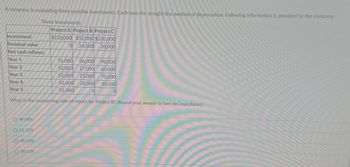

A company is evaluating three possible investments. Each uses the straight-line method of depreciation. Following information is provided by the company: Three Investments Investment Residual value Project A Project B Project C $220,000 $52,000 $220,000 0 24,000 20,000 Net cash inflows: Year 1 52,000 36,000 90,000 Year 2 52,000 27,000 60,000 Year 3 52,000 23,000 70,000 Year 4 52,000 20,000 30,000 Year 5 52,000 What is the accounting rate of return for Project B? (Round your answer to two decimal places.) 49.08% 51.32% O 45.15% O 30.13%

Bridgeport Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value A $260,084 $46,590 Project A 7 years $0 Project B Click here to view the factor table. Bridgeport Company uses the straight-line method to depreciate its assets. B $278,237 Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.) $44,540 9 years $0 Internal rate of return % %

arrow_forward

Bella Ltd wishes to invest in either project X or project Y, and has provided you with the following information. Project X Project Y Initial Investment Shs. 20,000 Shs. 30,000 Estimated Life 5 years 5 years Scrap Value Shs. 1,000 Shs. 2,000 The profits before depreciation and after taxation (cash flows) are as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Project x Shs. Shs. Shs. Shs. Shs. 5,000 10,000 10,000 3,000 2,000 Project y 20,000 10,000 5,000 3,000 2,000…

arrow_forward

what is accounting rate of return for project B ?

arrow_forward

The following information. . Please provide answer

arrow_forward

You are given the following data for a project that is to be evaluated using the APV method. Year EBIT CAPEX 0 O $201.765 O $193,822 O $185,617 O $222,872 O $213,918 1 $127.000 $60,000 2 Depreciation Increase in NWC Year-end net debt $80,000 Cost of net debt = 8% Unlevered cost of capital = 11.8% Corporate tax rate = 30% Calculate the total value of the project at t = 0. using the APV method. $72,000 $50,000 $100,000 $133,000 $40,000 $80,000 $60,000 $140,000 3 $138.500 $10,000 $84,000 $30,000 $140,000

arrow_forward

The company is considering three capital investment proposals. At this time the company only has funds available to pursue one of the three investments. Equipment A Equipment B Equipment CPresent value of net cash inflows $1,695,000 $1,960,000 $2,200,000Initial investment ($1,500,000) ($1,750,000) ($2,000,000)Net present value $195,000 $210,000 $200,000*initial investment is the amount invested A. Calculate the Present value index (or profitability index) for each project. B. Which investment should they choose and why?

arrow_forward

Dragonfly, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available: Investment A Investment B $101,000 Initial capital investment Estimated useful life $151,000 10 years 10 years Estimated residual value $20.000 $47.000 12% Estimated annual net cash inflow for 10 years $28.000 Required rate of return 12% Calculate the payback period for Investment A. (Round your answer to two decimal places.) O A. 1.00 year О В. 3.61 years O C. 2.22 years O D. 2.89 years

arrow_forward

Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: Line Item Description Maintenance Equipment Ramp Facilities Computer Network Amount to be invested $551,372 $327,621 $172,660 Annual net cash flows: Year 1 277,000 186,000 125,000 Year 2 258,000 167,000 86,000 Year 3 235,000 149,000 63,000 Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: 1. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each proposal. Use the present value of $1 table above. If required,…

A company is evaluating three possible investments. Each uses the straight line method of depreciation. The following information is provided by the company: Project A: Initial investment: 220 , 000 R es i d u a l v a l u e : 0 Net cash inflows: Year 1: 52 , 000 Y e a r 2 : 27,000 Year 3: 20 , 000 Y e a r 4 : 0 Year 5: 0 P ro j ec tB : I ni t ia l in v es t m e n t : 52,000 Residual value: 24 , 000 N e t c a s hin f l o w s : Y e a r 1 : 36,000 Year 2: 23 , 000 Y e a r 3 : 20,000 Year 4: 0 Y e a r 5 : 0 Project C: Initial investment: 220 , 000 R es i d u a l v a l u e : 20,000 Net cash inflows: Year 1: 90 , 000 Y e a r 2 : 60,000 Year 3: 30 , 000 Y e a r 4 : 0 Year 5: $0

A company is evaluating three possible investments. Each uses the straight line method of depreciation. The following information is provided by the company: Project A: Initial investment: 220 , 000 R es i d u a l v a l u e : 0 Net cash inflows: Year 1: 52 , 000 Y e a r 2 : 27,000 Year 3: 20 , 000 Y e a r 4 : 0 Year 5: 0 P ro j ec tB : I ni t ia l in v es t m e n t : 52,000 Residual value: 24 , 000 N e t c a s hin f l o w s : Y e a r 1 : 36,000 Year 2: 23 , 000 Y e a r 3 : 20,000 Year 4: 0 Y e a r 5 : 0 Project C: Initial investment: 220 , 000 R es i d u a l v a l u e : 20,000 Net cash inflows: Year 1: 90 , 000 Y e a r 2 : 60,000 Year 3: 30 , 000 Y e a r 4 : 0 Year 5: $0

https://www.bartleby.com/questions-and-answers/a-company-is-evaluating-three-possible-investments.-each-uses-the-straight-line-method-of-depreciati/e6e916d6-3614-4d42-b29b-a4f400defab0https://askfilo.com/user-question-answers-accounts/a-company-is-evaluating-three-possible-investments-each-uses-3232393934313633