A comparison of online stock trading simulators for teaching investments.

Citation only. At this time, full-text article is available only through licensed access provided by the publisher. Published in Journal of Financial Education, 36(1/2), 105-119.

Language

Publisher

California State University School of Business

Recommended Citation

Jankowski, J. & Shank, T. (2010). A comparison of online stock trading simulators for teaching investments. Journal of Financial Education, 36(1/2), 105-119.

Creative Commons License

This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License.

This document is currently not available here.

Best Stock Game for Students

Don’t waste time sifting through countless stock market games! This review provides a concise comparison of the best virtual trading platforms for high school, middle school, and college students. We highlight the pros and cons of each to help you make the best decision for your needs.

While some virtual stock market platforms have a long and successful track record spanning a decade or more, others are here today, gone tomorrow. The last thing you want is for your students’ progress to be wiped out when a platform unexpectedly shuts down. Trust me, I have seen many that have just disappeared over night and left their students hanging.

Whether you call it “stock games,” “stock market simulations,” “paper trading,” or “virtual trading” – these terms are often used interchangeably. They all refer to the same basic concept: you start with a virtual cash balance and get to experience the thrill of buying and selling stocks without risking real money. These are different than the best financial literacy games for students.

How to Choose the Right Stock Market Game

When choosing a platform, pay attention to the trading data. Some sites use end-of-day or 15-minute delayed prices, but real-time data and rankings are key! During market hours, your students will be glued to the ranking page, watching their portfolios fluctuate in real time. This instant feedback is incredibly motivating and encourages everyone to participate. We often hear that they create a more equitable learning environment where everyone has a chance to succeed.

Some platforms limit trading to U.S. stocks, while others offer a wider selection, including bonds, mutual funds, options, futures, cryptocurrencies, and global stocks. So keep reading and you will learn which might be the best for your class and students. The key is finding a game that allows you to customize the trading options to match your learning objectives. You decide which securities your students can trade. Want them to learn about Bitcoin? Turn it on. Prefer traditional securities? Leave it off.

To ensure the best learning experience for your students, be sure to consider these key features and differentiators when selecting a platform:

1. Types of Securities Traded:

The range of tradable assets significantly impacts the depth of the learning experience. Consider whether your curriculum focuses solely on U.S. stocks or if you want to introduce students to bonds, mutual funds, options, futures, cryptocurrencies, currencies, or global equities. Offering a wider variety can expose students to different asset classes and investment strategies, but it’s important to select a platform that aligns with your course’s learning objectives and the students’ level of understanding. Ideally, it would be best to be able to turn them on and off throughout the semester.

2. Prices Used to Fill Orders:

The pricing model significantly impacts the realism and engagement of the simulation. End-of-day prices offer a simplified view but lack the dynamic nature of real-time markets. Delayed prices, typically with a 15-minute lag, offer a better representation, but real-time prices provide the most authentic experience. Real-time data, though potentially more complex for beginners, allows students to react to market fluctuations and understand the immediacy of trading decisions.

3. Student Data Collected:

Prioritize student privacy when selecting a platform. Understand what data the platform collects and how it’s used. Some platforms might request sensitive information like Social Security Numbers, which should raise a red flag. Others might require student email addresses. Carefully review the platform’s privacy policy and ensure it aligns with your school’s data privacy guidelines and best practices for student data security.

4. Teacher/Professor Reporting:

Robust reporting tools help to monitor student progress and identify areas for improvement. Look for platforms that provide comprehensive data on student performance, including portfolio values, trading activity, and overall returns. The ability to rank students is valuable for fostering competition, but consider whether rankings are based solely on percentage return or incorporate risk-adjusted metrics like Sharpe ratio or Jensen’s alpha for a more nuanced assessment.

5. Customer Service for Both Students & Instructors:

Reliable customer support is critical, especially when dealing with complex trading simulations. Issues inevitably arise, such as missing trades, incorrect prices, or discrepancies in dividend or split adjustments. Ensure the platform offers accessible support channels for both students and instructors. Quick and accurate responses can prevent frustration and maintain the integrity of the learning experience.

6. Customization of Trading Rules:

The ability to customize trading rules allows you to tailor the simulation to your curriculum and student skill level. Look for platforms that allow you to set the dates and length of the trading period, establish commission rules, restrict day trading, control margin usage, and permit or prohibit short selling. These features provide flexibility in designing a challenging and realistic learning experience.

7. Diversification Requirements:

Encourage responsible investing by choosing a platform that promotes diversification. Some platforms allow students to concentrate their investments in a single stock, which can lead to unrealistic returns and a distorted understanding of risk. A platform that requires students to diversify their portfolios will teach them valuable risk management strategies and promote a more balanced approach to investing.

8. Accuracy of Prices and Accounting:

The accuracy of prices and accounting makes or breaks the integrity of the simulation. Inaccurate data can lead to frustration, distrust, and an inability to learn proper investing techniques. Ensure the platform has a strong reputation for accurate price data and reliable accounting for dividends, splits, and other corporate actions. A platform with known data errors should be avoided.

9. Cost:

While cost is a consideration, remember that you often get what you pay for. Free platforms might lack the features, support, and data accuracy of paid options. Paid platforms often offer superior customer support, more robust reporting tools, and a more reliable trading environment. Consider the long-term value of a platform that supports your teaching goals and provides a positive learning experience for your students.

10. Compliant with National and State Student Privacy Laws:

By now, we all know how important student privacy is, so choose a platform that complies with all applicable national and state laws, such as FERPA (in the US) and GDPR (if you have students from the EU). Understand what data the platform collects, how it’s stored, and whether it’s shared with third parties. A platform that prioritizes student privacy and adheres to data protection regulations is crucial for safeguarding student information.

We’ve compiled this list of our favorite stock market games for high school and college students, as well as individual learners looking to practice stock trading. We used the above 10 features to come up with this list.

Ranking of the Best Stock Games for Students

- PersonalFinanceLab.com – Best Stock Game for High School Students

- StockTrak.com – Best Stock Game for College Students (includes options, futures, bonds, global equities, cryptos)

- HowtheMarketWorks.com – Best FREE Stock Game for High School Students

- WallStreetSurvivor.com – Best Stock Game for Adults

- Virtual Stock Exchange – Best International Stock Game

Ok, there you have it. Above is the list of the best stock games for students, including high school and college students, and adults.

Now below we will give you the details on each…

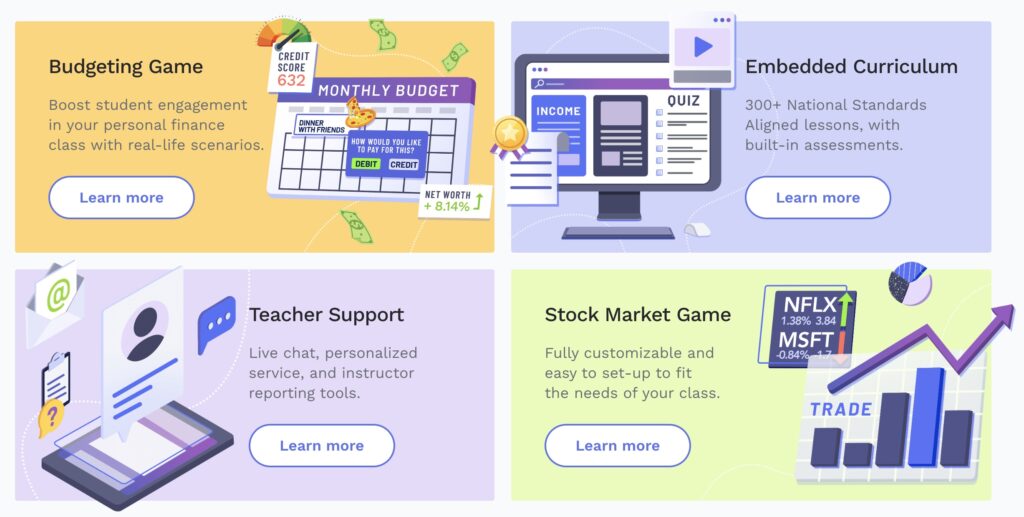

Best Stock Game for Students (High School): PersonalFinanceLab

PersonalFinanceLab has been around for quite a while but it is quickly becoming the industry leader for high school personal finance, business, economics and CTE classes.

It is the ONLY site that features a stock game, a budget / financial literacy game, curriculum, and certifications all in one platform.

Also, it is fully customizable so you can use or skip whichever feature you want.

Take a look at the pros and cons of PersonalFinanceLab….

- PersonalFinanceLab – PROS

- Allows teachers full customization of trading rules

- Real-time prices for US and Canadian stocks, bonds, mutual funds

- Includes investing lessons and a personal budgeting game

- Teacher and students email and phone support

- Very accurate prices and accounting for splits/dividends

- PersonalFinanceLab – CONS

- It is not free. $10 per account but price drops down to just $6 with volume discounts.

- It is fully customizable which is both a curse and a blessing. Takes a few minutes to set up.

PersonalFinanceLab offers over 300 lessons teachers can assign that meet state and national standards for financial education. But you won’t be overwhelmed by these lessons. They are broken down into the appropriate category by class subject.

These lessons come complete with quizzes and help set students up to succeed in the stock game and the budgeting game (and in real life)!

The stock game lets students trade risk-free with virtual money.

The teacher can change settings such as regular cash deposits, trading rules, and which lessons they want to correspond with the stock game.

The teacher can also track students’ performance and activity in their portfolios.

The Budget Game allows students to simulate the real-life responsibilities of managing income, paying bills, and dealing with unexpected life expenses.

Students progress through a simulated calendar, with each day bringing new surprises.

Events in the game are random and decision trees are based on probabilities.

A student might be faced with a flat tire or a necessary clothing purchase.

They can choose whether to charge these expenses to a debit or credit card, which will effect their financial situation further on in the game.

Pricing for PersonalFinanceLab starts at $10 per student but quickly drops to $6 for larger classes.

Best Stock Game for College Students: StockTrak

StockTrak.com is not only the best stock game for college students, but it is also the stock game that has been around the longest. StockTrak was the first virtual trading tool for students. The company has been around since 1990, providing telephone-based virtual trading in the early 1990s. Their web page, StockTrak.com was launched in 1996 making them the first online virtual trading tool.

We consider StockTrak a college site because of all the securities it trades. But it is also used by high schools, businesses and individuals who want to trade it all and pay the small fee.

StockTrak allows students to trade the widest range of securities of any virtual trading site. They allow students to trade stocks, bonds, mutual funds, options, futures, global equities, forex, and cryptos. Accounts can be denominated in US Dollars, Canadian Dollars, British Pounds, Euros, etc (about 50 currencies).

Take a look at the pros and cons of StockTrak….

- StockTrak- PROS

- Allows professors full customization of trading rules

- trading period, diversification, commission, interest rates can all be specified

- Real-time prices for US and Canadian stocks, options, futures, future options, forex, cryptos, funds

- delayed prices on global equities and bonds

- Can be used for full Investment classes or Personal Finance classes (includes a budget game)

- Class ranking can be by return, Sharpe Ratio, Alpha, Beta and others

- Includes investing lessons and how-to videos

- Professor and student email and phone support

- Very accurate prices and accounting for splits/dividends

- Allows professors full customization of trading rules

- StockTrak- CONS

- It is not free. $19-$29 per account depending on how many weeks the professor sets the trading period to be.

- It is fully customizable which is both a curse and a blessing. Takes a few minutes to set up.

Best FREE Stock Game for High School Students: HowTheMarketWorks

HowTheMarketWorks is another great stock simulation game. And the best part about it is that it’s absolutely FREE!

When you sign up for HowTheMarketWorks you get a virtual portfolio worth $100,000 that you can trade with as you please.

You can also create custom contests to compete against your friends and family.

HTMW hosts national contests that you can enter to win real prizes!

The Education Center also helps you learn investing tips that can help your virtual portfolio as well as your real one.

Like Personal Finance Lab, HowTheMarketWorks can also be used by teachers and students in the classroom.

Teachers can customize their students’ trading parameters and lessons.

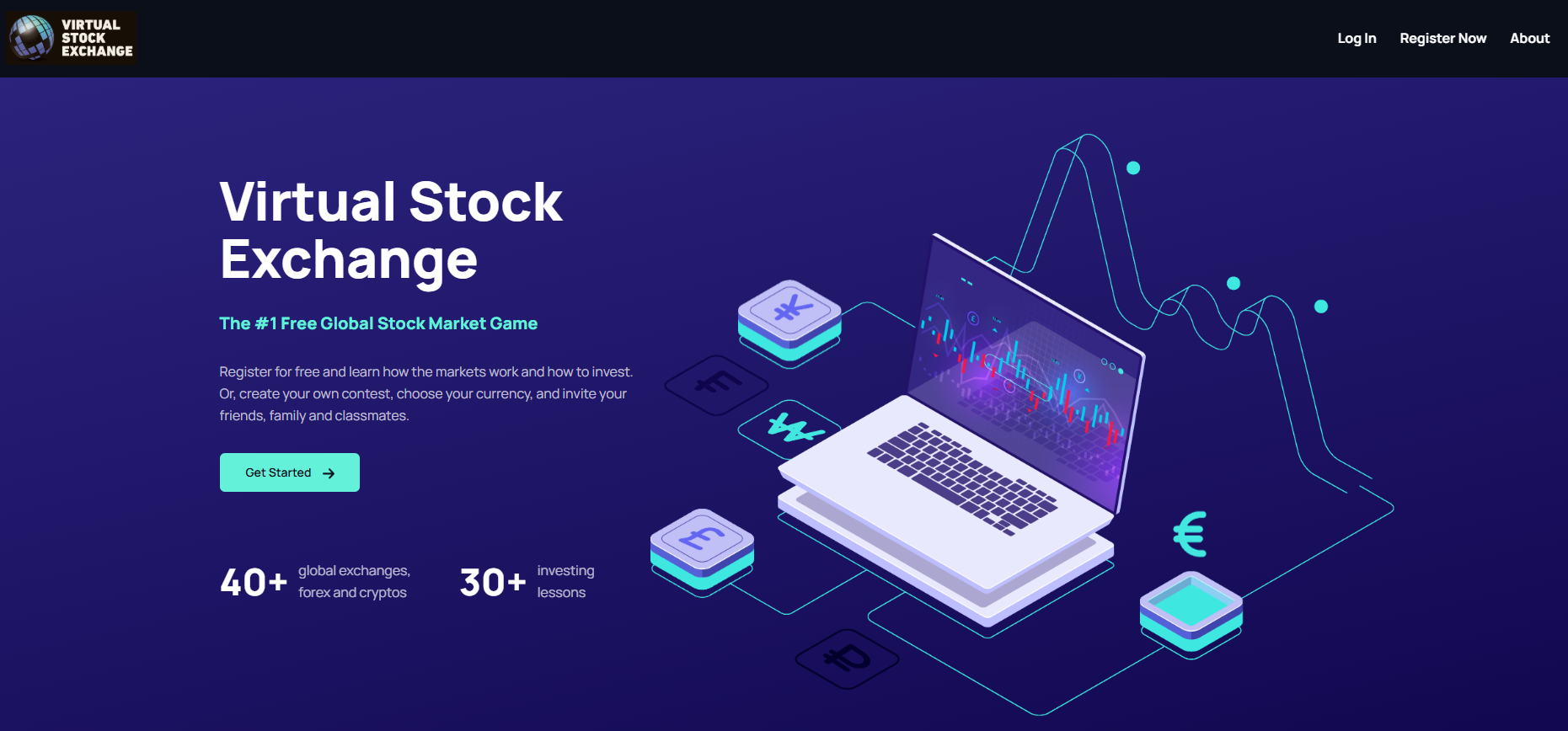

Best Stock Game for International Learners: Virtual Stock Exchange

Virtual Stock Exchange (VSE) stands out as the premier free option for anyone looking to dive into the world of global investing. While many platforms focus regionally or carry a cost, VSE delivers a truly international simulation experience at no charge, making it highly accessible for individuals, classrooms, and organizations across the globe.

We consider VSE the #1 free global game because of its unparalleled reach. It allows users to practice trading stocks, currencies, and commodities across 40+ international exchanges (NYSE, LSE, TSE, HKEX, SSE, etc.), plus Forex and Cryptos. A major advantage for international users is the ability to manage their virtual portfolio in dozens of local currencies – from USD and EUR to INR, BRL, KRW, and many more.

VSE isn’t just a trading platform; it integrates educational resources directly, featuring over 30 investing lessons and robust research tools within its Learn Center.

So while you’re trading virtual money, you can also learn more about the stock market and the types of securities you’re trading.

Conclusion

Teachers and professors can’t go wrong using any of the stock games reviewed on this page.

The above stock games are the best ones available for students based on the features we described above. High school teachers and college professors should be pleased with the quality of the site, the customization, as well as the reporting provided. The pros and cons we noted should really be considered when education is the main focus.

More and more research is coming out showing how games and simulations are a valuable addition to any classroom.

We applaud all the teachers and professors who want to bring real-world trading and financial education technology into their classrooms.

If you’re teaching a personal finance class, make sure you check out our review of the Best Budget Challenge Games for students.

Best Stock Newsletters as of June 29, 2025

#1. Alpha Picks

The BEST stock newsletter over the last 3 years–beating the market by over 40%.

#2. Motley Fool Stock Advisor

Winner of Best Overall Stock Newsletter

& Best Lifetime Return of 1,062% vs S&P’s 178%.

See their picks in our Motley Fool Review.

#3. Moby Premium

Consistently beating the market the last 4 years.

Excellent stock app with picks by industry to help you diversify. See their picks in our Moby Review.

LATEST ARTICLES

- Best StockX Discount Codes for 2025: Save on Your Next Shoes

- Best Finance Games for Students

- CNBC Pro Review: Is This Premium Subscription Worth Your Investment?

- Is CNBC Investing Club Worth It? A Comprehensive Review

- Is Achievable Good for Series 7? A Comprehensive Review of the Course

- Is Achievable Good for SIE? A Review of Its Effectiveness for Success

- Achievable Review: An Honest Look at Its Effectiveness for Students

- Is Moby Premium Worth It? A 2025 Review of Features, Stock Picks, and Value

- Best Moby App Promo and Discount Codes: Amazing Savings for July, 2025

- Is Stash Worth It? Does It Work?

Just Published June 29, 2025

Best Stock Picks Last 1 & 3 Years

See our June 29, 2025 Ranking of the Best Stock Newsletters. A few are beating the market, but one is crushing the market.

Best Stock Newsletter Under $500

Seeking Alpha’s Alpha Picks continues to easily beat the market with a high percentage of accuracy and is currently on sale.

Best Stock Newsletter Under $200

Motley Fool Stock Advisor continues to easily beat the market with a high accuracy.

Our Platform

- Stock Market Simulator

- Investing Courses for Beginners

- Best Stocks to Buy Now

- How to Invest Videos

- Free Online Investing Course

- Financial Literacy Game for Students

- Getting Started on WallStreetSurvivor

- Crypto Paper Trading

- Contact Us

- About WallStreetSurvivor

Review Center

- Motley Fool Review

- Seeking Alpha Review

- Alpha Picks Review

- Moby Stocks Review

- Wealthsimple Review

- Is Robinhood Safe to Use?

- Rule Breakers Review

- Best Investment Newsletters

- Best Investing Apps

- Best Motley Fool Discount Code

- Best Motley Fool Epic Discount Code

- Best Tipranks Discount Code

- Is Coinbase Safe?

- Free Crypto with Coinbase

- Best Stock Picking Service

Corporate Services

- White Label Stock Market Games

- White Label Virtual Crypto Trading

- Employee Financial Wellness

- Sponsor a College or High School

- CRA for Banks: Sponsor a School

Our Company

- Contact StockTrak

- About StockTrak

- Motley Fool Review

- Privacy Policy

- Terms and Conditions

- Advertise with Us

Family of Sites

Global Virtual Stock Game

Free Investing Course

Connect With Us

WallStreetSurvivor.com® is a property of Stock-Trak Inc. Copyright 2008-2025 Stock-Trak Inc. WallStreetSurvivor®, HowtheMarketWorks® and Stock-Trak® are registered trademarks of Stock-Trak Inc. All Rights Reserved. Stock-Trak Inc. is the leading provider of educational budgeting and stock market simulations for the K12, university, and corporate education markets. All information is provided on an “as-is” basis for informational purposes only, and is not intended for actual trading purposes or market advice. Quote data is delayed by at least 15 minutes and is provided by XIGNITE and QuoteMedia. Neither Stock-Trak Inc. nor any of its independent data providers are liable for incomplete information, delays, or any action taken in reliance on information contained herein. By accessing this site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms and Conditions. Stock-Trak Inc.’s education simulations are used by the world’s top universities and corporations.

https://digitalcommons.usf.edu/fac_publications/785/https://www.wallstreetsurvivor.com/best-stock-game-for-students/