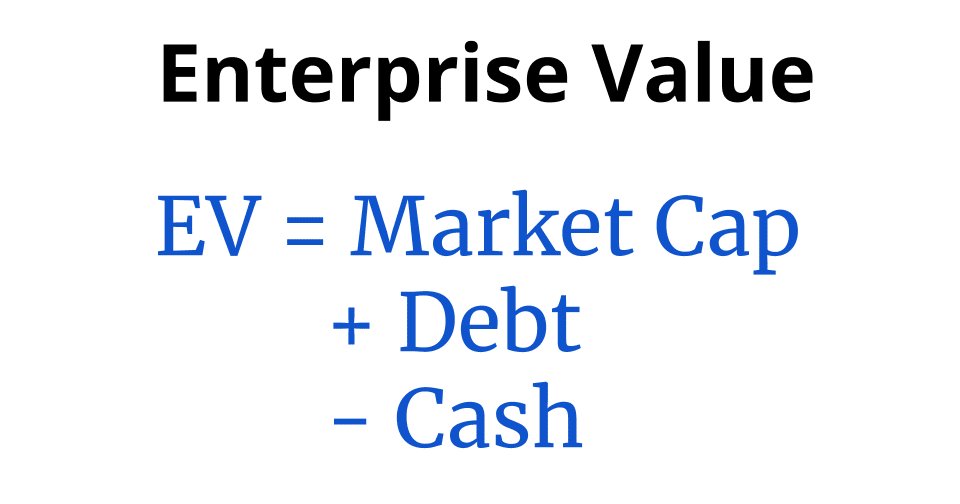

Enterprise Value Formula

The basic formula for Enterprise Value is:

EV = Market Capitalization + Total Debt – Cash and Cash Equivalents- Market Capitalization = Share Price × Total Shares Outstanding

- Total Debt = Short-term + Long-term debt

- Cash and Equivalents = All liquid assets

Example Calculation

Let’s say a company has:

- 10 million shares outstanding

- Share price = $40

- Total debt = $200 million

- Cash on hand = $50 million

Step 1: Market Cap = 10M × $40 = $400 million

Step 2: EV = $400M + $200M – $50M = $550 million

That’s the true cost to acquire the business.

⚖️ Why Enterprise Value Matters

Unlike equity value, which only shows the value for shareholders, EV provides a complete picture by including debt and subtracting cash.

- Compare companies with different capital structures

- Calculate more accurate valuation multiples

- Understand the actual “takeover price” of a company

Related Posts

Categories Blog, Calculators

OneSDR is reader-supported. As an Amazon Associate we earn from qualifying purchases. As a member of the eBay Partner Network we earn from qualifying purchases. We participate in the Etsy affiliate program. Thank you for your support.

- Disclaimer

- Privacy Policy

- Two Way Radio

- Amazon Deals ️

- About Us

OneSDR is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. When you click links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network. © 2025 oneSDR

Enterprise Value

Written by Kris Gunnars, BSc

Enterprise value (EV) is a metric that measures the total value of a company. It is more comprehensive than market capitalization because it also accounts for the company’s cash and debt levels.

You calculate it by taking a company’s market cap, then adding the total debt and subtracting the total cash.

Formula: EV = Market Cap + Total Debt – Total Cash

For companies with lots of debt or lots of cash, enterprise value is a much more useful way to measure the “true price” of a company or stock.

If you buy a company, then you also receive the company’s cash and debt. If the company has more debt than cash, then the true price of the company is higher because you will end up having to pay the debt.

But if the company has more cash than debt, then the true value of the company is lower because you can subtract the cash from the price.

Formula: how to calculate enterprise value

There are two commonly used formulas to calculate enterprise value. One of them is simple, but the other one is slightly more complex.

Simple formula:

Enterprise Value = Market Cap + Outstanding Debt – Cash & Equivalents

For this formula, all you need to know is:

- Market Cap: Stock price multiplied by the number of outstanding shares.

- Outstanding Debt: The sum of short-term and long-term debt on the company’s balance sheet.

- Cash and Equivalents: Amount of cash and cash-equivalents, such as short-term investments in marketable securities.

Complex formula:

A more complicated formula to calculate enterprise value also accounts for preferred stock and minority interest.

Enterprise Value = Market Cap + Preferred Stock + Outstanding Debt + Minority Interest – Cash & Equivalents

Most companies don’t have significant amounts of preferred stock or minority interest, so you won’t need to use the complex formula often.

Financial modeling

Professionals that are trying to put an exact value on a business may use much more comprehensive formulas. They might do detailed analyses of all the company’s assets and liabilities to figure out how much they are truly worth.

Enterprise value examples

(Note: The numbers below are for demonstration purposes and may not be up to date.)

Here’s how to calculate the enterprise value for a real company.

You find their market cap, which is widely available online. Then the amount of debt and cash and equivalents can be found on the balance sheet.

Apple (AAPL)

Apple (AAPL) has 4.38 billion shares outstanding and a stock price of $323. This gives them a market cap of 4.38 billion * $323 = $1,415 billion.

Apple also carries $205 billion in cash and $108 billion in debt on its balance sheet. Because of this, Apple’s enterprise value is $1,415B + $108B – $205B = $1,318 billion.

CVS Health (CVS)

CVS Health (CVS) has a market cap of $93 billion, with $8 billion in cash and $90 billion in debt. This gives them an enterprise value of $93B + $90B – $8B = $175B.

If someone were to buy CVS Health outright, then they would need to pay $93 billion. But they would also take on a lot of debt, making the true price closer to $175 billion.

Valuation metrics that use enterprise value

The enterprise value is used in many different valuation metrics. These include:

- EV/EBITDA: The EV to EBITDA ratio is often used instead of the more popular PE ratio. This removes all cash and debt, as well as interest payments, taxes, depreciation and amortization.

- EV/EBIT: The EV to EBIT ratio is similar to the EV/EBITDA ratio, except it does not remove depreciation and amortization.

- EV/Sales: The EV to sales ratio is often used instead of the P/S (price to sales) ratio.

- EV/FCF: The EV to free cash flow ratio uses free cash flow instead of earnings as the denominator.

Using enterprise value instead of price or market cap in valuation ratios can be useful to compare companies with different capital structures.

Enterprise value vs. the PE ratio

The PE ratio (price to earnings) can be calculated by dividing a company’s market cap by its earnings in the past 12 months.

However, this can be highly misleading for companies with a lot of debt. If someone were to buy such a company outright, they would end up having to cover the interest payments and pay the debt.

As an example, Verizon (VZ) stock has a PE ratio of 12.6, which seems relatively cheap. But if you use enterprise value instead of market cap, then the EV/Earnings ratio is 23.

In this case, using enterprise value instead of the market cap gives you a much more accurate picture of whether Verizon stock is cheap or not.

Negative enterprise value

A stock can have negative enterprise value. If the company has no debt but more cash than its market cap, then that makes the enterprise value lower than zero.

In theory, you would technically be getting paid for buying such a company outright. But takeovers usually require premiums to be paid above market prices.

You should be careful with such companies because there are probably good reasons why they are selling for such low prices.

https://www.onesdr.com/calculate-enterprise-value-ev/https://stockanalysis.com/term/enterprise-value/