A Guide to Unit Investment Trusts (UITs)

SmartAsset maintains strict editorial integrity. It doesn’t provide legal, tax, accounting or financial advice and isn’t a financial planner, broker, lawyer or tax adviser. Consult with your own advisers for guidance. Opinions, analyses, reviews or recommendations expressed in this post are only the author’s and for informational purposes. This post may contain links from advertisers, and we may receive compensation for marketing their products or services or if users purchase products or services. | Marketing Disclosure

If you have an investment portfolio or a 401(k), you’ve probably invested in a mutual fund. You may have also invested your savings in an ETF. Another similar option for investors who don’t want to buy individual securities is a unit investment trust (UIT). They’re similar to mutual funds, but they’re a more static investment, offering a fixed basket of securities for a fixed amount of time. Learn how UITs work and how to invest in them.

Consider working with a financial advisor as you pursue your investment strategy and tactics.

Unit Investment Trust Basics

A unit investment trust is a type of investment that offers a fixed portfolio of securities to an investor. Stocks and bonds generally comprise a UIT. Investors can be redeem them after a set period of time has passed. This is also known as the fund’s maturity date.

Unit investment trusts are one of the main types of investment companies. In this case, the term investment company refers to a company that pools investors’ money to purchase a group of stocks, bonds, and other securities. Other examples of investment companies are mutual funds and exchange traded funds (ETFs).

UITs are fixed investments, earning investors income in the form of dividends and capital appreciation. Dividends are the quarterly payments made from a company’s earnings to its shareholders, while capital appreciation is the profit earned when the price of the securities within the UIT increases over the life of the fund. Unit investment trusts require a small initial investment. That, paired with the fund’s low risk and high diversification factors, make them relatively desirable.

Unlike a mutual fund, in which fund managers can buy or sell securities at any time, UITs are not actively traded and have a set maturity date, usually 15 to 24 months from the outset of the fund, at which point the securities are purchased back from the investor and profits are earned, if any. Investors may also have the option to reinvest in the next round of UITs at this time.

Another difference between mutual funds and unit investment trusts? Unit investment trusts typically have a closed investment period, meaning that investors can only buy into the fund during a certain time period, after which the fund closes and doesn’t reopen until its maturity date. On the other hand, investors can invest in mutual funds at any time.

That’s why UITs have lower management fees than their mutual fund counterparts–because there’s a lot less management of the fund required. Remember the set end date, plus no buying and selling of securities during the life of the fund, which is common practice with mutual funds.

UITs vs. Mutual Funds

While unit investment trusts are similar to mutual funds, there are key differences between the two. Many mutual funds are open-ended, which means the fund manager can actively trade the fund – buying or selling stocks whenever he or she chooses. Securities within the fund can be bought and sold at any time. By contrast, unit investment trusts are close-ended, which means that the fund does’t do any trading.

It’s true that some mutual funds (like index funds) also take a passive investing approach, which means little to no trading by the mutual fund’s managers. But the other key difference here is that an investor in a UIT can’t do any trading, either. While an investor who owns shares of a mutual fund can sell at any time, an investor in a UIT is in it for the long haul. The stocks and bonds within the fund are held until its maturity, at which point the securities are bought back from the investor at their net asset value (NAV). In many ways, a UIT is a cross between a bond, a trust, and a mutual fund.

Mutual funds and UITs are similar in that they both allow an investor to own a diversified fund comprised of different types of securities, like stocks and bonds. This also means they both allow for greater portfolio diversification, always a good thing in the investment world. They also both utilize the practice of pooling investors’ money to purchase a grouping of securities. Another bonus? Both are regulated by the U.S. Securities and Exchange Commission (SEC).

So what’s a better investment? It really depends on the needs of the individual investor and their long-term goals. Mutual funds can offer a more actively-managed investment option (albeit with higher fees), while unit investment trusts offer a more hands-off approach and one with a set end date. Mutual funds, though, are more popular and investors use them more.

The Bottom Line

Both mutual funds and unit investment trusts are a great way to diversify your investment portfolio and reduce risk. The key difference is flexibility, for both the fund manager and the investor. While investors trade mutual funds whenever they want, unit investment trusts are held until their maturity date, at which time they are sold and the principal balance returned to the investor. There’s also no active trading of stock and bonds within a UIT, as the basket of securities is fixed for the life of the UIT.

Investing Tips

- Trying to decide the best way to build diversification into your portfolio? A financial advisor can build you an investment strategy that fits your financial plan. Finding the right financial advisor that fits your needs doesn’t have to be hard. If you don’t have a financial advisor yet, finding one doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Knowing what an investment might look like someday is important. Get a sense of how your investments might grow with SmartAsset’s free investment calculator.

Photo credit: ©iStock.com/filadendron, ©iStock.com/Squaredpixels, ©iStock.com/utah778

Rachel CauteroRachel Cautero writes on all things personal finance, from retirement savings tips to monetary policy, even how young families can best manage the financial challenges of having children. Her work has appeared in The Atlantic, Forbes, The Balance, LearnVest, SmartAsset, HerMoney, DailyWorth, The New York Observer, MarketWatch, Lifewire, The Local: East Village, a New York Times publication and The New York Daily News. Rachel was an Experian #CreditChat panelist and has appeared on Cheddar Life and NPR’s On Point Radio with Meghna Chakrabarti. She has a bachelor’s degree from Wittenberg University and a master’s in journalism from New York University. Her coworkers include her one-year-old son and a very needy French bulldog.

Unit trusts vs investment trusts: which performs better?

![]()

![]()

When it comes to investing in collective funds, we have a few choices. There are ‘passive’ funds, such as ETFs, which track indices like the FTSE100 and aim to replicate their risk and return profile by buying the same stocks or a sample of such; or there are ‘active’ funds, whose portfolio managers carefully select potentially lucrative investment opportunities from within a particular market. Given how polarised and volatile stock markets are currently, an active approach gives investors the comfort of a professional investment manager steering their wealth through the uncertainty.

If an active approach suits your taste, then in the UK you have two further options: unit trusts & open-ended investment companies (OEICs), often referred to as ‘funds’; or investment trusts, often called just ‘trusts’.

Funds are the mainstay of the industry, with around 5,000 available for us to choose from. Their key feature is that they expand or contract, much like an accordion, depending on demand and whether investors are stuffing cash into the fund or withdrawing it – hence ‘open-ended’.

Investment trusts, on the other hand, have a fixed amount of cash to invest. If you want to buy into them, you must buy their shares which are traded separately on a stock exchange – similar to buying the shares of BP or Vodafone. With around 400 on offer, they represent a much smaller part of the industry that is also very old – Alliance Trust itself was launched in 1888.

Investment trusts come with a host of features that can make them seem more complicated than funds. Yet, it is through these features that they offer private investors some serious benefits. There is a reason why they are often described as the industry’s best kept secret – and it starts with performance.

A star performer

A successful investment strategy won’t excite the thrill seekers – patience and lengthy periods of time in the markets is key to building wealth. In other words, we must nurture our investments and give them a chance to grow. When deciding if funds or trusts represent the best long-term investment opportunity, performance data that pits the two against each other reveals some compelling insights.

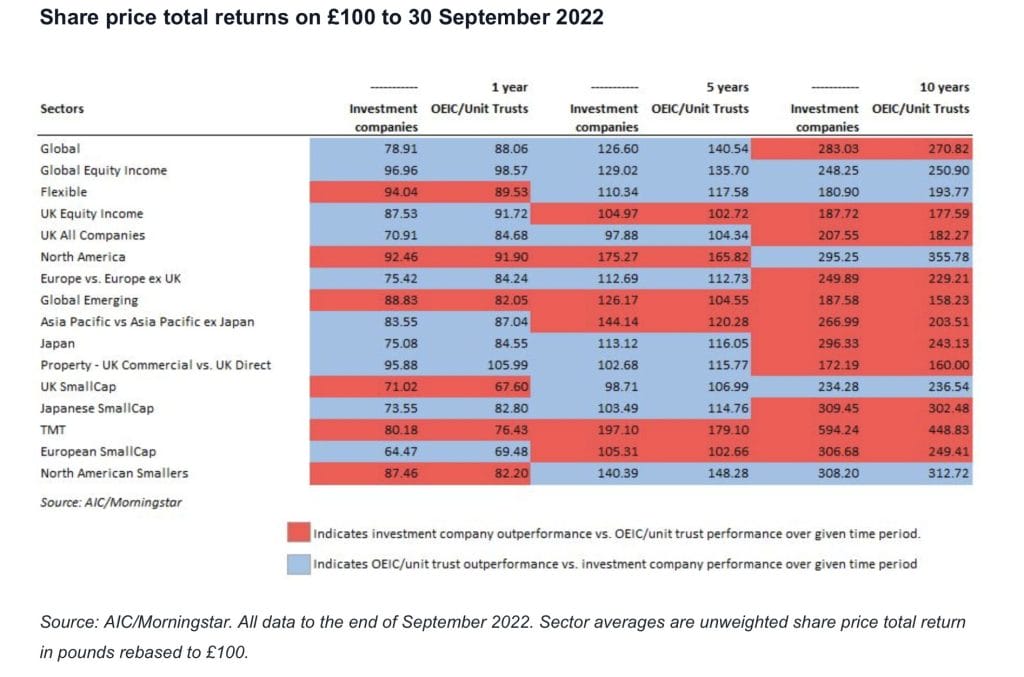

Below, we look at sector investment performance data from the last ten years up to June this year, compiled by the association of investment companies (AIC) – the industry body for investment trusts – and Morningstar, a data provider.

It shows that over shorter periods of time, on average, funds just outperform trusts. Yet, over longer periods of time, trusts increasingly outperform open-ended funds. When it gets to 10 years or longer – the ideal minimum timeframe for investing – trusts outperform funds in 11 out of the 16 sectors analysed, an undeniable achievement.

Importantly, this isn’t down the luck – there are a host of reasons why investment trusts tend to outperform funds.

Gearing-up for a long-term approach

One very important feature of investment trusts that contributes strongly to performance is their ability to gear – in other words, borrow extra money to make investments beyond what the trust’s capital would allow. Imagine it much like taking out a mortgage to buy a property. Some trusts may have long term gearing in place; others may have much more flexible arrangements in place, a bit like an overdraft.

Importantly, gearing exaggerates returns: boosting gains but also increasing potential loses too. Often, the facility is described as a double-edged sword, requiring the fund manager to wield it with skill. As a result, it can make the trust’s performance more volatile and is why over shorter periods of time open-ended funds may do better, depending on market conditions; but, similarly why over longer periods, when markets generally rise and the ups and downs of cycles are ironed out, trusts tend to win.

In addition, fund managers at the helm of investment trusts can use gearing facilities during times when markets panic and generally oversell, investing the cash on hand in the bargains left lying around. What is more, because the trust’s pool of capital is ringfenced, assets won’t need selling at low prices to raise cash if investors want their money back, as they would with our accordion-like open-ended funds.

Finally, there is the trust’s independent board – another unique feature. Governing the trust’s activities, boards are comprised of experts across legal, accounting, and investing, who will oversee the investment professionals running the strategy and ensure they are keeping to their investment mandate. Ultimately, if investments aren’t being managed to a high enough standard, the board can fire the manager and replace them with someone else.

The proof of the pudding

When it comes to achieving our financial goals, any sensible investing strategy involves investing for the long term. While investment trusts are nuanced and may appear complex, it is these very features that serve long term investors well. And the proof of the pudding is in the eating: the data shows that, on average, investment trusts beat open-ended funds when given the time to do so. For these reasons, we believe investment trusts are the perfect investment for private investors seeking to build their wealth over the long term.

Alliance Trust is an investment trust with a history stretching back to 1888, and has been serving investors for generations. For more on Alliance Trust and its strategy, please find out more here.

The views expressed are the opinion of the Manager and are not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. The views expressed were current as at August 2022 and are subject to change. Past performance is not indicative of future results. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. You should not assume that any investment is or will be profitable. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. TWIM is the appointed Alternative Investment Fund Manager of Alliance Trust plc. Towers Watson Investment Management Limited (“TWIM”) of 51 Lime Street, London, EC3M 7DQ, is authorised and regulated in the United Kingdom by the Financial Conduct Authority (FCA Register Firm Reference Number 446740, refer to the FCA register for further details) and incorporated in England and Wales with Company Number 05534464. Alliance Trust plc is a listed UK investment trust and is not authorised and regulated by the Financial Conduct Authority.

https://smartasset.com/investing/unit-investment-trust-uithttps://stepstoinvesting.com/blog/unit-trusts-vs-investment-trusts-which-performs-better/