7.3 Stock Compensation

Copying or printing Roadmaps is currently disabled. If you are a DART subscriber, please log in to enable these features. Deloitte clients who are not DART subscribers may request printed copies of Roadmaps from their engagement teams.

Show contents

7.3 Stock Compensation

Because the receipt of employee services in exchange for a share-based payment award is a noncash item, the granting of such awards is not presented in the statement of cash flows.

However, in presenting cash flows under the indirect method, an entity would present the compensation cost recognized in net income in each reporting period as a reconciling item in arriving at cash flows from operations. In addition, an entity must present any cash paid by employees (e.g., the exercise price) to the entity for such awards as cash inflows from financing activities.

Cash received upon early exercise of a share-based payment award.

Income tax effects of share-based payment awards.

Settlement of equity-classified share-based payment awards.

Settlement of liability-classified share-based payment awards.

Remittances of statutory withholding on share-based payment awards.

Amounts related to an employee stock purchase plan (ESPP).

For more information about the accounting for share-based payment awards, see Deloitte’s Roadmap Share-Based Payment Awards .

7.3.1 Cash Received Upon Early Exercise of a Share-Based Payment Award

An early exercise refers to an employee’s ability to change his or her tax position by exercising a share-based payment award and receiving shares before the completion of the requisite service period (i.e., before the award is vested). The early exercise of an award results in the employee’s deemed ownership of the shares for U.S. federal income tax purposes, which in turn results in the commencement of the holding period (under the tax law), allowing any subsequent appreciation in the value of the shares received (and realized upon the sale of those shares) to be taxed at a capital gains rate rather than an ordinary income tax rate.

Under ASC 718, an early exercise of a share-based payment award is not considered substantive for accounting purposes (see ASC 718-10-55-31(a)). That is, the share is not considered “issued” because the employee is still required to perform the requisite service to earn the share. Although the share is not considered issued, the cash received from the early exercise represents proceeds from the issuance of an equity instrument and would still be classified as a financing activity. As a result, such cash would be recognized as a cash inflow from financing activities under ASC 230-10-45-14(a).

In addition, as defined in ASC 230-10-20, cash flows from operating activities are “generally the cash effects of transactions and other events that enter into the determination of net income.” A transaction in which cash is received from an employee who elects to early exercise an option is not the type of transaction that enters into the determination of net income.

7.3.2 Income Tax Effects of Share-Based Payment Awards

Before the issuance of ASU 2016-09, entities were required to present any realized excess or deficient tax deductions (“excess tax benefit” or “tax deficiency”) on a gross basis as separate components of financing activities.2 However, ASU 2016-09 clarified that the income tax effect of any excess tax benefit or tax deficiency is recognized in the income statement; therefore, excess tax benefits or tax deficiencies represent operating activities in a manner consistent with other cash flows related to income taxes.

7.3.3 Settlement of Equity-Classified Share-Based Payment Awards

Amount paid to settle the award does not exceed the fair-value-based measure of the award on the settlement date — In accordance with ASC 718-20-35-7, if the cash paid to repurchase the equity-classified award does not exceed the fair-value-based measure of the award on the repurchase date, the cash paid to repurchase the award is charged to equity. That is, repurchase of the equity-classified award is viewed as reacquisition of the entity’s equity instruments. Accordingly, the cash paid to reacquire the entity’s equity instruments is presented as a cash outflow for financing activities under ASC 230-10-45-15(a), which indicates that payments of dividends or other distributions to owners, including outlays to reacquire the entity’s equity instruments, are cash outflows for financing activities.

Amount paid to settle the award exceeds the fair-value-based measure of the award on the settlement date — If the cash paid to repurchase the equity-classified award exceeds the fair-value-based measure of the award on the repurchase date, the cash paid in excess of the fair-value-based measure of the award is viewed as compensation for additional employee services and is recognized as additional compensation cost. Accordingly, if the equity-classified award is repurchased for an amount in excess of the fair-value-based measure, the portion of the cash paid to reacquire the entity’s equity instruments that equals the fair-value-based measure of the award is presented as a cash outflow for financing activities under ASC 230-10-45-15(a). The portion of the cash paid in excess of the fair-value-based measure, for additional employee services, is presented as a cash outflow for operating activities under ASC 230-10-45-17(b), which notes that cash payments to employees for services are cash outflows for operating activities.

Example 7-3

Company A is making a tender offer to repurchase $20 million of common stock in the aggregate (the stock was originally distributed as share-based compensation awards) from its current employees. On the basis of an independent third-party valuation, A concludes that the purchase price paid to the employees for the common stock exceeds the fair value of the common stock by a total of $4.5 million. In accordance with ASC 718-20-35-7, the amount paid to employees up to the fair value of common stock acquired should be recognized in equity as a treasury stock transaction and should therefore be presented as a cash outflow for financing activities. The $4.5 million that was paid in excess of the fair value of the common stock constitutes compensation expense and is therefore presented as a cash outflow for operating activities.

7.3.4 Settlement of Liability-Classified Share-Based Payment Awards

In accordance with ASC 718-30, the grant-date fair-value-based measure and any subsequent changes in the fair-value-based measure of a liability-classified award through the date of settlement are recognized as compensation cost. Accordingly, the cash paid to settle the liability-classified award is effectively payment for employee services and is presented as a cash outflow for operating activities under ASC 230-10-45-17(b).

Note that an entity may enter into an agreement to repurchase (or offer to repurchase) an equity-classified award for cash. Depending on the facts and circumstances, the agreement to repurchase (or offer to repurchase) may be accounted for as either (1) a settlement of the equity-classified award or (2) a modification of the equity-classified award that changes the award’s classification from equity to liability, followed by a settlement of the now liability-classified award.

If the agreement to repurchase (or offer to repurchase) is considered a settlement of an equity-classified award, the cash paid to reacquire the entity’s equity instruments is presented in a manner consistent with the discussion in the previous section. If the agreement to repurchase (or offer to repurchase) is considered a modification of the equity-classified award that changes the award’s classification from equity to liability, the cash paid to settle the liability-classified award should be presented in the statement of cash flows in a manner similar to the conclusion above. That is, under ASC 230-10-45-17(b), the cash paid to settle the liability-classified award is effectively payment for employee services and is presented as a cash outflow for operating activities.

7.3.5 Remittances of Statutory Withholding on Share-Based Payment Awards

Regardless of whether the employer meets the employee’s statutory tax withholding requirement for liability-classified or equity-classified share-based payment awards through either a net settlement feature or a repurchase of shares upon exercise of an employee share option (or vesting of a nonvested share), an entity must account for the withholding as two transactions in the statement of cash flows. That is, in substance, this transaction is (1) a gross issuance of shares and (2) a repurchase of the amount of shares needed to satisfy the employee’s statutory tax withholding requirement. Therefore, the presentation in the statement of cash flows must also reflect the two transactions.

First, the gross issuance of shares is presented as a financing activity. For example, the cash received for an employee share option as payment for the exercise price of the award is classified as a financing cash inflow. In contrast, for a nonvested share award, because no cash is received from the employee, the gross issuance of shares is presented as a noncash financing activity.

In the second step, when an employee elects to have shares withheld to satisfy its statutory withholding tax obligation, the employer is deemed to have repurchased a portion of the shares that were received by the employee in the first step. While the employee does not receive cash directly, the employer has, in substance, repurchased shares from the employee and remitted the cash consideration to the tax authority on the employee’s behalf. Because the cash payment is related to a repurchase of stock, it is presented as a financing cash outflow.

In some circumstances, an exercise of the award may occur in one reporting period while the amount withheld for tax purposes may not be remitted to the tax authority by an employer, on behalf of the employee, until a subsequent reporting period. In these circumstances, for the second step of the transaction, the financing cash outflow is reported in the period in which the cash is paid to the tax authority. In the initial reporting period, the employer has issued the gross amount of shares and is deemed to have repurchased the requisite number of shares needed to satisfy the employee’s statutory tax withholding requirement by issuing a note payable to the employee. The note payable issued for the repurchase amount is viewed as a noncash event that has no impact on the statement of cash flows. In the subsequent reporting period, the employer remits the payment for the note payable; however, the employee requests that the amount be remitted to the tax authority on the employee’s behalf instead of directly to the employee. This results in the financing cash outflow.

Example 7-4

An entity grants 1,000 nonvested shares to an employee. The plan allows the employer to net-settle the award to cover the statutory tax withholding requirement. Upon vesting, the entity withholds 250 shares to cover the statutory withholding requirement and issues the employee the remaining 750 shares. For cash flow purposes, the entity must account for this transaction as (1) the gross issuance of 1,000 shares and (2) the repurchase of 250 shares to satisfy the statutory withholding requirement. Because no cash is received from the employee for the nonvested share award, the gross issuance of the 1,000 shares is classified as a noncash financing activity. The “repurchase,” through the net settlement feature, of the 250 shares to satisfy the statutory withholding requirement is classified as a financing cash outflow. The contemporaneous “receipt of cash,” through the net settlement feature, from the employee and the remittance of cash by the entity to the tax authority have no net impact on the statement of cash flows.

Connecting the Dots

In June 2018, the FASB issued ASU 2018-07, which simplifies the accounting for share-based payments granted to nonemployees for goods and services. Under the ASU, most of the guidance on share-based payments to nonemployees is aligned with the requirements for share-based payments granted to employees. As a result, much of the guidance in ASC 718, including most of its requirements related to classification and measurement of share-based payment awards to employees, will apply to nonemployee share-based payment arrangements. The ASU also revises ASC 230-10-45-15(a) to extend the requirement to classify, as a financing activity, a repurchase of shares to satisfy an employee’s statutory tax withholding obligation related to share-based payments granted to nonemployees.

7.3.6 Amounts Related to an ESPP

An ESPP is a plan in which employees can purchase an entity’s shares, typically at a discount. Generally, employees contribute to the ESPP through payroll deductions over a period between the enrollment date and purchase date (referred to as the purchase period). The accumulated payroll withholdings are then used to purchase the entity’s shares on behalf of the participating employees. The cash withheld from employees’ salaries during the purchase period would be recorded as a liability on the entity’s books until the cash is either used to purchase shares or returned to the employee in accordance with the terms of the ESPP award.

Method 1 — At the time of withholding, the entity would recognize an accrued liability for compensation not paid to the employee (i.e., the amount withheld represents the cash that will be used to purchase shares in the future). Because the amount withheld is recorded as a liability, this amount would be presented as a reconciling item between net income and cash flows from operating activities. Upon issuance of shares, the entity would present the decrease in the liability as a cash outflow from operating activities (i.e., reflecting a change in working capital balances) and would present a cash inflow from financing activities.

Method 2 — In a manner similar to the presentation of amounts withheld as described in Method 1, the entity would recognize an accrued liability for compensation not paid to the employee (i.e., the amount withheld represents the cash that will be used to purchase shares in the future). Because the amount withheld is recorded as a liability, it would be presented as a reconciling item between net income and cash flows from operating activities. Upon the issuance of shares, the entity would disclose the transaction as a noncash financing activity to reflect the extinguishment of a liability through the issuance of shares, in a manner similar to other noncash transactions, such as equity-settled debt.

Example 7-5

This example illustrates Method 1 as described above.

Company N offers an ESPP to all eligible employees. On January 1, 20X1, an employee enrolls in N’s ESPP. Under the plan, the employee elects to have an aggregate amount of $100 per month withheld from its compensation for the next six months (i.e., until June 30, 20X1) for a total of $600. The $600 will be used to purchase a variable number of shares of N’s stock at the stock’s market price on July 1, 20X1.

Stock Based Compensation

Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

What is Stock Based Compensation?

Stock Based Compensation (also called Share-Based Compensation or Equity Compensation) is a way of paying employees, executives, and directors of a company with equity in the business. It is typically used to motivate employees beyond their regular cash-based compensation (salary and bonus) and to align their interests with those of the company’s shareholders. Shares issued to employees are usually subject to a vesting period before they are earned and can be sold.

Types of Equity Compensation

Compensation that’s based on the equity of a business can take several forms.

Common types of compensation include:

- Shares

- Restricted Share Units (RSUs)

- Stock Options

- Phantom Shares

- Employee Stock Ownership Plan (ESOP)

How it Works

Companies compensate their employees by issuing them stock options or restricted shares. The shares typically vest over a few years, meaning, they are not earned by the employee until a specified period of time has passed. If the employee quits the company before the shares have vested, they forfeit those shares. As long as the employee stays long enough with the company, all of their shares will vest. They can hold the shares indefinitely, or sell them to convert them into cash.

Stock-Based Compensation Example

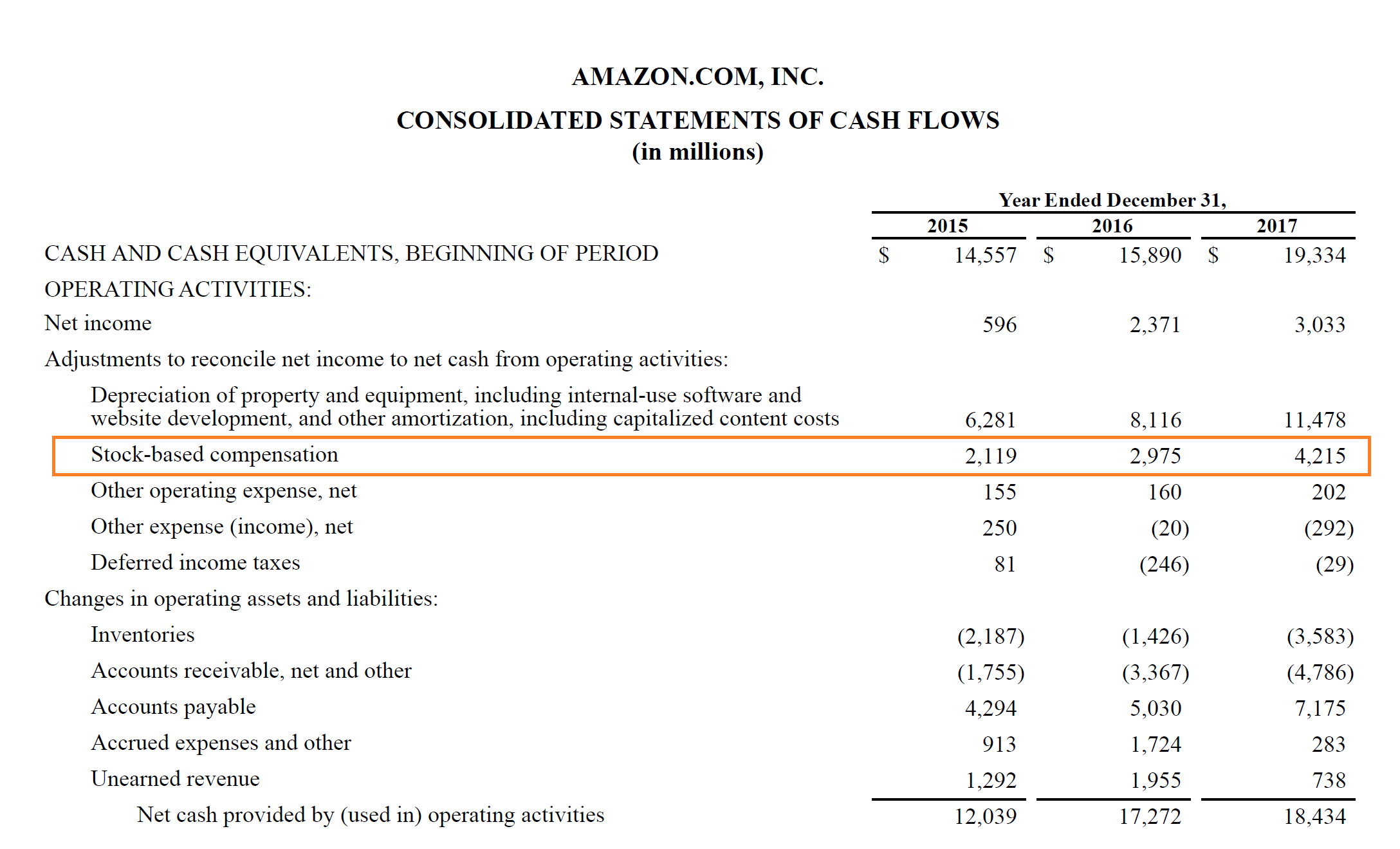

The easiest way to understand how it works is with an example. Let’s look at Amazon’s 2017 annual report and examine how much they paid out in equity to employees, directors, and executives, as well as how they accounted for it on their financial statements.

As you can see in the cash flow statement below, net income must be adjusted by adding back all non-cash items, including stock-based compensation, to arrive at cash from operating activities.

In 2017, Amazon paid $4.2 billion of share-based compensation to its employees.

Since the company has approximately 560,000 employees, that works out to about $7,500 per employee on average.

Advantages of Stock Based Compensation

There are many advantages to this type of remuneration, including:

- Creates an incentive for employees to stay with the company (they have to wait for shares to vest)

- Aligns the interests of employees and shareholders – both want to see the company prosper and the share price rise

- Doesn’t require cash

Disadvantages of Share Based Compensation

Challenges and issues with equity remuneration include:

- Dilutes the ownership of existing shareholders (by increasing the number of shares outstanding)

- May not be useful for recruiting or retaining employees if the share price is decreasing

Implications in Financial Modeling & Analysis

When building a discounted cash flow (DCF) model to value a business, it’s important to factor in share compensation. As you saw in the example from Amazon above, the expense is added back to arrive at cash flow, since it’s a non-cash expense.

While the expense does not require any cash, it does have a capital structure impact on the business, since the number of shares outstanding increases.

Analysts need to decide how to address this issue, and there are two common solutions:

- Treat the expense as a cash item (don’t add it back).

- Add it back and increase the number of shares outstanding by the number of shares awarded to employees (both vested and non-vested).

Additional Resources

Thank you for reading CFI’s guide to Stock Based Compensation. To continue learning and advancing your career, these CFI resources will be helpful:

- Financial Modeling Guide

- Investment Banking Salary Guide

- Financial Analyst Salary Guide

- Investment Banking Job Description

- Net Unrealized Appreciation (NUA)

- See all accounting resources

Get Certified for Financial Modeling (FMVA)®

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.

https://dart.deloitte.com/USDART/home/codification/presentation/asc230-10/roadmap-statement-cash-flow/chapter-7-common-issues-related-cash/7-3-stock-compensationhttps://corporatefinanceinstitute.com/resources/accounting/share-stock-based-compensation/