Debt vs Equity: Impact on Cash Flow and Growth

Explore the pros and cons of debt and equity financing, and how each option impacts cash flow, ownership, and growth strategies for businesses.

Published on

January 5, 2025

Debt and equity financing are two key ways businesses raise funds, each with unique impacts on cash flow, ownership, and growth potential. Here’s a quick breakdown:

- Debt Financing: Borrow money, repay with interest. Keeps full ownership but requires regular payments, which can strain cash flow.

- Equity Financing: Sell part of your business for funding. No repayment stress, but you share ownership and profits.

Quick Comparison

| Factor | Debt Financing | Equity Financing |

|---|---|---|

| Ownership Control | Retains full ownership | Reduces ownership stake |

| Cash Flow Impact | Requires regular payments | No repayment needed |

| Cost Structure | Fixed interest (tax-deductible) | Shared profits or dividends |

| Risk Level | Higher risk during downturns | Investors share financial risk |

| Decision Making | Full control remains with owners | Shared authority in decisions |

| Growth Flexibility | Constrained by payment obligations | More room for operational growth |

The right choice depends on your financial health, growth goals, and risk tolerance. Many businesses use a mix of both to balance control, cash flow, and growth.

Debt Financing: Benefits and Drawbacks

Benefits of Debt Financing

Debt financing provides several advantages for mid-market companies. First, it allows you to keep full ownership and control over your business decisions. Second, interest payments on loans are tax-deductible, which can lower your taxable income and reduce the overall cost of borrowing. Third, the fixed monthly payments make it easier to plan and manage cash flow, especially for businesses with steady revenue streams.

Drawbacks of Debt Financing

One of the biggest challenges with debt financing is the requirement to make regular payments, no matter how your business is performing. This can be especially difficult during economic downturns, when revenue might fluctuate.

Taking on too much debt can lead to financial instability, damage your credit, and make it harder to secure future loans. Additionally, debt commitments can restrict your ability to invest in growth initiatives or adapt to changes in the market.

| Risk Factor | Impact |

|---|---|

| Regular Payments | Puts pressure on cash flow, even during low revenue periods |

| Leverage Risk | Can create financial instability and harm credit |

| Business Flexibility | Limits ability to explore new opportunities |

To manage these risks, it’s important to maintain a balanced debt-to-equity ratio and ensure you have enough cash flow to cover repayments. Consulting with financial advisors experienced in mid-market businesses can help you develop a debt strategy that supports your long-term goals while minimizing risks.

While debt financing offers control and structured payments, equity financing presents a different set of considerations, especially for companies looking for more adaptability.

Equity Financing: Benefits and Challenges

Benefits of Equity Financing

Equity financing offers businesses a way to secure funding without the pressure of repayment obligations, making it a useful option for companies with fluctuating revenue or those aiming for rapid expansion. Beyond just money, equity investors often bring industry expertise, valuable connections, and strategic advice, helping businesses tackle obstacles and identify growth opportunities. During tough economic times, this approach eases financial stress, allowing companies to focus on reinvestment and growth without the burden of debt.

| Benefit | Impact on Business |

|---|---|

| Cash Flow Flexibility | Frees businesses from repayment obligations, reducing financial strain |

| Investor Resources | Provides access to expertise, networks, and guidance |

| Growth Capital | Funds expansion efforts without adding debt |

Challenges of Equity Financing

Despite its benefits, equity financing isn’t without its downsides. Selling equity means giving up a portion of ownership, which can dilute control over business decisions. Over time, sharing profits and ownership can become more expensive than traditional debt financing, especially for companies that grow substantially.

Another hurdle is managing relationships with investors. Equity investors often demand regular updates, board representation, and a say in major decisions. Conflicts may arise if their priorities don’t align with the company’s leadership.

“The decision between debt and equity financing requires careful evaluation of your company’s financial health, growth prospects, and risk tolerance”, says David Metzler of Phoenix Strategy Group.

Working with experienced advisors can help structure equity deals that align with business objectives while maintaining healthy investor relationships. Understanding these factors is key to comparing equity financing with other funding options like debt financing.

Debt vs Equity: A Side-by-Side Comparison

Debt vs Equity Comparison Table

Mid-market companies need to weigh how financing options affect their operations and growth potential. Below is a comparison that outlines the main differences between debt and equity financing:

| Factor | Debt Financing | Equity Financing |

|---|---|---|

| Ownership Control | Retains full ownership | Reduces ownership stake |

| Cash Flow Impact | Requires regular payments | No repayment needed |

| Cost Structure | Fixed interest payments (tax-deductible) | Shared profits or dividends |

| Risk Level | Higher risk during downturns | Investors share financial risk |

| Decision Making | Full control remains with owners | Shared authority in decisions |

| Growth Flexibility | Constrained by payment obligations | More room for operational growth |

| Exit Requirements | Repayment required as per terms | No repayment obligations |

| Additional Benefits | Tax deductions on interest | Access to expertise and networks |

These distinctions help companies decide which financing route aligns with their goals and circumstances.

Choosing Between Debt and Equity

For mid-market companies looking to balance growth with financial stability, the right financing choice depends on their specific goals and situation.

- Debt financing works well for businesses with steady revenue and predictable cash flow. For example, manufacturing companies with stable contracts and consistent profit margins often manage debt payments with ease.

- Equity financing is better suited for businesses in high-growth industries or those operating in unpredictable markets. Startups and tech companies, with irregular revenue streams and a need for capital without immediate repayment, often lean toward equity.

Key considerations include:

- Debt is ideal for companies with strong cash flow and stable finances, while equity suits businesses in volatile or fast-growing markets.

- When interest rates are high, equity may be a better option, whereas low rates make debt more attractive.

- Many successful mid-market firms combine both debt and equity, adjusting their mix based on market trends and growth opportunities.

A balanced approach often proves to be the most effective strategy. Combining debt and equity allows businesses to manage risks while capitalizing on opportunities, adapting as their needs and the market evolve.

sbb-itb-e766981

Considerations for Mid-Market Companies

Aligning Financing with Business Goals

Mid-market companies need to carefully match their financing choices with their overall business strategies. For instance, businesses with steady revenue streams and a solid market position might lean toward debt financing to cover working capital needs. On the other hand, companies aiming for quick expansion or entering new markets could find equity financing a better fit.

Timing and objectives play a key role. Often, a mix of approaches works well – using debt for projects that generate revenue and equity financing for long-term growth plans that require more patience.

Evaluating Financial Health

Before deciding on a financing route, a thorough check of the company’s financial health is essential. This involves focusing on three critical metrics:

| Financial Metric | Target Range | Impact on Financing Decisions |

|---|---|---|

| Debt-to-Equity Ratio | 1.5-2.0 | Higher ratios reduce the ability to take on more debt |

| Operating Cash Flow | 1.5x debt service | Reflects capacity to handle additional debt |

| Gross Profit Margin | Industry-dependent | Measures ability to cover debt obligations |

Stable cash flow often makes debt financing a good choice, while uncertain cash flow may push companies toward equity. Once financial health is clearly assessed, experienced advisors can help craft financing strategies that align with the company’s goals.

Using Financial Advisors

Bringing in financial advisors can significantly improve financing decisions. Advisors, such as Phoenix Strategy Group, bring expertise in deal structuring and strategy optimization, using tools like cash flow forecasting and financial modeling.

Here’s how advisors add value:

- Offer detailed analysis of financial metrics and growth plans

- Provide access to advanced forecasting tools and market insights

- Objectively assess financing options

- Assist in structuring and negotiating terms

It’s important to choose advisors who understand your industry and growth stage. The right advisor can help balance immediate financing needs with long-term goals, ensuring your decisions drive growth without creating unnecessary future challenges.

Conclusion: Making Smart Financing Choices

Key Points to Keep in Mind

Debt financing allows you to maintain full ownership and offers tax advantages but requires careful cash flow management to meet repayment obligations. On the other hand, equity financing removes repayment stress and brings investor support, but it means sharing ownership and profits. The best choice depends on factors like:

- Your current financial health and cash flow stability

- Long-term growth plans and opportunities in the market

- How much control you want to retain over operations

Steps to Take Next

Start by analyzing your company’s key financial metrics to figure out the best financing option for your situation. Collaborate with seasoned advisors who can break down your choices and structure deals to align with your business goals. When weighing your options, think about the following:

| Factor | Debt Financing | Equity Financing |

|---|---|---|

| Timeline | Best for short to medium-term needs | Ideal for long-term growth goals |

| Control | Retain full operational control | Shared decision-making |

| Growth Support | Limited to the capital provided | Includes expertise and connections |

“The decision between debt and equity financing requires careful evaluation of your company’s financial health, growth prospects, and risk tolerance”, says David Metzler of Phoenix Strategy Group.

Experts like those at Phoenix Strategy Group can offer critical insights through tools like cash flow forecasting and financial modeling. These tools help you see the potential impact of various financing options on your business growth.

FAQs

Is it better for a company to have more debt or equity?

Deciding between debt and equity depends on your company’s specific situation. Debt financing can often be less expensive because lenders charge fixed interest payments, which are usually lower than the returns expected by equity investors.

The right mix of debt and equity depends on factors like your company’s cash flow, growth stage, tax position, and risk tolerance. For instance:

- Cash Flow Stability: If your cash flows are steady, debt financing might be a better option due to its tax benefits.

- Growth Stage: Companies in high-growth phases may lean toward equity to avoid the pressure of fixed repayments.

- Tax Position: Profitable companies can take advantage of debt’s tax-deductible interest.

- Risk Tolerance: If your company prefers to avoid risk, keeping debt levels moderate is wise.

| Factor | Impact on Financing Choice |

|---|---|

| Cash Flow Stability | Steady cash flows make debt financing appealing |

| Growth Stage | High-growth companies often lean toward equity |

| Tax Position | Profitable firms benefit from debt’s tax advantages |

| Risk Tolerance | Lower risk tolerance suggests less reliance on debt |

While debt is typically cheaper, it requires reliable cash flow to meet repayment obligations. On the other hand, equity can offer flexibility and bring in investors who may provide strategic guidance. Balancing these options depends on your company’s financial health, growth ambitions, and operational priorities – all factors we’ve explored earlier in this article.

Related Blog Posts

- 5 Cash Flow Management Strategies for Growth Companies

- How Financial Strategy Supports Business Growth

- Why Cash Flow Sensitivity Analysis Matters for Startups

- Debt vs Equity: Cost of Capital Comparison

Healthcare Capital Markets Outlook: Short-Term Opportunities Versus Long-Term Uncertainty

Kelly Arduino

April 25, 2018 3:18 pm

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Healthcare organizations are entering a time of uncertainty in the capital markets due to policy shifts, yet the current climate remains conducive to maintaining the trajectory of current investment strategies.

The healthcare industry is experiencing a period of relative stability in its capital markets today, in which borrowers continue to enjoy lower-than-average interest rates and flexible terms with options for direct placement with banks, the public market, and advantageous governmental programs. Yet it also is seeing incremental change, with the market having begun the climb from historic low rates. This change means organizations should not only prepare for a higher cost of capital, but also be open to considering alternative financing structures that require a lengthier completion process and ongoing monitoring.

The outlook becomes hazy, however, as one’s perspective on healthcare capital markets shifts from the short term to the long term because of recent significant policy developments advanced by the Republican Congress and the Trump administration, as well as various other factors. The policy changes, coupled with the dynamic of new players entering the healthcare business, suggest that over the long term the healthcare industry can expect to see new debt structures, new sources, and eventually, new metrics for monitoring and assessing the credit strength of an organization.

Over the long term, changes in the federal tax law stemming from enactment of the Tax Cuts and Jobs Act (TCJA) in late 2017, volatility in both the debt and equity markets, Federal Open Market Committee (FOMC) policy under Jerome Powell, the new Chairman of the Federal Reserve, and changing investors’ perceptions will shape the cost and structure for healthcare borrowers for the foreseeable future. Further, nontraditional healthcare organizations and management teams are entering the healthcare market, bringing with them different ideas regarding options for financing capital.

Many changes will be gradual. Although some minor changes in the status quo for borrowing will occur in 2018 going into 2019, healthcare borrowers can expect to see more radical changes with the ongoing effects of tax reform and the further influx of nontraditional players changing the healthcare business landscape.

In the current environment, hospitals and health systems, and not-for-profit organizations in particular, should have a clear understanding of what has changed and how will it affect the current capital landscape, and they should be familiar with the evolving landscape of new structures and alternative financing options that are likely to become increasingly important for borrowers in the future landscape.

A Closer Look at the Current Environment and How It’s Changing

Today, historically favorable market conditions are holding for both large and highly rated multihospital systems and urban medical centers, and for smaller community and rural hospitals that may be below investment grade or unrated by the major credit rating agencies. To date, interest rates have increased by about 0.5 percent, 30-year tax-exempt bond rates are hovering around 4.25 percent, and shorter-term debt, as well as debt undergoing an interest rate reset, can be as much as 1 percent costlier than in the recent past. However, as policy changes begin to bring about shifts in the cost and availability of capital, the likely future effects of the TCJA and the FOMC’s recent motions in shaping the new normal are worth considering.

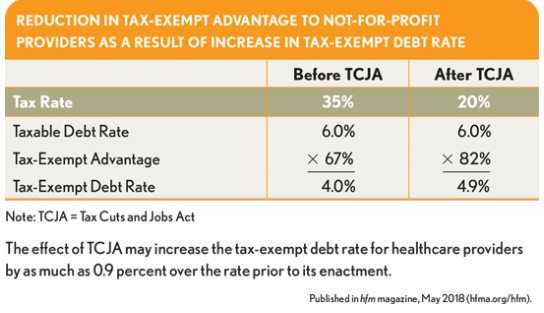

Predictably, given that the Federal Reserve already has made one interest-rate hike in 2018, and another two are expected this year, the cost of capital has increased and can be expected to increase further. Less predictable is the likely impact of the reduced corporate tax rate on tax-exempt providers. Not-for-profit and municipal health systems traditionally have used tax-exempt debt to finance projects. The benefit of tax-exempt debt is that the bondholder does not pay taxes on the interest received and, in exchange, accepts a lower interest rate. The relationship between the interest rate and the benefit to the borrower has roughly corresponded to the corporate tax rate. With the drop in the corporate tax rate under the TCJA from 35 percent to 20 percent, the benefit of avoiding taxes is reduced, and if this relationship holds, tax-exempt institutions will see a significant increase in capital costs, as depicted in the exhibit below.

Challenges with direct placement debt. Indications of how this dynamic will affect interest rates can be seen in tax-exempt direct placement debt. Direct placement refers to debt purchased by a single bank or other investor (e.g., insurance company). This debt often includes a clause in the loan documents in which a change in the corporate tax rate triggers an interest rate increase or, in some instances, an automatic reissuance of the debt. Few paid attention to such clauses in years past.

To date, the application of such clauses, with increases in interest rates, appears to vary significantly depending on the debt holder. In the first quarter 2018, however, many borrowers received notification that their interest rate would increase by amounts ranging from 0.25 percent to 1 percent. For organizations that are potentially subject to such increases, or that have debt clauses that require reissuances, it may be time to renegotiate the capital structure and gain greater flexibility for managing changes in interest rates.

Although an environment with rising interest rates is expected, investors’ high demand for tax-exempt debt, which provides stable returns and liquidity, may mitigate some of the increase. It is generally believed that, for the near term, average long-term tax-exempt bond fixed rates will continue to range between 4.25 percent and 5 percent. Over the long term, however, the new corporate tax rate will drive the cost of tax-exempt debt further upward. How much and when remain to be seen.

The Demand for Capital Financing Remains Strong Amid Market Changes

Demand for debt financing has not slowed, but financings from here forward may require changes from past practices. Healthcare organizations not only should include higher debt costs in planning forecasts of financial performance, but also should consider taking a longer-term look at flexibility of financings.

Available options are changing.For example, advance refundings—mechanisms for allowing a borrower to refinance debt prior to the call period—are no longer allowed. (The call period is the lock-out period, typically lasting 10 years, during which the bonds cannot be paid off or refinanced without penalty.) When interest rates were low, many borrowers used the advance refunding option by folding existing debt into a financing for a new project, resulting in an overall interest rate.

To illustrate, consider that a bond has a call period of 10 years, and that in the eighth year of the payback, interest rates are significantly lower than when the bonds were issued. With an advance refunding option, an escrow fund could have been set up and funded by new lower-rate debt until year 10, at which time the old bonds could be paid off entirely and the new lower-rate debt put in its place.

A possible remedy may be to consider shorter call periods, such as five years or less, although with this approach, the interest rate paid may be slightly higher. The benefit of such an approach is that the organization can react to lower interest rates or change its debt portfolio—by extending the payback period or changing debt covenants, for example.

With new debt issues, organizations should consider other creative ways to maintain flexibility, such as multimodal structures. Such structures allow for some flexibility regarding the bond modes, which refers to how the bonds are offered. Modes include commercial paper, variable-rate demand bonds, or long-term fixed-rate bonds. An example is debt issued today in the form of a variable-rate demand bond that allows for conversion to a long-term fixed-rate bond without the need for refinancing or reissuing the debt. This approach is cost-effective and allows the borrower to easily make changes to its overall debt portfolio (i.e., changing percentage of fixed-rate to variable-rate debt). Additional flexibility can be obtained on direct placement debt with interest rate resets, but such an approach is best pursued with the assistance of skilled legal counsel.

Further nuances in the debt documentation can allow for additional flexibility at the time of an interest-rate reset. Language that allows the lender and borrower to mutually agree to changes regarding when the interest rate sets again (e.g., from five to 10 years), which index rate will apply (e.g., prime rate, the London Inter-Bank Offer Rate, Treasuries), and under what conditions the credit spread (i.e., additional charge beyond the index rate) can be reevaluated should be incorporated into the loan agreement. Such language can be advantageous to both parties by allowing adaptation of the debt to capital market conditions when the time comes for the next interest-rate reset.

Although multimodal debt and other alternative language are not widely used today, this approach is representative of the innovative thinking that is being applied to developing new borrowing structures. Borrowers also should be familiar with the various alternative financing instruments that are available and be able to assess which of these options might be advantageous for their circumstances.

Alternative Financing Instruments

In the current rising-interest-rate environment, alternative financing options will become more important for borrowers that do not have a high credit rating, or that cannot achieve one because of their size and/or financial performance. Viable financing options continue to be available in the taxable debt markets as well as through government-supported programs. The following are a few of the most prominent options among the many that are available.

Taxable bond offerings. Taxable bonds could become more prolific, with usage extending across a wider range of borrowers than has been seen historically. Usually reserved for public offerings of borrowers with high-investment-grade ratings (A1/A+ and better) issuing large amounts of debt (over $100 million), the taxable bond markets have become increasingly receptive to offerings by not-for-profit healthcare organizations over the past year. With the differential between taxable and tax-exempt rates, the avoidance of the additional documentation and debt issuance may be worth a slightly higher rate.

A recent example is Stanford Health’s $500 million offering of 30-year taxable bonds carrying an AA-/Aa3 (high investment grade) rating, with a yield to investors of 3.795 percent. Smaller issuers could benefit from avoiding fully funding a debt service reserve fund and look to other options, such as a drawdown on the project fund during construction, thereby reducing the capitalized interest cost.

HUD-insured mortgages. Acting through Sections 242, 241, 232 and 223(f) of the National Housing Act, the U.S. Department of Housing and Urban Development (HUD) offers mortgage insurance on hospital facilities seeking both construction financing and existing debt refinancing. The result is a lower cost of borrowing than could be obtained simply based on the organization’s credit rating. Because HUD-insured hospital loans allow for a 90 percent loan to value, which can include existing property plant and equipment, the required equity into a project is reduced, allowing the borrower to preserve cash. With fixed-rate debt for up to 28 years, this program is widely used by borrowers with low or sub-investment-grade ratings. The program has become more efficient in processing loans, but it continues to be more onerous to access than other options—the tradeoff being the lower cost of borrowing.

USDA Rural Development CF Programs. The U.S. Department of Agriculture (USDA) offers two types of financing for rural development that continue to be attractive for qualified healthcare organizations: the Community Facilities (CF) Direct and Guaranteed Loan Programs. The Direct Loan Program, with $2.2 billion authorized for lending in FY18, makes loans directly to the borrower, with fixed rates amortized for up to 40 years. At a current rate of 3.87 percent with no application fees and no covenants, this option provides rates and terms even highly rated entities cannot access. Often a direct loan is paired with a CF Guaranteed Loan, providing the lender with a 90 percent guarantee from USDA on principal. To qualify for a USDA CF loan, a project must be undertaken solely by a locally owned and controlled not-for-profit entity or a municipal entity located in a rural area or town with a population of up to 20,000. Because the program has a long track record of success and wide political appeal, it is likely to continue well into the future.

Impact of Disrupters on Capital Spending and Financing Mechanisms

An additional trend that promises to have an important impact on healthcare capital markets in the future is the entry of “disrupters” into the markets—that is, new players with new ways of looking at the healthcare business. These disrupters include not only non-healthcare organizations entering the healthcare business but also executives from other industries who bring with them new ideas of how to manage healthcare organizations.

A prominent recent example of this trend was the announcement in January of a healthcare collaboration involving Amazon, Berkshire Hathaway, and JPMorgan Chase to establish an independent healthcare company for their employees (the exact nature of which is yet to be determined).

a Other new partnerships include the following:

- A partnership between Allscripts and Lyft focused on helping patients make appointments b

- CVS’s acquisition of Aetna, aimed at creating distribution synergies c

- Apple’s official entry into the electronic health record market d

Concurrently, the influx of new executives recruited from other industries to lead newly merged systems and provide innovative thinking brings other disruptions. Many of these executives are from retail or service industries and won’t necessarily rely on traditional strategic and financial definitions of performance and success. Instead of market share, a key metric could be “cost of new customer acquisition,” with strategies developed around such metrics.

The implication of such developments for the capital markets is that capital investment may shift the focus of health care away from facilities. For example, a company might develop an app to maximize supply chain management or to market and implement a customer loyalty program. Instead of developing budgets by hospital department contribution margin, the budgeting focus is likely to tilt toward profitability by patient and number of ancillary services purchased. Such an approach will become particularly relevant as health care shifts to remote delivery of assessment and services through improved telehealth access. If health care becomes managed by more retailers and marketers, one could easily imagine a time when patients might be able to purchase their own “exceptional hospital beds,” with free delivery to their homes after discharge, along with meal delivery designed by the provider’s in-house nutritionist and chef.

Traditional healthcare financing mechanisms are not currently equipped for this type of underwriting, but private equity and to some degree public equity are better positioned to assist.

New organizations and partnerships bring different approaches to raising capital. Many of these companies have large balance sheets, can raise equity through stock sales, and lack a traditional not-for-profit hospital’s constraints on how they can use the money. The requirements of bricks and mortar to collateralize a bank loan or the need to follow the rules of average life and approved uses of funds are not relevant. A tax-exempt bond opinion is unnecessary.

Perhaps investors will be more comfortable with this type of debt. After all, they don’t have to understand what a diagnosis-related group (DRG) is or master the complexity of contractual allowances. Not only will earnings before interest, taxes, depreciation, and amortization (EBITDA) and ROI be paramount in underwriting, but also—unlike with bond funds—equity investors may want to become more involved in running the business, introducing another dynamic that would shape the future of healthcare business.

In this environment, looking at the financial performance of a health system overall becomes more relevant than slicing and dicing financial performance by individual facility. With this change in perspective, the capital plan for investment will emphasize the contribution to the whole rather than individual financial metrics of particular sites, thereby denoting a definitive move away from assessment based on geography to one based on patient contribution regardless of where care is delivered in the health system.

Balancing Near-Term Need With Long-Term Readiness

Despite looming changes in the healthcare industry and the rollout of new federal requirements, capital at favorable rates and terms will continue to be available in the near term. The cost of capital will be higher than the historically low-rate environment enjoyed over the past decade, but options for shorter terms, use of taxable debt, and governmental programs will mitigate some of the increases. Healthcare organizations should model increased financing costs as part of their capital planning process and adjust accordingly as they continue to look for new “best practices.” The resiliency of the capital markets, with emerging new structures and products, bodes well for well-run healthcare borrowers in need of capital for well-conceived projects.

Looking longer term into the future capital landscape, more radical change is ahead. How and when that change will occur is hard to predict, but the shifting landscape of companies and expertise managing the healthcare business will undoubtedly exert a greater impact on the cost of capital than that resulting from near-term changes. The healthcare industry can expect to see news of further disruptions in the months and years to come, and some of them may be profound. The need to maintain a flexible approach to capital finance and planning will be paramount, and organizations should pay close attention to emerging debt structures and trends.

https://www.phoenixstrategy.group/blog/debt-vs-equity-impact-on-cash-flow-and-growthhttps://www.hfma.org/finance-and-business-strategy/capital-finance/60452/