Demystifying Investment Banking: An introduction

Stephen Barnett, former Investment Banker and AmplifyME’s Director of Corporate Finance, kicks off the first in a six-part series of blogs designed to demystify the world of Investment Banking. These blogs aim to provide students and graduates with the information and tools needed to make the most informed choices about their future.

May 24 / Rachel Aspinall

Setting the scene

Let’s start with a question:

What’s the difference between Investment Banking, Corporate Finance, IBD, Advisory and Global Banking? Of course, this is a trick question – they are all terms for (roughly) the same thing.

In finance we have tend to find as many ways as possible to confuse the uninitiated.

So, over the next six weeks we are going to attempt to demystify Investment Banking, taking you on a jargon-free journey through this exciting, highly competitive area of the bank.

Let’s start with a question:

What’s the difference between Investment Banking, Corporate Finance, IBD, Advisory and Global Banking? Of course, this is a trick question – they are all terms for (roughly) the same thing.

In finance we have tend to find as many ways as possible to confuse the uninitiated.

So, over the next six weeks we will demystify Investment Banking, taking you on a jargon-free journey through this exciting, highly competitive area of the bank.

Defining our terms and busting the jargon

Investment Banking is the catch-all term for a division within a bank that helps facilitate, or broker, transactions between companies and investors, companies and other companies or investors and other investors. In return for this service, they get (lots of) fees.

Investment banking can be roughly split in two: Global Banking and Global Markets. The fundamental difference between the two is who pays you – in Global Banking, your client is a company looking to raise funds, or buy another company, or restructure.

In Global Markets (also known as Sales and Trading), your clients are investors (asset managers, hedge funds) looking to buy and sell investments at the best price.

In reality, these two divisions are very different and, by law, should not interact with each other (for example, Global Bankers might hold non-public information about a company that the Sales and Trading teams are not allowed to know about).

Frustratingly, when people talk about Investment Banking, or IBD, they often mean Global Banking – the division of the bank that serves companies seeking to undertake significant and strategic initiatives.

For the remainder of the series therefore, we will use Investment Banking and IBD (Investment Banking Division) interchangeably – our clients are companies, and we are doing fun things like capital raising, Mergers and Acquisitions and restructuring.

As Investment Bankers, you are brokers, helping to facilitate transactions, be it between a buyer of a company, and a seller (Mergers and Acquisitions), the issuer of a bond and an investor (Debt Capital Markets), or an issuer of Equity and an investor (Equity Capital Markets).

Moreover, you quickly become trusted advisors to the leadership teams of companies. You are operating on a strategic level, helping companies execute sometimes transformational (and often risky) transactions. You do a lot of ‘free’ strategic work, helping company management set and execute their corporate strategy, providing industry updates and insight on a competitor’s strategy in the hope that you will land a mandate for some big, fee-paying business (for example, as a bookrunner on a company’s Initial Public Offering).

Investment Banking is the catch-all term for a division within a bank that helps facilitate, or broker, transactions between companies and investors, companies and other companies or investors and other investors. In return for this service, they get (lots of) fees.

Investment banking can be roughly split in two: Global Banking and Global Markets.

The fundamental difference between the two is who pays you – in Global Banking, your client is a company looking to raise funds, or buy another company, or restructure.

In Global Markets (also known as Sales and Trading), your clients are investors (asset managers, hedge funds) looking to buy and sell investments at the best price.

In reality, these two divisions are very different and, by law, should not interact with each other (for example, Global Bankers might hold non-public information about a company that the Sales and Trading teams are not allowed to know about).

Frustratingly, when people talk about Investment Banking, or IBD, they often mean Global Banking – the division of the bank that serves companies seeking to undertake significant and strategic initiatives.

For the remainder of the series therefore, we will use Investment Banking and IBD (Investment Banking Division) interchangeably – our clients are companies, and we are doing fun things like capital raising, Mergers and Acquisitions and restructuring.

As Investment Bankers, you are brokers, helping to facilitate transactions, be it between a buyer of a company, and a seller (Mergers and Acquisitions), the issuer of a bond and an investor (Debt Capital Markets), or an issuer of Equity and an investor (Equity Capital Markets).

Moreover, you quickly become trusted advisors to the leadership teams of companies. You are operating on a strategic level, helping companies execute sometimes transformational (and often risky) transactions.

You do a lot of ‘free’ strategic work, helping company management set and execute their corporate strategy, providing industry updates and insight on a competitor’s strategy in the hope that you will land a mandate for some big, fee-paying business (for example, as a bookrunner on a company’s Initial Public Offering).

The structure of investment banks

All investment banks are different, however the big ones tend to follow a similar organisational structure. A typical IBD ‘floor’ will consist of product teams and sector teams.

The main product teams are:

- Mergers & Acquisitions – helping companies buy, sell, dispose and spin off (covered in week 1).

- Equity Capital Markets – helping companies raise capital through the issuance of new equity (week 2).

- Debt Capital Markets – helping companies raise capital through the issuance of new debt (week 3).

- Leveraged Finance – helping non-investment grade companies raise capital through debt issuance (often as part of a Private Equity backed Buyout) (week 4).

- Restructuring – helping companies and government restructure their debt and organisational structure if they get into trouble (week 5).

Sector teams are a little bit different. They are specialists in a particular sector (Industrials, Real Estate, Healthcare etc.) and maintain strong relationships with companies within that sector, advising on corporate strategy, including capital raising and mergers and acquisitions. We will cover sector teams in week 6.

All investment banks are different, however the big ones tend to follow a similar organisational structure. A typical IBD ‘floor’ will consist of product teams and sector teams.

The main product teams are:

- Mergers & Acquisitions – helping companies buy, sell, dispose and spin off (covered in week 1).

- Equity Capital Markets – helping companies raise capital through the issuance of new equity (week 2).

- Debt Capital Markets – helping companies raise capital through the issuance of new debt (week 3).

- Leveraged Finance – helping non-investment grade companies raise capital through debt issuance (often as part of a Private Equity backed Buyout) (week 4).

- Restructuring – helping companies and government restructure their debt and organisational structure if they get into trouble (week 5).

Sector teams are a little bit different. They are specialists in a particular sector (Industrials, Real Estate, Healthcare etc.) and maintain strong relationships with companies within that sector, advising on corporate strategy, including capital raising and mergers and acquisitions. We will cover sector teams in week 6.

Ready to put theory into practice?

Check out our flagship M&A Finance Accelerator delivered in partnership with UBS. Register for the next event below and step into the role of Junior Analyst at an investment bank.

Check out our flagship M&A Finance Accelerator delivered in partnership with UBS. Register for the next event below and step into the role of Junior Analyst at an Investment Bank.

Corporate Finance vs Investment Banking

Difference Between Corporate Finance vs Investment Banking

If you are a finance student aspiring to enter the world of finance with a bang, then you must be aware of two of the most promising career choices in this domain – Corporate Finance and Investment Banking. Both profiles are extremely competitive and offer excellent career paths with prospects to grow exponentially. This article, Corporate Finance vs Investment Banking, would dig deeper into both job profiles and provide a better understanding of the subtle differences between the two in terms of the nature of work, work-life balance, compensation, and other aspects.

Valuation, Hadoop, Excel, Mobile Apps, Web Development & many more.

What is Corporate Finance?

As the name suggests, corporate finance deals with decisions pertaining to a company’s capital structure, actions taken by the management, and the sourcing of funds. One of the main objectives of corporate finance is to increase shareholder value, which is only possible if the firm’s value goes up. So, it guides the critical steps to be taken to increase the firm’s value through the appropriate implementation of the available recourses of finance. It focuses on three aspects of a corporation – capital structure, capital budgeting, and working capital management.

What is Investment Banking?

Investment banking is a distinct division of the banking sector, and it offers advisory services to help companies raise funds through securities. It either helps the securities issuing companies go public or acts as the intermediary between them and prospective subscribers. In addition, it advises on how to raise funds for the companies. Some of the few notable globally recognized investment bankers who have operated as both underwriters and mediators include Goldman Sachs, Morgan Stanley, JP Morgan Chase, etc.

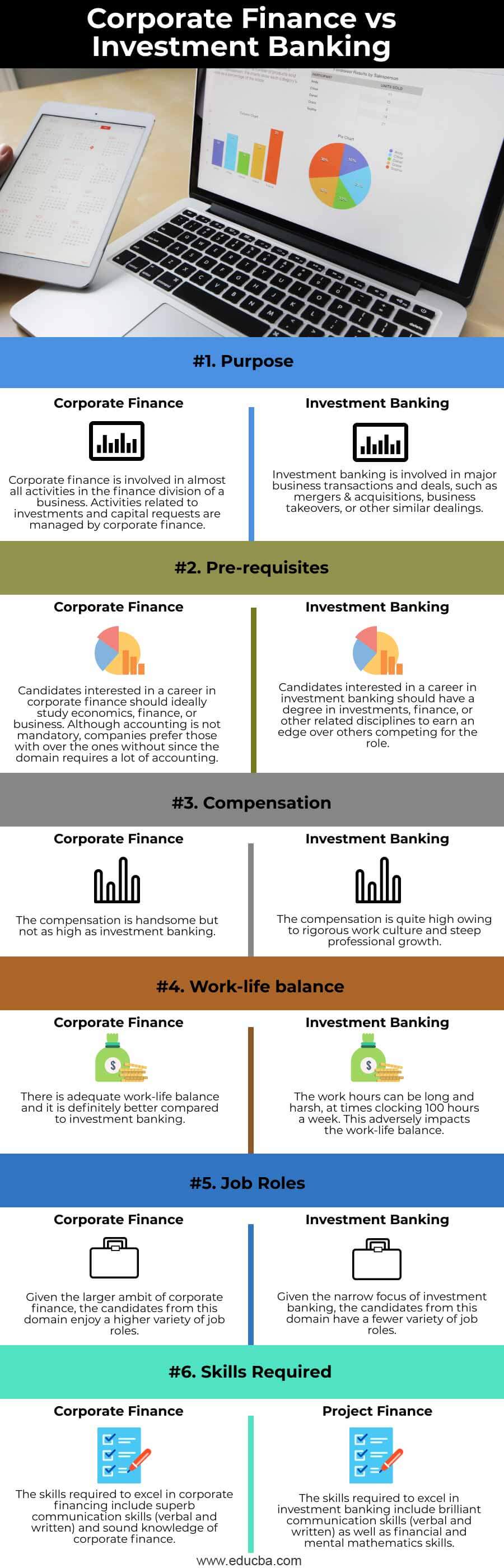

Head To Head Comparison Between Corporate Finance vs Investment Banking (Infographics)

Below is the top Comparison between Corporate Finance vs Investment Banking:

Key Differences Between Corporate Finance vs Investment Banking

Some of the key differences between Corporate Finance vs Investment Banking are as follows:

- One of the key differences between corporate finance and investment banking is the mode of financing used in each of them. Corporate finance primarily focuses on decisions pertaining to capital structure – debt financing vs equity funding, along with analysis of profitability and costs of financial projects. On the other hand, investment banking is explicitly into helping a business raise capital through stock trading or other means.

- Corporate finance is a broader concept, while investment banking can be seen as one small unit. Essentially, investment banking can be deemed to fall under the ambit of corporate finance because the former is another form of financing.

- The investment banking teams are usually small, and the working is inverted bottom-up, which means the team needs to bear most of the workload. Thus, a 100-hour week is common in this domain, where social life sometimes grinds to a complete halt. Although, on the other hand, the work culture is relatively comfortable in the corporate finance space, the working hours are certainly not as grueling. But this is also why investment banking professionals get paid way higher than corporate finance analysts.

Corporate Finance vs Investment Banking Comparison Table

Below is the 6 topmost comparison between Corporate Finance vs Investment Banking:

| Head | Corporate Finance | Investment Banking |

| Purpose | Corporate finance is involved in almost all activities in the finance division of a business. Activities related to investments and capital requests are managed by corporate finance. | Investment banking involves major business transactions and deals, such as mergers & acquisitions, business takeovers, or other similar dealings. |

| Pre-requisites | Candidates interested in a career in corporate finance should ideally study economics, finance, or business. Although accounting is not mandatory, companies prefer those with over the ones without since the domain requires a lot of accounting. | Candidates interested in a career in investment banking should have a degree in investments, finance, or other related disciplines to earn an edge over others competing for the role. |

| Compensation | The compensation is handsome but not as high as investment banking. | The compensation is high due to the rigorous work culture and steep professional growth. |

| Work-life balance | There is adequate work-life balance, which is better than investment banking. | The work hours can be long and harsh, sometimes clocking 100 hours a week. This adversely impacts the work-life balance. |

| Job roles | Given the larger ambit of corporate finance, the candidates from this domain enjoy a higher variety of job roles. | Given the narrow focus on investment banking, the candidates from this domain have a fewer variety of job roles. |

| Skills required | The skills required to excel in corporate financing include superb communication skills (verbal and written) and sound knowledge of corporate finance. | The skills required to excel in investment banking include brilliant communication skills (verbal and written) as well as financial and mental mathematics skills. |

Conclusion

So, while making a career choice, you should try to evaluate the available options in an objective manner. Basically, you should compare your skills with the ones required for the role and check whether or not you fit into their work culture. It holds true for both career options. Although both are highly competitive areas in finance, investment banking has the edge regarding the salary offered and professional growth prospects. The work-life balance should also be factored into the decision because it can be a deal-breaker for many who prefer spending creative time away from work. However, any one factor mustn’t strongly influence the decision, be it the work hours or the compensation. You should try to have a balanced view of the given criteria and then decide on the job role.

Recommended Articles

This has been a guide to the top difference between Corporate Finance vs Investment Banking. Here we also discuss the key differences between Corporate Finance vs Investment Banking with infographics and a comparison table. You may also have a look at the following articles to learn more.

- Commercial Bank vs Investment Bank

- Investment Banking vs Private Equity

- Management Consulting vs Investment Banking

- Merchant Banking vs Investment Banking

Primary Sidebar

all.in.one: FINANCE – 750+ Courses | 6133+ Hrs | 40+ Specializations | Tests | Certificates 6133+ Hours of HD Videos | 40+ Learning Paths | 750+ Courses | 40+ Projects | Verifiable Certificate of Completion | Lifetime Access

all.in.one: AI & DATA SCIENCE – 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates 4655+ Hours of HD Videos | 80+ Learning Paths | 470+ Courses | 50+ Projects | Verifiable Certificate of Completion | Lifetime Access

https://amplifyme.com/blog/demystifying-investment-banking-an-introductionhttps://www.educba.com/corporate-finance-vs-investment-banking/