A company is evaluating three possible investments.each uses the straight

Before Social Security, 51 percent of men over age 65 worked. Today that number is

A. 9 percent. B. 32 percent. C. 43 percent. D. 24 percent.

A multi-branch if statement directs program flow through exactly one of its branches.

Answer the following statement true (T) or false (F)

Computer Science & Information Technology

Reid (1962) suggests that a trained investigator can achieve ______% accuracy in differentiating truthful and untruthful statements.

a. 65 b. 75 c. 85 d. 95

Criminal Justice

Describe each of the types of deception used by law enforcement. Of these, which do you see as most problematic for suspects/defendants? Why?

What will be an ideal response?

Criminal Justice

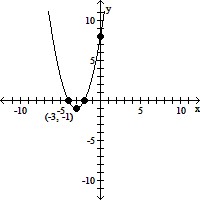

Determine the quadratic function whose graph is given.

A. f(x) = -x2 + 6x + 8 B. f(x) = x2 – 6x + 8 C. f(x) = x2 + 6x – 8 D. f(x) = x2 + 6x + 8

Mathematics

What will be an ideal response?

Health Professions

A patient with moderate mitral stenosis with minimal calcification and regurgitation is preparing to have surgery. Which procedure would be most appropriate to restore normal function to this patient?

A) Annuloplasty B) Valve replacement with biological valve C) Valve replacement with caged ball valve D) Commissurotomy

Define specific asset

According to Ayurveda, all foods have their own heating or cooling energy and postdigestive effect

Indicate whether the statement is true or false

A study comparing social support of employees in a U.S.-based company with that of employees in its former subsidiary in Israel found significant differences in how each viewed sources of social support. How did employees in the United States view social support?

*a. They made clear distinctions between types of support providers. b. There were no distinctions between types of support providers. c. All support providers were considered external to the organization. d. All support providers were considered internal to the organization.

Factor completely.x2 + 16x + 64

A. Prime B. (x + 8)(x – 8) C. (x + 8)2 D. (x – 8)2

Mathematics

A promise that neither confers any benefit on the promisee nor subjects the promisor to any detriment is an illusory promise

a. True b. False Indicate whether the statement is true or false

Q1 A company is evaluating three possible investments. Each uses the straight-line method of depreciation. Following information is provided by the company: Project A $230,000 Project B Project C $54,000 12,000 Investment $230,000 36,000 Residual value Net cash flows: Year 1 56,000 56,000 56,000 56,000 56,000 38,000 29,000 25,000 22,000 94,000 64,000 74,000 34,000 Year 2 Year 3 Year 4 Year 5 What is the accounting rate of return for Project B? (Round your answer to two decimal places.

Q1 A company is evaluating three possible investments. Each uses the straight-line method of depreciation. Following information is provided by the company: Q2 Martin Production Co. is considering investing in specialized equipment costing $975,000. The equipment has a useful life of five years and a residual value of $75,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are given below:

Video Video

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending now This is a popular solution!

Step by step Solved in 3 steps

Knowledge Booster

Learn more about Financial Planning

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.

Similar questions

arrow_back_ios arrow_forward_ios

arrow_forward

Subject: acounting

arrow_forward

A Company is considering a proposal of installing a drying equipment. The equipment would involve a Cash outlay of 6,00,000 and net Working Capital of 80,000. The expected life of the project is 5 years without any salvage value. Assume that the company is allowed to charge depreciation on straight-line basis for Income-tax purpose. The estimated before-tax cash inflows are given below: Year Before-tax Cash inflows (‘000) 1 2 3 4 5 240 275 210 180 160 The applicable Income-tax rate to the Company is 35%. If the Company’s opportunity Cost of Capital is 12%, calculate the equipment’s discounted payback period, payback period, net present value and internal rate of return. The PV factors at 12%, 14% and 15% are: Year 1 2 3 4 5 PV factor at 12% 0.8929 0.7972 0.7118 0.6355 0.5674 PV factor at 14% 0.8772 0.7695 0.6750 0.5921 0.5194 PV factor at 15% 0.8696 0.7561 0.6575 0.5718 0.4972 10-22

arrow_forward

Carlin Company, which uses net present value to analyze investments, requires a 10% minimum rate of return. A staff assistant recently calculated a $740,000 machine’s net present value to be $106,500, excluding the impact of straight-line depreciation. FV of 1 (i= 10%, n = 7): FV of a series of $1 cash flows (i W 10%, n = 7): PV of $1 (i= 10%; n = 7): PV of a series of $1 cash flows (i = 10%, n= 7): 1.949 9.487 0.513 4.868 If Carlin ignores Income taxes and the machine is expected to have a seven-year service life, the correct net present value of the machine would be:

arrow_forward

Vandezande Inc. is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value. The cash flows that would be produced by the machine are (Ignore income taxes): Net Cash Flows Year 1 $ 128,000 Year 2 $ 105,000 Year 3 $ 126,000 Year 4 $ 123,000 Year 5 $ 122,000 Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period of this investment is closest to:

arrow_forward

arrow_forward

The Amani Company is planning a $200,000 equipment investment that has an estimated eight-year life with no estimated salvage value. The company has projected the following annual cash flows for the investment. Year Cash Inflows $120,000 $70,000 $60,000 $60,000 $60,000 Total $370,000 1 4. Assuming that the cash inflows occur evenly over the year, what is the payback period for the investment? (Ignore income taxes in this problem.)

arrow_forward

What is Question Four a. Assume that Green Housing Company is considering an investment of $200,000 in a new at the end of its useful life. The annual cash inflows are £250,000, and the annual cash outflows equipment. The new equipment is expected to last 12 years. It will have a zero salvage value are 150,000. Assume that the annual cash flows are uniform over the asset’s useful life. Management has a required rate of return of 18%. i. Calculate the present value of net cash flows ii. Calculate the net present value for this investment iii. Calculate the Discounted Payback Period iv. Advice management of Green Housing Company base on your results

arrow_forward

Subject: accounting

arrow_forward

Most Company has an opportunity to invest in one of two new projects. Project Y requires a $320,000 investment for new machinery with a six-year life and no salvage value. Project Z requires a $320,000 investment for new machinery with a five-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. Project Y Project Z Sales $ 385,000 $ 308,000 Expenses Direct materials 53,900 38,500 Direct labor 77,000 46,200 Overhead including depreciation 138,600 138,600 Selling and administrative expenses 28,000 27,000 Total expenses 297,500 250,300 Pretax income 87,500 57,700 Income taxes (38%) 33,250 21,926 Net income $ 54,250 $ 35,774 Compute each project’s accounting rate of return.

https://quizgoat.com/pack/20981/quiz-fall-5-business-accounting-and-taxationhttps://www.bartleby.com/questions-and-answers/q1-a-company-is-evaluating-three-possible-investments.-each-uses-the-straight-line-method-of-depreci/dbaceec9-bc48-47be-958d-381792063be8